6 market research strategies for marketing, insights, and PR

6 market research strategies to better understand your audience, improve campaigns, stay ahead of competitors — and drive smarter business decisions.

August 1, 2025

Market research is the process of gathering information about consumers, customers, competitors, and your industry to get a better understanding of your target audience.

Market research can help you answer questions like:

How big is my target market?

Who are my potential customers?

What pain points does my target audience struggle with?

What are my consumers’ buying habits?

How much are potential customers prepared to pay?

Who are my competitors?

What are their strengths and weaknesses?

These insights help improve new product design, customer experience, marketing campaigns, advertising ROI, and conversion rates.

Why market research is more important than ever

It's easy to make assumptions about your audience, your industry, or even the economy as a whole. But in a constantly evolving media landscape, market research is more valuable – and immediate – than ever. Fortunately, it’s also easier to access primary market research data than it has been at any point in history.

Market research is also an important counterbalance against misinformation. Good research can disprove your own incorrect assumptions, or those of key stakeholders. It can also help you identify misinformation in the public sphere that might cause potential damage to your brand.

Within large companies, market research provides extremely useful insights to many business units. In particular, it can improve the work of communications, marketing, customer service, and product development teams.

For example, market research can help your teams:

identify new target consumers and audiences

inform product roadmaps and go-to-market strategies

solidify marketing and communications strategies

focus social media efforts (paid and organic) on the right channels

anticipate market size and how much stock you need (for physical products)

get a competitive advantage by anticipating upcoming market trends

Key elements of an effective market research strategy

Goals aligned with business objectives

There is a lot of data out there. Far more than any one company could ever analyze, even with all the tools in the world. For market research to be useful, you need to understand why you’re doing it.

What are you looking to learn, and why? Do you want to answer one of the questions listed right at the top of this post? Something more specific? Something else altogether?

This requires setting clear goals for your new market research activities. They should tie directly back to specific business objectives. It’s a good idea to work backwards here. Start by going through your existing business plan, and think about what kind of data could help you develop or refine your strategy for meeting your targets.

We get into what this might look like for specific departments a little later on in this post. For now, just remember that you need to have a purpose for your market research work in order for it to produce useful results.

The right market research methods

Before we dive into the methods themselves, let’s define some important terms and types of market research.

Primary vs. secondary research

There are two important types of information gathering: Primary research and secondary research.

Primary research is information that your company collects directly through the methods below.

Secondary research is looking at existing information. Using existing sources can reduce the amount of primary data you need to collect. For example, you may be able to use census reports to cut down on your primary demographic research.

Sources of secondary data include:

Media outlets

Trade groups and industry associations

Census data

Trusted sources of statistics, like Pew Research Center or Statista

Competitors' websites and social media channels

Quantitative vs. qualitative data

Quantitative data is made up of numbers, statistics, and other concrete facts you can plug into a chart or graph.

Qualitative data is more nuanced. It puts the numbers in context to help you understand the thoughts and consumer behavior behind your quantitative data.

So, for example, your follower count is quantitative data. It’s a simple number. There’s no debate, opinion, or nuance.

But your brand perception is qualitative data. What do people think about your brand? How would they describe you? Do they feel more negatively or positively about you than they do about your competitors? None of these can be answered with a concrete number or a simple yes/no.

Both quantitative and qualitative data analysis can be very useful when you conduct market research. Qualitative data requires more specialized tools for dataset analysis, but can provide very rich insights.

Now let's dive into some research methods.

1. Surveys

If you want to know what people think, you can always ask them. Surveys are a tried-and-true method to get specific feedback. They can be classified as qualitative or quantitative research depending on whether you ask closed or open-ended questions.

It’s best to keep them short. Only ask for the information you really need. The longer your survey is, the less likely people are to complete it. That’s why the most common types of brand surveys — CSAT and NPS — are just one question. (Customer satisfaction and Net Promoter Score questionnaires simply ask respondents to evaluate either satisfaction or likelihood to recommend on a scale of 1 to 10.)

Many customer research surveys are conducted by email.

Source: UVic Alumni Association email

A more modern way to conduct a very simple survey is to use a social media poll. For example, based on the results below, Alexandra Gater might want to get more of her

2. Focus groups

In a focus group, you invite a group of people to provide feedback on a focused issue – like a messaging or pricing strategy. They can also be used for evaluating product concepts.

Make sure the demographics of your focus group match those of your target market. It’s not useful to ask single college students for feedback on a minivan ad campaign.

Using focus groups as a qualitative research tool can be expensive – and they can be tricky to handle. You’ll need to provide an incentive for people to attend and have skilled moderators who can stop any one participant from dominating the conversation.

3. A/B testing on social media

In a survey, people tell you what they think. With A/B testing, they show you.

Using A/B testing, you can test small variations in your social posts and ads to see which is most effective for your chosen metrics. This could be engagement, traffic, or even conversions.

These small changes help you understand what your audience is looking for from your brand. You can also see how different messaging lands on different social platforms and optimize your future content accordingly.

4. In-person product testing

If you have a physical product, in-person product testing can be a great way to get early feedback on everything from product quality to package design. You can also get a sense of how people perceive your product compared to your competitor.

One of the best known examples of this is the Pepsi Challenge – a blind taste test between Pepsi and Coke that was everywhere in the 1980s and ‘90s. It’s back for 2025, testing Pepsi Zero against Coke Zero.

While this type of testing can provide in-depth insights if done right, it’s most effective when you ask for specific feedback rather than just asking which product someone likes best. Confession: As teenagers in the 1990s, my friends and I always tried to choose Pepsi in the taste test, just to see how many of us could actually tell the difference. Asking for feedback about why we made our choices would have helped to counter this skewed result.

5. Social listening

Most of the methods we’ve talked about so far give you specific insights from one person or small group of people.

Social listening, on the other hand, measures wide public sentiment. You can see how people feel about your brand. You can also uncover topics and themes they associate with you, and how they feel about those aspects.

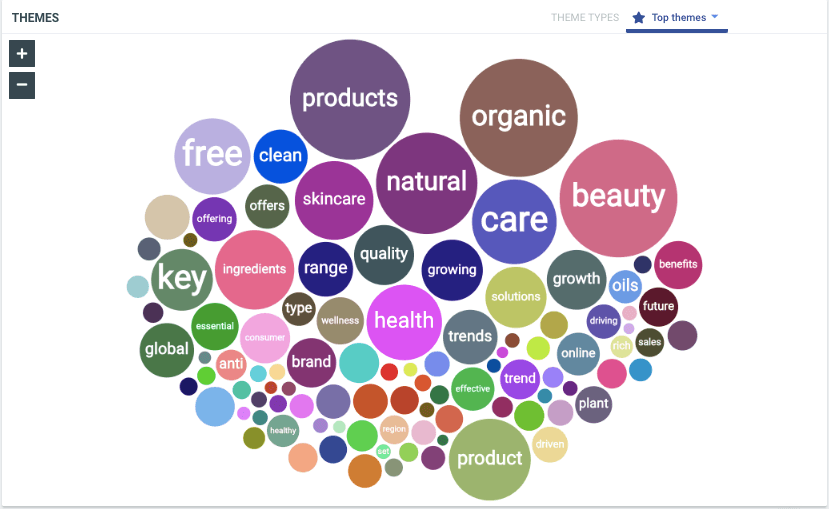

For example, the cosmetics brand Yves Rocher used social listening to learn that consumer preferences for beauty products were shifting. While consumers previously responded best to promises of reducing wrinkles or a shrinking waistline, they now look for assurances about natural ingredients and focus on self-care.

Source: Talkwalker

Catching this shift in perception in real time allowed Yves Rocher to focus on promoting their organic ingredients, and even shift future product development to stay closely aligned with their customers.

6. Competitive benchmarking

A solid understanding of what your competitors are doing helps you set realistic expectations for your own brand. The process of identifying your competitors is also a useful way to identify potential avenues of secondary market research. What can you learn from your competitors’ past successes and mistakes?

There are two types of competitors to benchmark against:

Direct competitors: Sell similar products and services as you do.

Indirect competitors: Sell different products/services but target the same consumer base. Their products are not a direct substitute for yours but could address a similar want or need.

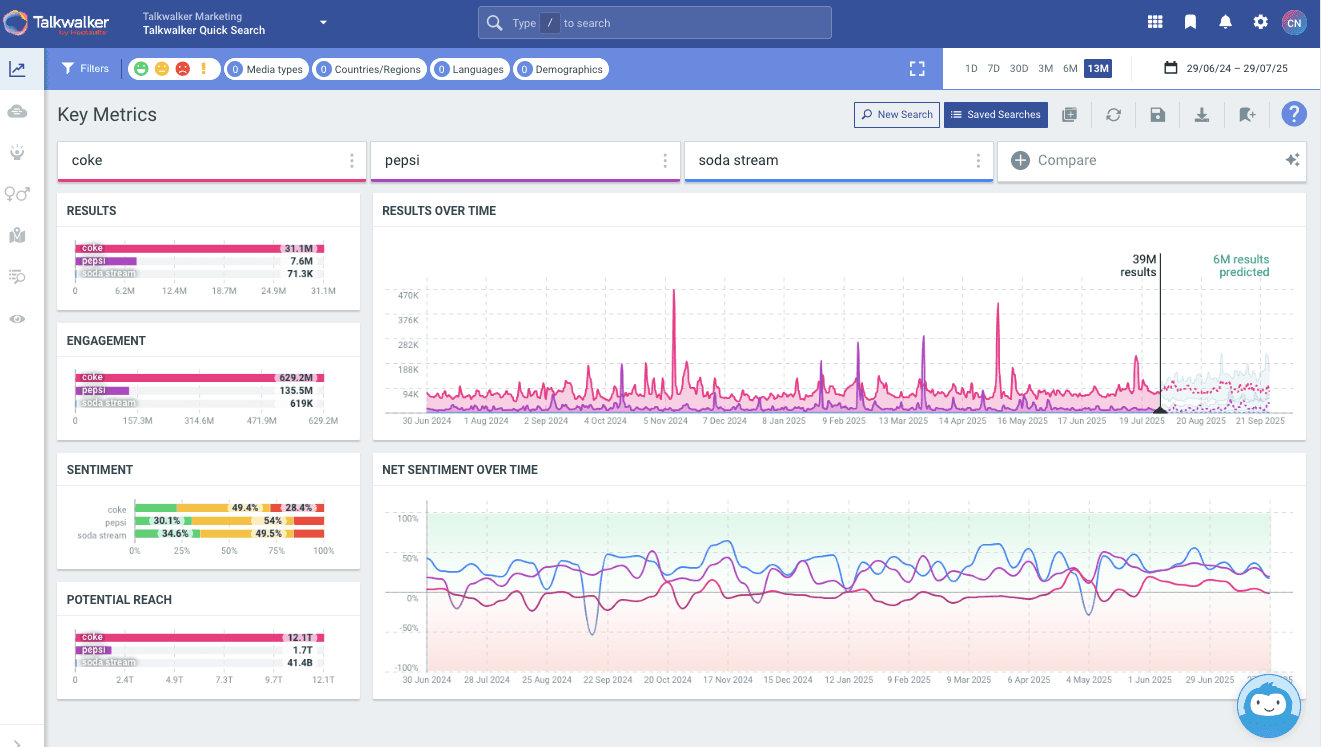

So, Coke and Pepsi are direct competitors. Coke and Soda Stream are indirect competitors. They all target customers looking for fizzy beverages, but in different ways.

For example, here’s a breakdown of the key social metrics for Coke, Pepsi, and Soda Stream, along with predicted conversation volumes over the next 60 days.

Source: Talkwalker

An insights-based action plan

Once you’re done collecting data—both quantitative and qualitative—it’s time to analyze your findings. This is where you extract the valuable insights that will help you make data-informed decisions about what you do next.

Review and summarize the key findings from your market research. Make sure to compare your findings from different research methodologies to ensure consistency, or to analyze any discrepancies.

Then, map each of your findings to a course of action. For example, if you find that consumers are concerned about the sustainability of your packaging, you could look into ways to reduce waste and use more sustainable options. If you already have reasonably sustainable packaging, maybe you could undertake a marketing campaign to highlight that fact.

You may not be able to address every action item you uncover through market research – this would simply be too time-consuming. Prioritize items for your plan by tying them back to the business objectives from the start. Strive for a balance between level of effort and potential impact.

Market research strategy examples

For social media managers

Goals:

Align content strategy with prospect and customer needs

Set appropriate performance targets

Identify emerging social trends early, from content themes to new platforms and technologies

Identify potential influencers

Key strategies:

Analyze follower demographics and behaviors

Benchmark against competitors to set appropriate performance targets

Monitor trending content themes

Research tools:

Demographics analysis dashboard

Competitor benchmarking dashboard

Trend analysis tools

For example, an NBA team used social listening and sentiment analysis to analyze what kind of content resonated best with their audience. Their market research showed that their audience wanted them to be bolder, more unique, and more authentic.

They used these insights to modify their brand voice and their content strategy. They shifted their focus to fan activity and turned fans into brand ambassadors. The result was a 46% increase in overall impressions across social platforms and a 352% increase in video views on Facebook, Instagram, and X. Engagement also increased 27%. With these real brand value contributions, the social team even got the budget to add a new hire.

For PR and communications

Goals:

Protect the brand reputation

Identify and address brand risk scenarios early

Align brand messaging with customer and prospect needs

Identify key figures in the industry, like thought leaders and journalists

Key strategies:

Use social listening for early risk identification and reputation management

Dig into social listening details to identify key players and understand consumer sentiment

Benchmark against competitors to understand place in the industry

Research tools:

Social listening dashboard and alerts

Sentiment analysis dashboard

Influencers dashboard

Competitor benchmarking dashboard

For example, the London-based Bayes Business School wanted to keep a close eye on its brand reputation during its renaming process. It had previously been named Cass, but that name was removed after it was revealed that Sir John Cass had ties to the slave trade.

The school knew that not everyone would be onboard with the change right away, so it was important to monitor media coverage and social sentiment, and to keep an eye out for misinformation. Using social listening and a consolidated social media dashboard, the team was able to engage and respond with both positive conversations and to correct misinformation before it got out of control.

Now that Bayes Business School is revamping its MBA program, it can use a similar strategy to ensure the message gets out.

For insights teams

Goals:

Ensure data guiding business decision-making is current, complete, and accurate

Identify market gaps and opportunities

Turn insights gathered from market research into cost-effective, actionable recommendations

Key strategies:

Use social listening to identify industry and global trends at the start of the upward curve

Deep dive into data analytics

Report findings and recommendations to key stakeholders

Research tools:

Social listening dashboard and alerts

Trend analysis tools

Social and market analytics tools

Reporting tools

For example, Dubai TV Channels set up social media listening and alerts to track the conversation about their TV channels, shows, and programs. They used data visualizations broken down by audience group and sentiment graphs to understand the impact of each episode.

Dubai TV Channels combined this data with traditional surveys, then analyzed the results to make holistic data-driven recommendations about the programming schedule and content.

Common market research mistakes (and how to avoid them)

Over-indexing on vanity metrics

Vanity metrics like the number of followers, likes, or comments are some of the easiest data points to track. They’re definitely worth keeping an eye on, as the number of followers can be directly tied to purchase intent.

However, these numbers do not tell the whole story, about your brand or anyone else’s. To get the full picture, you’ve got to dive into customer preferences and affinity using the research strategies above.

Ignoring data from niche channels

Sometimes, the clearest insights can come from the most niche sources. Sure, people might be talking about your innovative new agricultural technology on X or LinkedIn. But they’re probably talking about it more on relevant subreddits and even more in niche industry publications and blogs.

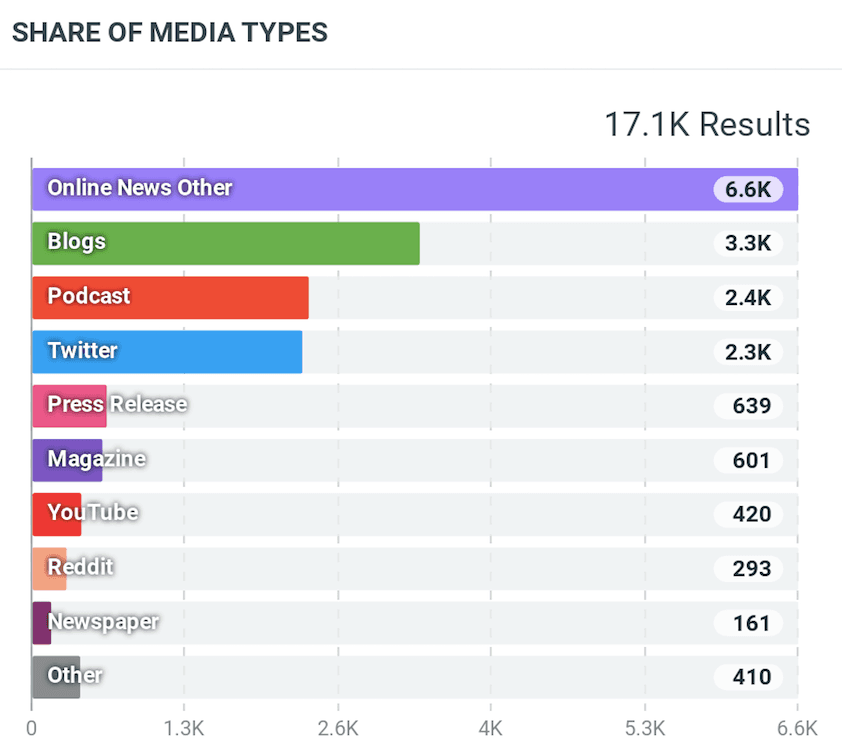

For example, here’s the breakdown of where people are talking about "agricultural automation.”

Source: Talkwalker

Use a tool like Talkwalker to ensure your market research includes more niche channels. Talkwalker includes 150 million data sources, including social networks, blogs and forums, online news sites, print and broadcast media, and review sites.

Siloed approach to research across departments

This post is about market research. It’s important to make the distinction from marketing research. The insights you’ll uncover apply well beyond the marketing team.

You’ve already seen that they have clear uses for PR, social media, and insights teams. But they can also provide important learnings for product development, customer service, and tech support.

Above all, ensure you’re not duplicating effort by having multiple teams conduct their own research. Create a unified approach and share findings across the organization.

How to build an actionable market research strategy with Talkwalker

You’ve already seen a couple of ways that Talkwalker can help in your market research strategy. Let’s look at how to use some specific tools within Talkwalker to gather the data you need. (Tip: Some of these tools are free!)

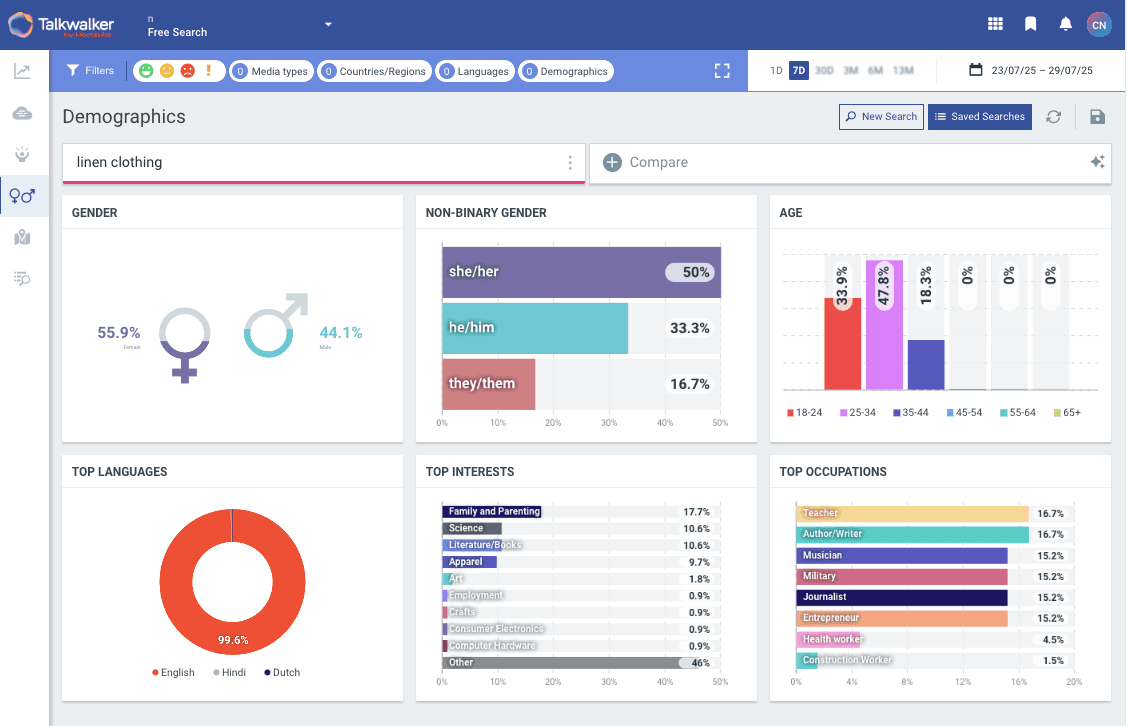

Search for your brand, your products, or keywords related to your industry to understand who’s talking about you and what they’re saying.

Fine-tune your search depending on geography, language, media type, media channel, devices, etc. You can use the AI query builder to build a more comprehensive or specific search.

This data collection will help you create detailed user personas, ensuring you target the right audience.

You can also compare your brand to a competitor to begin your competitive analysis.

Free search is limited to 7 days of data, but it is still a useful starting point.

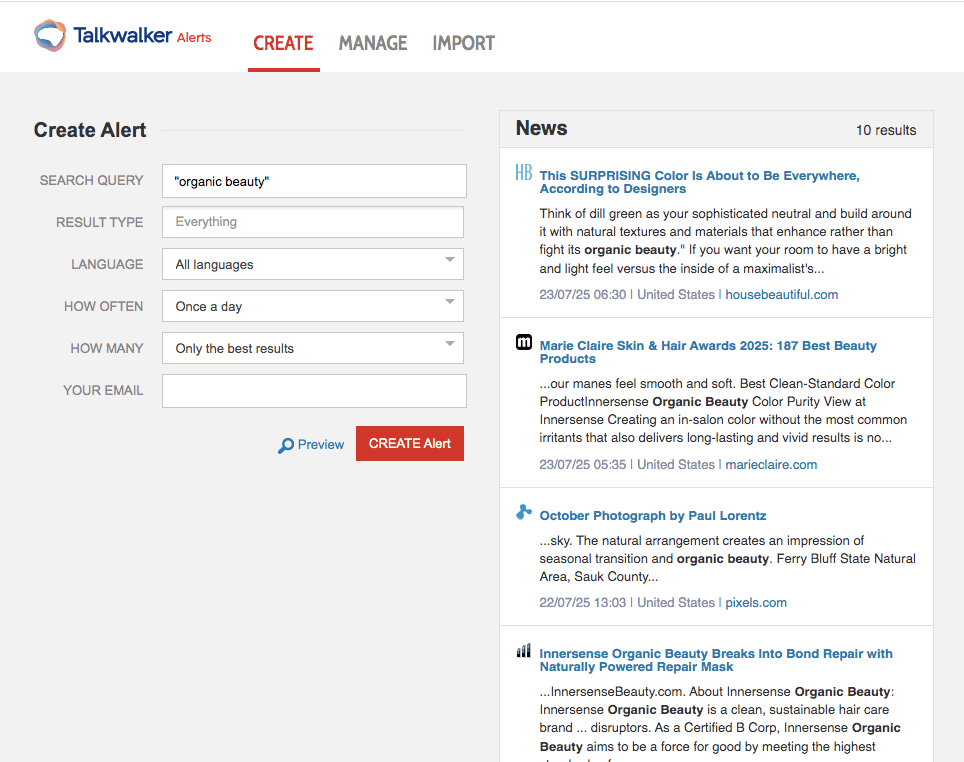

Talkwalker Alerts is similar to Google Alerts in that it monitors online sources for mentions of your brand, keywords, or whatever search query you choose. You can also set up alerts to monitor your competitors, industry, trends, and so on.

But Talkwalker Alerts include news platforms, blogs, forums, and X (formerly Twitter) in their results, so you get a more thorough picture of who’s talking about you, and what they’re saying.

You can choose to get alerts in real time, daily, or weekly. This info will help you stay one step ahead in your market research, since the results come to you rather than you having to seek them out.

The free Talkwalker Alerts offer limited data sources compared to the full Talkwalker product, but are still a good place to start!

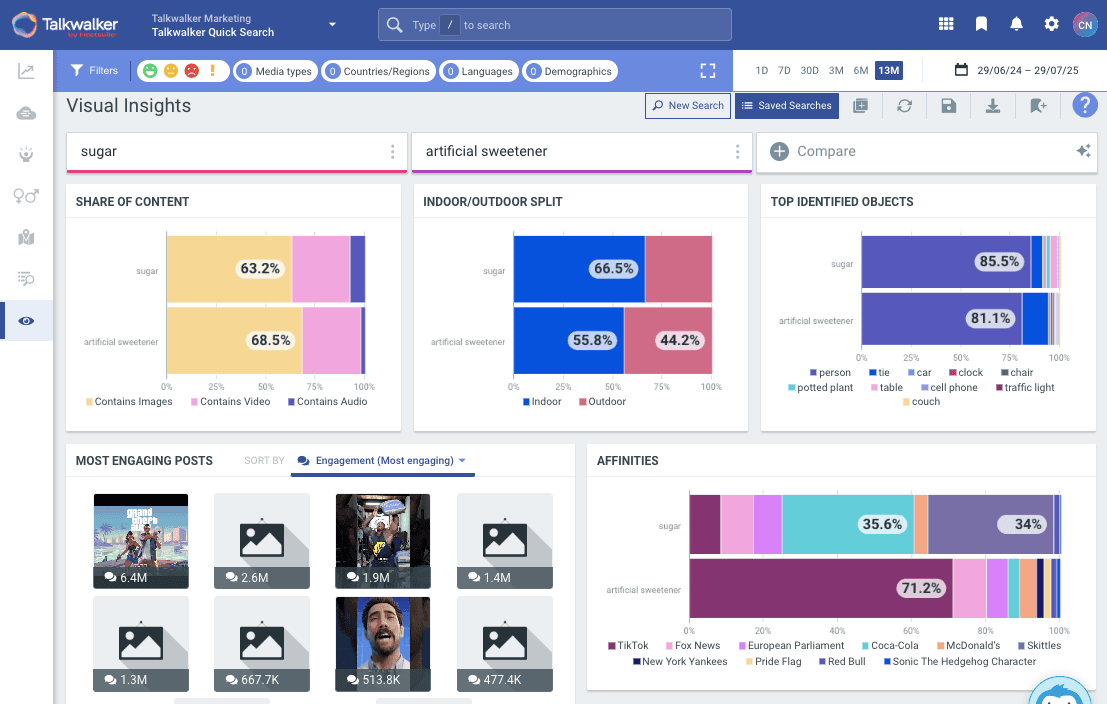

Quick Search is the ideal starting point for any Talkwalker market research query. Using the AI query builder, you can create a search for your brand, your competitors, or any keywords related to your industry. You can even compare topics and brands, or combine your brand with industry keywords. You can make your search as wide or as focused as you like.

With AI-powered themes and market segmentation models combined with detailed demographics reporting, you can gain a deep understanding of your target market.

You can track reviews of your product and follow the social sentiment related to your brand to see how things are changing over time. This is a good way to spot big wins or potential missteps as they happen, so you can amplify your actions or quickly correct course.

Competitive benchmarking helps you understand your overall place in the industry. And you’ll get a list of the most engaging content creators on your topics so you can reach out for potential influencer partnerships.

It’s an all-in-one market research tool that provides all the details needed for social media, communications, and insights teams.

In a fast-moving world, you need fast answers. Get real-time, data-backed responses to management-critical questions in a flash, and make informed decisions within your market. See how Talkwalker can help your team stay informed.

{{cta('261047136466','justifycenter')}}

Market research tools & guide

Looking to jump into a new market? Change your marketing strategy? Launch a new product? If you want to win, if you want your business to survive, you have to do market research. It’s the best way to understand consumers, competitors, your industry. Equip your company with insights and make informed business decisions, with market research tools and tips. Ready?

CTA …

Would you get married, without planning? Bake a cake? Buy a car? Without researching, without being fully informed, your flowers won’t arrive, your cake won’t rise, your car will be a non-starter.

Thought not.

The same applies to your marketing campaigns. Your product launches, events, price hikes, targeting new countries, etc. You need to research, ask questions, pull out data, back your decisions with proof that you’re heading in the right direction. Making data-driven decisions.

If you follow the right process, you’ll be able to answer the following questions...

How big is my target market?

Who are my potential customers?

What are my consumers’ buying habits?

How much are potentials prepared to pay?

Who are my competitors?

What are their strengths and weaknesses?

I’m going to show you how to do quick and effective market research, along with the market research tools you’ll need...

Table of contents

What is market research?

Benefits of market research

Market research process in 5 steps

Types of market research data

Market research tools & methods

What is market research?

On a large scale, the definition of market research is the process of gathering information about consumers, customers, competitors, and your industry, to get a better understanding of what a company’s target market is looking for.

Once data has been collected and analyzed, the insights help businesses make informed decisions about their strategies and operations. Driving better product design, improved user experience, targeted marketing campaigns, tailored advertising, improved conversion rates.

Market research as a tool is essential for a startup, looking to understand its target audience. Or, if a brand is planning to launch a new product or service. Researching potential customers to identify how an audience will react.

Companies can instigate free marketing research inhouse, or outsource to agencies. Methods include surveys, interviews, focus groups, in-store product testing, social media...

Benefits of market research

There’s huge competition out there for all of us. It’s vital that we understand the preferences of consumers. Their buying beahavior. If we don’t research the market, we’re guessing what consumers want. Adopting a market research process is a way to guarantee customer satisfaction, reduce churn, and stay one step ahead of competitors.

Using analytics is a great start, but you need to do more. Research will tell you what consumers are thinking. Why they’re purchasing one product over another. Why they’re not buying yours, but they’re happy to buy from your competitor for a higher price.

For example, Google Analytics shows you that potential customers are visiting your website, and clicking to the pricing page, then bouncing off your site. Research will help you understand why.

Google Analytics | Track website traffic

This is a free market research tool...

IMAGE

Market research tool - Google Analytics

Analytics intelligence - brand performance insights - key changes, new trends, opportunities. Smart Goals, Smart Lists, and Session Quality data can be used to increase conversions.

Reporting - understand how visitors are using your site and apps - interactions, value, user behavior. Track and analyze Google Ads, Display & Video 360, and Search Ads 360.

Data analysis and visualization - inbuilt reports to visualize your data - customize and segment datas. Report on multiple campaign touchpoints on the path to conversion.

Data collection and management - import customized data and combine with analytics data.

Data activation - predictive analysis reveals valuable users and actions - users to re-market with ads. Demographic data about your audience - age, gender, and interests, etc.

Let’s look in more detail at why market research is important…

Identify how your brand’s products or services are being talked about - consumers, industry, competitors. Using social listening to monitor the conversations around your brand - positive and negative - will strengthen your communication strategy and enable you to jump in and protect your brand’s reputation.

You’ll learn what consumers want and need. Their preferences, buying habits, income. This means you’ll be able to design the products and services that people are asking for.

It finds insights and opportunities about the value of new and existing products and services, so you can plan and strategize effectively.

Understanding the volume of consumer needs - market size - will enable you to produce sufficient stock to fulfil supply demands. Eliminating wasted money on over production, and increasing profits.

Competitor analysis will help you create business strategies to ensure you lead in your industry.

What’s the sentiment behind consumer comments? Positive, negative, neutral. Apply the same analysis to your competitors.

Identify consumer communication channels - customers and potential clients - so you’re sharing your marketing messages on the appropriate channels.

Market research example | Starbucks

My Starbucks Idea kicked off in 2008. Customers, potentials, and employees were invited to visit the website and submit ideas. Flavor suggestions, new products, improvements, relaunching old products, etc.

Starbucks asks consumers questions for new product ideas.

A popular suggestion was the introduction of dairy-free milk products. This, along with a market research report from Mintel demonstrating an increase in sales of dairy-free milk products, persuaded Starbucks to follow the trend. Going on to launch drinks using coconut milk, almond milk, and oat milk.

https://twitter.com/starbucksuk/status/948803686003720194?lang=en

Starbucks also uses social listening, asking questions, and monitoring online conversations on Twitter, Facebook, Instagram, etc., to find out what people are saying about the brand. Collecting valuable feedback to enable brand and product improvement.

https://twitter.com/Starbucks/status/1337427530744176642

BOOM! Starbucks’ market research strategy ensures they give consumers exactly what they’re asking for.

Marketing research process

Okay. Now I’ll highlight the best practices you should follow for your market research…

Define your problem or new opportunity

If you start your market research without knowing the problem or opportunity, you’re gonna waste a ton of time and a heap of money. Recognizing the issue will decide what you need to find out and how you’ll source the information.

Your opportunity might be… how are you going to launch a new product in a specific location. Your problem… your newsletter readers are unsubscribing. Why, and how to get them back?

Ask questions that’ll reveal potential causes for your problem, so you can decide on the appropriate action you need to take.

What does your ideal customer look like - demographic information, occupation, income, interests, etc.?

What content are readers looking for? Do they want more promos? More/less frequent newsletter?

Build your market research plan

Your market research plan should include all the methods you’re going to use to find the answer to your problem, or how to explore a new opportunity.

Market research methods include creating a survey, interviewing customers and prospects, running A/B tests, listening to online conversations, polls on social media, and more. This is primary data that your company will collect.

Before you spend time and money on your research, check whether other organizations suffering the same problem or looking at a new opportunity have already researched. This is called secondary data.

Gather data and information

The best market research collects both quantitative and qualitative data…

Quantitative data - analyzing figures to get hard data on how consumers behave

Qualitative data - putting data into context to understand why consumers behave a certain way

For example, you’ve created a landing page for users to register for your newsletter. Unlike your usual form, asking for name, email address, and company, you’ve requested more details. But, you’re worried it will discourage users from signing up. Perform an A/B test to identify which version works best. For your market research process, ask consumers if they’d be happy to share more information about themselves. Using both methods will give you quantitative and qualitative data. Way more valuable insights.

User testing will provide a tone of insights and data on how consumers behave. Whether it’s new content, design, product updates, etc. Tools such as Hotjar - heatmap tools, and Google Analytics will track website traffic and behavior.

Hotjar | Visitor behavior

This is a super, cool tool for tracking how consumers behave when visiting your website.

IMAGE

What are visitors doing on your website?

You can see what they’re looking at. Where on the page they’re clicking. Their scrolling movement. How long they look at a particular section on a page. How they travel around your website.

Use Hotjar to optimize conversion and usability of your site, improve user experience, and kill pain points.

The heatmap will record mouse movements on a page. That’s right, you can make mouse movies.

Features include:

Visitor Recordings – monitor consumer actions on your site

Heatmaps – tracks where consumers scroll and click to see which sections get the least or most attention

Conversion Funnels – find out which pages cause consumers to bounce from your site

Form Analytics – see where visitors are dropping off and identify why they’re not completing forms

Feedback Polls – add a polling box to high-traffic pages to collect instant feedback

Analyze data & report results

Time to analyze the data.

You must avoid guesswork. I mean, if you’ve an idea in your head, don’t look for patterns to prove it. It’ll distort your results.

Look for trends. See the overall picture.

When creating your marketing research report, include the methods you used - survey, interviews, etc. - the insights you collected, your conclusions, and the action you intend to take.

Action!

Market research done. Insights collected. Time to act.

Start working on your new marketing campaign, product launch, new landing pages, etc. It’s important to remember that market research isn’t a one time process. It has to be ongoing. Trends change, problems mutate, new competitors hit the market, pandemics strike.

Types of market research data

If you want to answer questions like these...

What are the buying habits of the consumers you’re targeting?

Why are potential customers abandoning their shopping carts?

How much are consumers prepared to pay for our latest product?

Why are consumers buying products from our competitors that are more expensive than ours?

These aren’t questions you or your team can guess the answers to. As well intentioned as you all are, you’re blinkered. You’re in a vacuum, where your product is the best. Your product is super easy to use. You know your target audience, inside out.

No you don’t. You’re making assumptions. You need to do market research.

There are two kinds of market research data...

Primary market research data

This is the data that you and your organization collect. Or a market research firm, if you’re going that route. You control this data.

It’s a combo of qualitative and quantitative research, whereby you contact consumers, prospects, customers, etc. You’ll be looking to collect two types of information...

Exploratory market research asks open-ended questions to groups of people. The goal being to collect opinions.

Specific market research is targeted, and will provide answers to questions that you found after exploratory research. For example, feedback on your last event, product launch, etc.

Secondary market research data

Secondary data already exists. It’s public information that's, for instance, shared in newspapers, media, government documents, industry reports, financial reports, etc.

Use secondary data to understand industry trends and shifts in the market. Sources include…

Public and government libraries

Newspapers, magazine, television

Universities and educational institutions

Trade groups, industry associations, industry reports, Industry analysts

Government reports

Census data

Research centers - e.g., Pew Research Center in the US, providing data on social issues, public opinion, and demographic trends

Reputable websites, including your competitors

Quick Search | Trend research tool

To follow trends, Quick Search is your tool. It’s our social media search engine…

Unlimited searches going back 13 months

AI based themes and segmentation models

The best global coverage - social networks, news, blogs, and forums

Compare multiple brands - benchmark your performance with multiple brands and competitors

Talkwalker Quick Search - social media analytics tool for tracking trends.

Market research tools & methods

While you’ll find mention of several tools throughout this post, to help you with your market research, I’ve included market research methods as part of your toolkit. Without them, research would be impossible.

Primary market research takes time. But, you’re sure to get all the answers to your questions. Don’t feel you have to stick to one research method. Here goes…

Create user personas

First up, you need to get to know your target audience. People who use products, services, websites, that are similar to yours. These are your ideal customers.

Free Social Search | Monitor conversations

You can use a social media analytics software - Free Social Search - and search for your brand, to understand who’s talking about you and what they’re saying. Fine-tune your search depending on geography, language, media type, media channel, devices, etc. Boolean operators will ensure the accuracy of your search terms.

Talkwalker’s Free Social Search for consumer intelligence.

The data you collect will help you create a detailed user persona, ensuring you target the right audience with your market research.

Download my buyer persona template, to help record the insights you gather.

You need to be able to answer the following questions...

Who are your ideal customers?

What’re their demands/needs?

What’s stopping them from meeting these needs?

Social media

Looking for quick, real-time feedback? Social media channels are the way to go. Tackle it like this…

Measure engagement levelTrack social mentions, shares, comments, and likes to find the most popular posts. This data will help you replicate successful posts. You’ll also understand the needs of your target audience.

Monitor your brand’s imageTrack reviews of your brand and product, to understand the level of customer loyalty towards you and your competitors.

PollsAsk questions directly using polls on social networks. Make it fun, to encourage responses and increase engagement. You’ll learn the needs of customers and prospects.

Surveys

Surveys are the most common market research tool, and they don’t have to cost you anything. Unless - and it’s worth it - you’re going to give a prize for the best contribution.

Your survey should be short. I’d say no more than 15ish open-ended and/or closed-ended questions. It could be via an email, on your website, over the phone, or go retro with snail mail.

SurveyMonkey | Online market research tool

“81% of businesses who track their Net Promoter Score - NPS - describe themselves as very or extremely successful.”

SurveyMonkey includes a vast range of use cases - online polls, Facebook surveys, employee satisfaction surveys, etc. You can also use questionnaire examples, free survey templates, and pre-written survey questions.

Features include...

The free plan offers unlimited surveys, with max 10 questions per survey. It’s limited to viewing the first 40 responses. The paid plan gives unlimited surveys and questions, tracking of email responses, pop up online surveys, and recurring surveys - weekly, monthly, quarterly.

It supports multiple languages, video, and image questions, rating and ranking questions, question and page skip logic, A/B test questions, etc.

Team collaboration features include shared themes, templates, and library. You can build surveys and analyze results. There are customization options and white labeling.

Real-time analysis and reports can be filtered, visualized in a dashboard, or exported in various formats.

Mobile app support for viewing or analyzing survey results. Mobile SDK and API access is also available.

IMAGE

caption

You’ll be asking a set of questions to find out what they thought of your last marketing campaign, last event, new product/feature. How they felt about their stay in your hotel. What they think of the customer service in your bank.

You get the idea.

Surveys are a popular choice because they’re easy, and as I said, cheap. You can quickly collect data that’s relatively easy to analyze.

Interviews

The main benefit of a one-on-one in-depth interview, is that you’re able to collect non-verbal clues. Also, even though you have a list of set questions, you can do follow up questions depending on the responses, for deeper insights.

If face-to-face isn’t possible, doing a video conf call is a good option.

Don’t sell your company or product. Your interview shouldn’t involve a sales pitch. Chat with the person, asking about their pain points, frustrations, what they’re looking for in your product, their purchasing habits, why they use brand X and not brand Y, etc. Ask questions. Lots of questions.

Do not push your preferences or bias. For instance, what do you think about our competitor’s rather expensive service?

Focus groups

This involves inviting a selected group of people and engaging in a conversation about your… pricing strategy, new product, shopping experience, social media campaign, etc.

Your focus group should match your target market. If you’re launching a new range of clothes for babies, ideally your group will consist of people who have kids. Starting a company that sells skateboards, talk with a young demographic.

That’s not to say the older generation don’t skateboard. Please don’t shoot the messenger.

Focus groups as a market research tool can be expensive, and tricky to handle. Results can be distorted if one member of the focus group dominates. Or, when using several moderators, their different styles sway results.

Observational research

Simple but effective.

This market research tool involves watching a person use your product or a similar one. The user should fit your ideal customer persona, your target.

For instance, you’ve recently updated and launched your new website. Your company loves it. No issues. While positive feedback is encouraging, this isn’t a true test of your site. You need fresh eyes. Observe someone navigating your site. Ask them to find a particular page or make a purchase. You’ll find potential stumbling blocks and be able to improve the CX.

Your new product has hit the streets. Generally, comments are positive. But there are complaints about a particular feature. Again, your team had no issues. Of course, they’re familiar with every aspect of the product. Watch a user interacting with your product, and oops… found the problem.

There are two kinds of observational market research...

Overt - users using your product, aware that you’re watching

Covert - users being watched interacting with your product, without their knowledge

I’d avoid recording either overt or covert observational research. If the user knows, it could change their behavior. If the user doesn’t know… well, it’s a bit dodgy.

Analyze results

Remember, the goal of market research is to collect data and create actionable insights to improve your product, service, marketing campaigns, startup launch, etc.

Use a flow diagram to track your research process, so you can understand consumer needs.

Market research flow diagram.

A customer journey map shows you how a consumer converts into a customer. Demonstrating their initial interaction with your brand, and the steps they take to purchase.

Market research customer journey map

Competitor analysis & benchmarking

This market research method means doing some legwork. Virtually or IRL. You’re going to be checking out your competitors.

Take a look at my Competitor Analysis Guide, for the steps you need to take.

For brick and mortar companies, take a walk. Visit your competitors’ businesses. What are they charging for products? How’s the customer service? What are customers saying? What’re they doing right? What’re they doing wrong?

Online or offline, take a look at your competitors’ websites. Check review sites for comments - positive or negative. Monitor their social media channels. Identify funding, acquisitions, and pricing. You’ll need a social media analytics tool, to collect all the data.

Rather than having to constantly check websites, set up Talkwalker Alerts for mentions of company names, trends, and products, to be notified of any shifts in the market.

Talkwalker Alerts | Monitor brand mentions

Free market research tool...

Caption

Talkwalker Alerts monitors all online mentions of your brand and keywords. This includes news platforms, blogs, forums, websites, and Twitter. You can also set up alerts to monitor your competitors, industry, trends, etc.

You’ll be equipped to make data-driven decisions and stay one step ahead in your industry. You’re identifying their strengths and weaknesses.

SWOT analysis- strengths, weaknesses, opportunities, threats.

Benchmark against…

Direct competitors - selling similar products and services as you

Indirect competition - selling different products/services but targeting the same consumer base

Takeaway

The goal of market research is to collect and analyze information from your industry and competitors, understand how your product will be received compared to others. Market research answers the following...

Who are my customers?

How much demand is there for my product or service?

How are customers using my product?

Is there product feedback to improve my product?

Which pain points does my product solve?

How is the performance of my brand, compared to my competitors?

Where are opportunities for growth in my market?

The Talkwalker platform offers several analytics tools that you’ll need to work efficient market research. If you’d like a demo from one of our experts, get clicking. You can see examples of how Free Social Search, Quick Search, Talkwalker Analytics, sentiment analysis, and heaps more, will knock your research into touch.

CTA