11 best marketing strategies for financial services Talkwalker

Use the best marketing strategies for financial services to lead in the financial sector and outrank your competitors.

May 1, 2022

- Table of content

- What is financial services marketing?

- Challenger bank vs neobank vs traditional

- Best marketing strategies for financial services

- 1. Deliver financial services to digital natives

- 2. Optimize your financial services website

- 3. Help Google find your site with SEO

- 4. Use paid ads for fast SEO

- 5. Develop your social media presence

- 6. Map the financial servives customer journey

- 7. Outreach & engage consumers

- 8. Tell consumers stories

- 9. Answer questions with your content

- 10. Use video marketing to help & sell

- 11. Don’t give up on email marketing

- Win customers with the best marketing strategy

There’s a growing crowd of people that have never stepped foot inside a bank, and they’ve no inclination to do so.

Say hello to the post-pandemic, digital world.

A survey from Deloitte in April 2020 showed that during the pandemic, customers moved towards digital banking in greater numbers than had previously been seen. No surprise there. We had no choice.

But, this transformation hasn’t stopped. The 2021 survey confirms this increasing shift towards digital online banking, via mobile banking apps or bank websites.

The COVID pandemic has forced financial institutions to address this change in consumer behavior, and drastically improve the digital experiences they offer.

“The digital revolution has catalyzed increases in the access and use of financial services across the world, transforming ways in which people make and receive payments, borrow, and save,” World Bank Group President David Malpass.

Now, I’m not saying that banking consumers are abandoning brick and mortar branches. Some people like to have the choice. Meeting face-to-face with humans is their preference. While others have reservations with regard to sharing highly sensitive information online.

So, while banks will need to improve the digital experience, traditional banking will still play a big part. All banks offer online services - to a greater or lesser extent - and if banks want to stand out from the financial services crowd, the digital user experience has to be user-friendly. They must move toward digital technologies to increase visibility, while streamlining operations.

This post is going to look at both digital and traditional marketing techniques for financial services institutions.

Table of content

What is financial services marketing?

Marketing strategies for financial services include various methods designed to drive brand awareness of financial products and services. Multiple marketing campaigns are used to earn leads that’ll convert into new customers.

Marketing strategies should include both…

Traditional marketing - print, TV and radio, events, billboard advertising,events

Digital marketing - website, blogs, social media, landing pages, PPC ads, online events, email

The ideal is a combination of traditional and digital.

The financial services industry has a history of being ‘stuffy’, governed by regulations. Many of these banks continue to trust and rely on traditional marketing channels.

But, digital marketing campaigns - across industries - are proven to work. They promote engagement and conversions.

It’s vital that financial services follow a marketing strategy that embraces both, to drive brand awareness, reduce churn, and increase revenue.

Challenger bank vs neobank vs traditional

Banking has been around for a long time. It has a reputation of being old-fashioned and highly regulated. All that's changing, with the growth in challenger banks and neobanks.

This post shares the 11 best marketing strategies for financial services. The strategies work across the board - online and offline. Even the traditional banks have websites that need optimizing.

First up, what are the different types of banks?

Traditional banks

Traditional banks have a physical presence. You'll find them in most towns and cities around your country. They provide branded ATMs, a large team, face-to-face customer service, and dedicated account managers.

Examples of traditional banks include NatWest, ING, Bank of America, Santander, HSBC…

While they provide online services, it's generally considered a by-product.

If you're looking for a personalized service, or you're in an industry that requires trust, traditional banks are your best choice.

Challenger banks

Challenger banks are smaller. While they challenge traditional banks, with regard to services provided, they do so using modern financial practices. A challenger bank is a digital bank, with a bank license.

Many are only available online or through an app.

Examples of challenger banks include Starling Bank, Monzo, Revolut, Axos Bank, Varo Bank, One Finance, SoFi…

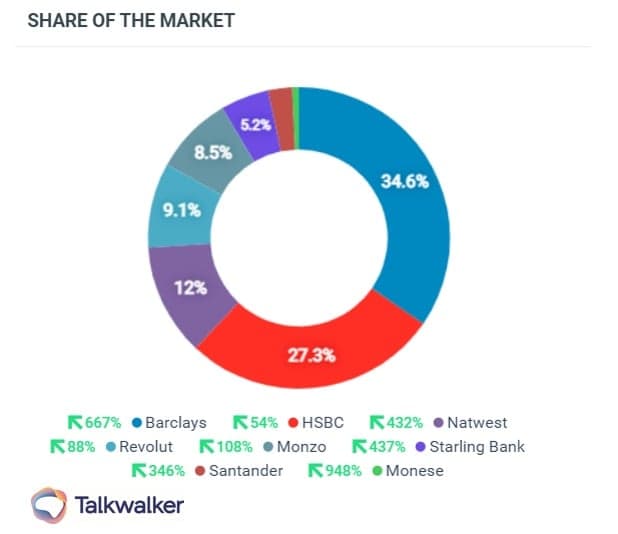

Share of market - while traditional banks still dominate, we can see the growth of challenger banks in the UK, demonstrating that combined, their size matches that of NatWest.

Read How Monzo's marketing strategy set it on the path to success if you'd like to know more about the rise of online-only banks and how they're reshaping the relationship between banks and consumers.

Neobanks

Neobanks are financial tech startups. An excellent customer experience and getting as many customers as possible is their focus. A neobank offers some banking services, but isn’t regulated as a bank.

All business is done online. No physical location. No face-to-face.

Occasionally, neobanks provide personal accounts, but generally their core business comes from small-to-medium businesses, with startups making up a large portion of their customer base.

Examples of neobanks include Fi Money, Jupiter, FamPay, Chime, Varo, Aspiration…

Download High Street vs Challenger Banks

Download our latest report - High street vs challenger banks in the UK - in which we’ve distilled twelve months of data - earned and shared media - to determine the future of banking.

Check this out if you're looking for marketing strategies for financial services in the UK specifically.

Best marketing strategies for financial services

I’m going to share 11 marketing strategies to help all the financial marketers out there, looking to increase leads and drive revenue.

I’ll include brand awareness, social media marketing, lead generation, SEO strategies, and more…

1. Deliver financial services to digital natives

Digitization is when a digital representation of an object, image, sound, signal, or document is created. Basically, converting data from analogue to digital.

I don’t really want to get into the whole rhetoric of one generation doing this, and another generation doing something else, because it’s too easy to make generalizations.

But, one can’t ignore the fact that older generations - Silent, Baby Boomers, etc. - opened their bank accounts face-to-face. At the time, they had no choice. Having received personalized customer service, many continue to expect that from financial institutions.

Gen X, Millennials, Gen Z, on the other hand, are happy to go online and set up their accounts, and more. Minimizing human interaction.

The fact that multiple generations need, expect different things, means that financial services have to cater for all. Digital and traditional channels.

The traditional channels are well-established. But they do need to maintain an optimized website - ranking, quick loading, easy to navigate, and secure.

For those younger peeps, the digitization of banking products enhances customer services, ensuring convenience and time saved. The elimination of human error, increases customer loyalty and reduces churn.

To meet the demands of digital natives, forward-thinking finance marketers should consider the channels used - business website, search engines, mobile devices. Therefore, your campaign strategy for financial services should include social and paid ads, segmentation of audience, targeted content.

2. Optimize your financial services website

Consumers are going to spend time on your website, and it’s vital their experience is faultless. Design, navigation, usability, and accessibility must be streamlined.

According to PwC’s 2021 Digital Banking Consumer Survey, 82% of 18 to 24 year old smartphone users perform mobile banking. While 46% rely purely on digital channels for their banking needs.

If your website makes their life difficult, they’ll find a site that doesn’t. If your website takes ages to load, wave goodbye. If it’s hard to find information, wave goodbye. Is it secure? No? Is it responsive on all devices?

Yep, wave goodbye.

Make your website speedy

40% of consumers will bounce out of a website if it takes more than three seconds to load.

1 2 3 gone!

High-resolution images will slow down loading time. Any image above 1MB is going to cause problems. And, choose JPEG over PNG, everytime.

JavaScript and jQuery plugins are great if you’re looking to include dynamic content on your website. But, if it isn’t implemented correctly, your loading time will be snail-like.

Using Flash content? While interactive applications and animation can be cool, it can dramatically slow loading speed.

Ads on websites are common. Annoying, but common. They certainly monetize high traffic sites and can bring great ROI. The drawback is that with a ton of ads on your site you’re going to have a ton of HTTP requests that all need processing.

Caching can improve the performance of your website. It’s a method of saving frequently used data points in the cached memory. So, requests for the same content are delivered from the cached memory.

Avoid too many landing page redirects. They impact speed, and get worse after 3-5 redirects. Cut out the chain, and link from 1 to 5 directly.

Streamline the customer experience

An improved customer experience can increase KPIs by more than 80%. While a good user interface - UI - can increase the conversion rate by up to 200%.

Not to be sniffed at.

To clarify… UI refers to screens, icons, buttons, forms, etc., that a user interacts with on a website, app, mobile device. UX is the journey a user has with your product/brand. From first touch - online/offline - to purchase, and after. Combined, they will contribute to the customer experience for financial services.

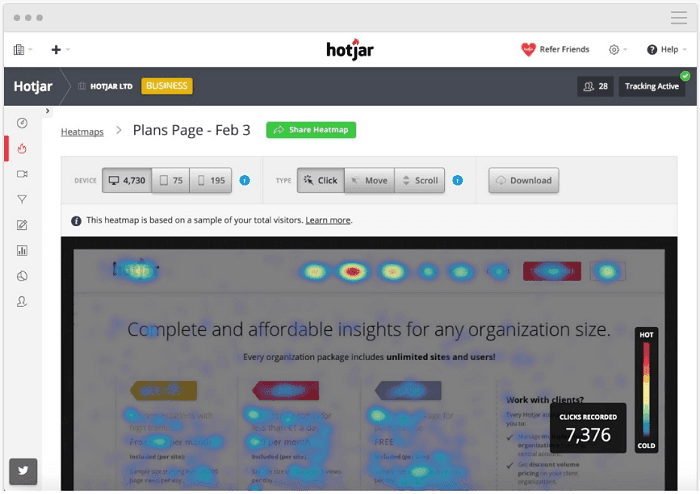

You need to pay special attention to the content you share, on your website, blog, ads, apps, videos. The colors on your site, and the template. Use a tool like Hotjar or Microsoft Clarity to snapshot heatmaps and scrolling behavior, to find areas where users are struggling.

Hotjar will track how consumers behave on your website. Where they click and scroll, and areas that confuse them.

If they get frustrated or lost, you’ve failed. The visual aspects of your website should be designed to build trust….

Colors

Photos & graphics

Fonts

Calls to action

Ensure your website is user-friendly. Intuitive. Consumers have entered your website to look for answers or to perform a function. If they struggle, you’ll lose them. Don’t make them hunt for your contact information. Don’t make forms overly complicated.

See How Abu Dhabi Islamic Bank Improved CX

Download our report - How Abu Dhabi Islamic Bank became UAE’s top banking mobile app - to see how the bank improved the CX on its mobile app, and increased brand loyalty by 12%, and positive sentiment by 40%.

Make your website mobile responsive

In 2020, there were 1.9B individuals worldwide using online banking, with this figure estimated to increase to 2.5B by 2024.

Way back in 2013, Google announced that an important ranking factor is whether websites are mobile friendly.

Therefore, your financial services website has to be responsive. That’s to say, the same URL and html, making it easier for Google to index. A responsive site uses the same content, and renders the display differently, according to the device it’s being viewed on.

Consumers are 5 times more likely to abandon a site if it’s not optimized for mobile.

Speaks for itself.

Build a secure website

85% of consumers will abandon their cart if data was sent through an unsecured connection.

It’s critical that your website is HTTPS. Not HTTP. You’ll not only protect your business, but also your consumers.

The HTTPS protocol uses transport layer security - TLS - to encrypt HTTP requests, making it more secure.

Again, it comes back to Google. The search engine promises to offer the best user experience for people, so its ranking algorithm favors HTTPS.

3. Help Google find your site with SEO

If you’re not on page one, consumers will see your competitors’ ads and websites before you.

How often do you click to page two?

How to get on page one without paying? SEO - search engine optimization.

By choosing relevant keywords for your financial services websites, users will find your website with a single search. And if you have a strong SEO strategy. At the top of the page.

Boom!

Choose keywords for financial services and you’ll see…

Ranking at the top of page one in search engines, making your site more visible and bringing more organic traffic

More organic visitors to your site, meaning more form submissions, sign ups, calls

Calls, forms, sign ups, will convert into sales

Conversions, leading to increased revenue

Bonus… word of mouth advertising from happy customers

When a search engine crawls your website, it’ll hunt for keywords so that when a user enters a search, it can bring up the absolute best option.

Your SEO strategy has to be a living thing. It’ll need ongoing optimization as, for instance, new banking features are launched or consumer language changes. You have to monitor consumer behavior, conduct trend analysis for financial services, and monitor your competitors.

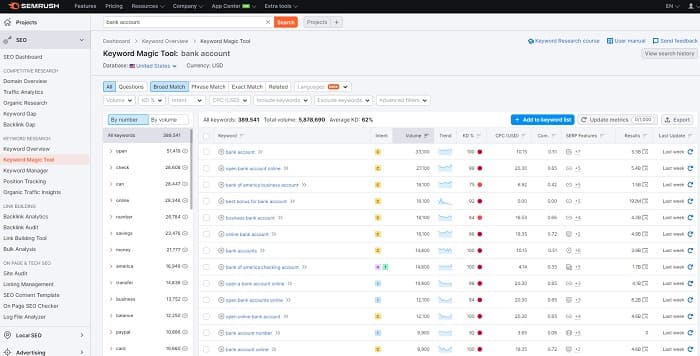

Tools such as Semrush and Ahrefs will enable you to find relevant keywords for your financial services website, and show you the keywords your competitors are ranking for.

Nothing wrong with a little healthy competition.

How to conduct competitor analysis goes into more detail about how to track, analyze, and outsmart the competition.

Semrush - keyword research and online ranking data, including metrics such as search volume and cost per click. The platform also collects competitor keyword usage.

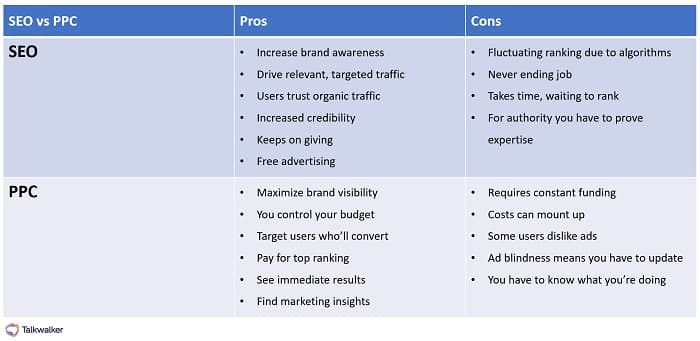

Looking to understand SEO vs PPC - Which is best for your brand, check out this post that explains the benefits of both and how to enable both for your brand.

Can Google see your site?

Google has more than 200 ranking factors. Its spiders crawl the Internet for content that’ll be stored in its database, so when a user enters a search, the search engine can find the perfect result. To introduce your site to Google, you should…

Have a site map that navigates the search engine around your site

Register your site with Google Webmaster Tools. This is so Google can contact you about any malware issues. You’ll also be able to geo-target your website to a particular country, if needed.

The Google algorithm scores your site and ranks it. While the ranking factors are secret, there are some that are obvious…

Domain authority - DA

The power of your domain name - talkwalker.com, for instance. DA is based on age, popularity, and size.

Age proves your website has longevity. If you’ve maintained your domain name and it receives high traffic, search engines recognize it as a trusted source.

Popularity is down to links. If you have high-authority inbound links to your site, they prove that your website has information that’s relevant and high quality.

Size - yes, it’s important - is a lot of high-volume pages with top-quality content and inbound links.

Apologies for any repetition, but it’s important to emphasize.

HTTP vs HTTPS

Is your website secure?

Mobile-friendly

Is your website responsive?

Loading time

How fast does your site load?

Images

Are your images optimized/compressed?

Content

Is your content relevant and unique?

What’s your keyword strategy?

How often do you update your content?

Do you have long-form content?

Do you have lots of quality backlinks?

Types of content marketing

Unique. Relevant. Quality.

The goal being to keep everyone happy. Search engines and Consumers.

Blogs

News stories

Social media posts

Infographics

Videos

Podcasts

FAQs

Customer case studies

eBooks

White papers

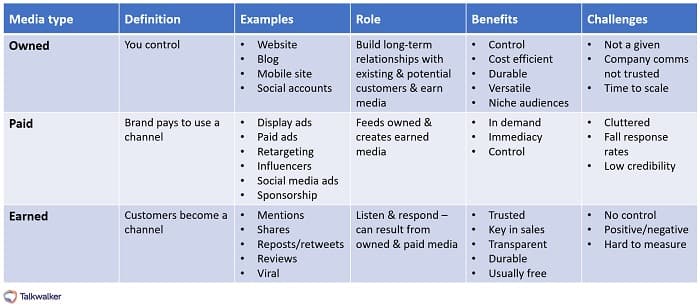

Your content strategy for your finance firm should use a combination of paid, earned, and owned media to engage with consumersand increase brand awareness.

4. Use paid ads for fast SEO

While you have an SEO strategy that’ll get you on page one in search engines, if you want to move fast, you need to use a combination of SEO and PPC.

Use a combination of SEO and PPC to dominate page one in search engines.

Types of paid ad campaigns

Remarketing/retargeting ads - showing ads to consumers who’ve previously visited your website

Search ads - appear at the top of organic search results after a person has entered a search

Display ads - showing ads to consumers when they’re on other relevant sites

Social media ads - paid social media advertising ensures your brand is seen

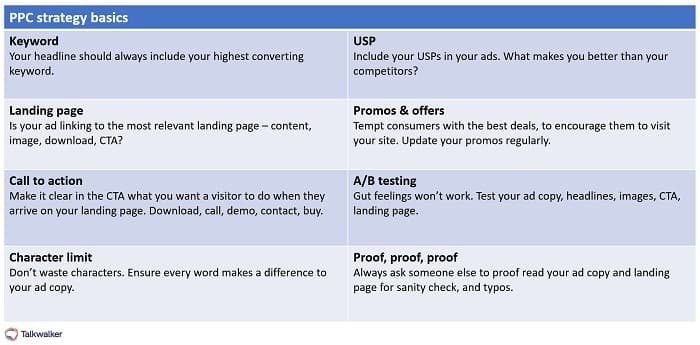

Use this PPC checklist to ensure you’ve ticked all the boxes. Halt or update, if you see that your ads aren’t performing as planned.

5. Develop your social media presence

As of April 2022, there are 4.65 billion social media users around the world. 58.7% of the total global population. In the last 12 months alone, users increased by 326 million.

Users typically spend an average of 2.5 hours per day, visiting an average 7.4 different social media platforms each month.

Seems rather redundant to say that your marketing strategy should include social media marketing. From Baby Boomers to Gen Z, consumers use social media to follow the news, comment on brands, make purchases, self-educate, and have fun.

Developing and maintaining an online presence that provides value will create engagement, increase brand trust and loyalty, identify marketing opportunities, and ultimately, build your customer base.

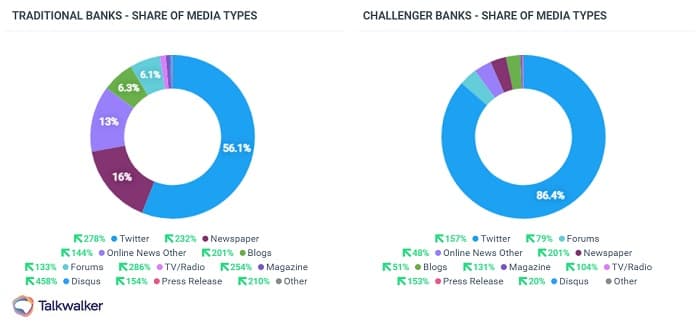

Twitter drives conversation for traditional and challenger banks, with online and print media significantly higher for high street banks. Banks - Monzo, Starling, Revolut, Monese - should address this issue to avoid stunted growth.

Determine which social media channels your target audience uses. Could be that you only need to use one - Unlikely. Could be you need to market across multiple social platforms.

Decide on your social media strategy…

Will you use social media for customer service?

Looking to build trust, back office stories and images will show the human face of your business.

Share helpful, honest, and relevant posts. Humanize your financial services institution.

6. Map the financial servives customer journey

When mapping the customer journey - and there will be several - analytics will show you the various routes taken. The most important journeys, while highlighting actions for specific customers.

Using their preferred social media channel

Personalizing the messaging

Eliminating sticking points

Their journey has a goal that’s to open an account, apply for a loan, action a wire transfer, etc. Their journey could start on a mobile app, in a brick and mortar bank, on a phone call, paid ad, website…

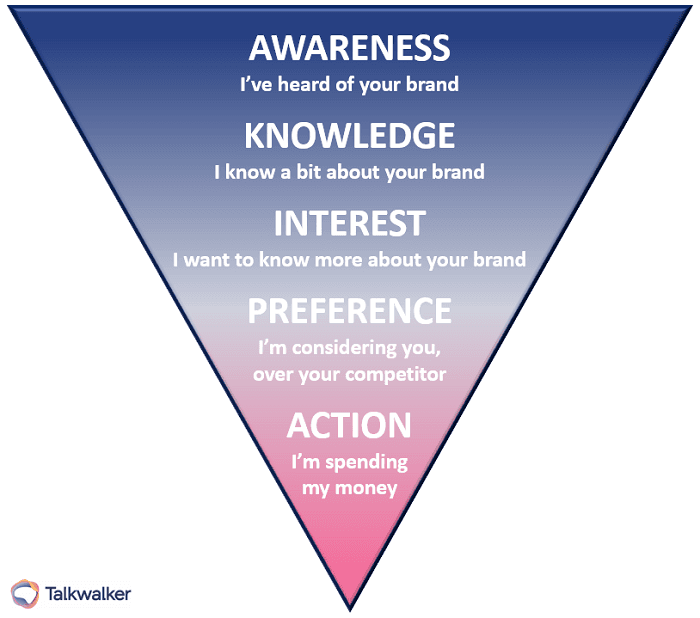

How a consumer converts into a customer - their initial awareness of your brand, and the steps they take to purchase.

Your consumer journey analytics strategy will ensure that every team in your organization has access to real-time insights into consumer behavior. Which customers are saving for a rainy day so might consider taking out a loan. Customers looking to buy a property, so they’ll need mortgage application advice. Youngsters about to leave the nest and head off to university, who may need money management tips.

Giving your teams full-exposure means they’re working in alignment. Collaborating on how to develop the consumer journey and provide the best customer experience.

You can target specific customers, or segments, and provide relevant assistance.

But, as I said, it’s a ton of data. Too much to process manually, and too easy to mess up.

How to map & measure the consumer journey walks you through the benefits of mapping the customer journey, consumer journey measurement, how to measure the customer journey, and the tools and metrics to measure.

Benefits of analyzing the customer journey?

Mapping the customer journey is more complicated than it used to be. There's offline and online channels. Multiple entry points. Multiple goals. It'll help you and your team understand the interactions happening between your financial firm and the customer. Your business processes will benefit...

Target your marketingOnce you understand a particular journey a customer has taken, you can target each step with personalized content for each step. This will in turn, improve click-through and conversion rates.

Keep teams updatedYour customer journey map can be shared across teams, to ensure that everyone is inline, with regard to company language and voice. Building a customer-centric culture across your firm.

Drive conversions & retentionRefer to your customer journey map when creating your financial services marketing strategy so that you address and meet every goal. You'll identify sticking points, why customers are abandoning halfway through a request, and at which point customers churn.

7. Outreach & engage consumers

This strategy works for both digital and traditional marketing. A financial service provider reaching out to customers and potentials - online/offline channels - to offer assistance. Providing ‘how to’ videos, money management, business management services, free consultations, webinars, etc.

The Director of Business Banking at NatWest shares insights on how businesses can start their sustainability journey.

Not only does this help consumers, it inspires confidence and loyalty, and increases brand awareness of the products and services on offer.

Read Our Bottomline Customer Case Study

Leading fintech, Bottomline Technologies, used Talkwalker to better understand industry conversations and build brand awareness.

A financial services marketing strategy should work with your offerings and target outreach towards relevant consumer segments or demographics.

For instance… With governments pushing the use of electric vehicles - EV - to tackle climate change, your bank could launch a campaign and target outreach to consumers about the long-term savings of buying an EV, and how you can help with the cost of installing a charge point in the consumer’s home.

8. Tell consumers stories

Let me tell you a story…

Remember, you’re dealing with humans. It has to be more than just a marketing tactic. It has to be genuine.

Consumers research before spending their cash. Read customer reviews. Ask peers. Just imagine the research they do when it comes to keeping their money safe?!!

Your content - be it on social media, blog, ads, videos - should tell a story. It should offer advice and reassurance.

Use digital storytelling in marketing strategies for financial services to show real customers. To build customer relationships. To promote your financial service.

9. Answer questions with your content

Marketing strategies for financial companies must include a content strategy. The goal of this strategy is to answer every single question that a consumer has today, and might have tomorrow.

The content should be easy to understand. It has to help and educate consumers. It has to be recognized by Google as unique and relevant.

Rather than make this post any longer than it is, take a look at How to create a content strategy. Working across industries, consumers hold positive feelings towards a brand after reading its content. Also, include customer stories.

90% of consumers state that user-generated content - UGC - influences their buying decisions.

10. Use video marketing to help & sell

In 2020, 96% of consumers increased their video consumption. Nine out of ten said they want more videos from brands. In 2022, it’s predicted that a person spends 100 minutes per day watching videos.

With viewers retaining 95% of a message when seen in a video, compared to 10% when reading it in the text, videos must be part of your marketing strategy for your financial services company.

Set your goals

Create videos that build trust

Educate consumers

Use UGC and reviews

Personalize your videos

One minute of video is worth 1.8 million written words.

Customer testimonials & reviews

Adding customer user-generated content to a product page can increase conversion by up to 6.4%. While 66% of consumers trust customer reviews 12x more than brand content.

If you have customers that are happy to become brand advocates, invite them to tell their story. You’ll build trust and show potential customers how their peers are using your services.

How-to videos

How-to videos get more attention than any content category on YouTube.

Create videos that help navigate consumers through procedures, such as how to invest their savings, planning for the future, budgeting, taking out a loan, etc. Explain complex financial services.

TD Bank uses webinars and videos to educate consumers on personal investments. They show experts sharing insights and tools, to help businesses manage transactions.

Tell your story

Humanize your brand and share your firm’s history. Introduce your team, share back office footage, personalize. Build a transparent relationship.

11. Don’t give up on email marketing

78% of marketers have seen an increase in email engagement over the last year. In financial services, email marketing has an average 4,400% ROI.

Your email marketing content strategy should include…

A newsletter with links to your blog posts

Updates and changes to the services you provide

How-to videos and educational guides

Socially conscious projects, volunteer work

Awards and press releases

Customer testimonials and review

Upcoming events and webinars

Win customers with the best marketing strategy

The best marketing strategy for financial services comes with a customer-centric approach, whether they’re coming to you via an app, your website, phone call, or face-to-face. It starts with you understanding the issues that matter to consumers, how you can help them, and keeping them happy.

Leading fintech, Bottomline Technologies, wanted to find and understand industry conversations, while building brand awareness. Having access to analytics wasn’t helping the brand understand how its content strategy was performing, and whether it was benefiting the business.

To align its organic and paid marketing, Talkwalker’s consumer intelligence platform was able to provide a clear picture of industry intelligence, social media, and media placement. The Bottomline team was then able to share insights across the board, so work could be optimized with customized reports and dashboards.

Download our customer case study to see how speed to insights was accelerated and business pain points addressed.