Top consumer trends in UAE

UAE consumer trends give retailers insight on behavioral changes caused by the pandemic.

March 1, 2021

Observe shifting consumer behavior amid these turbulent times

During the past year, brands in the United Arab Emirates adapted their strategies to match current consumer trends that are largely shaped by the ubiquity of digital services. The year 2020 taught brands and consumers alike the importance of adaptability in the face of adversity, in addition to prioritizing marketing metrics like ‘brand loyalty’ and ‘brand affinity’.

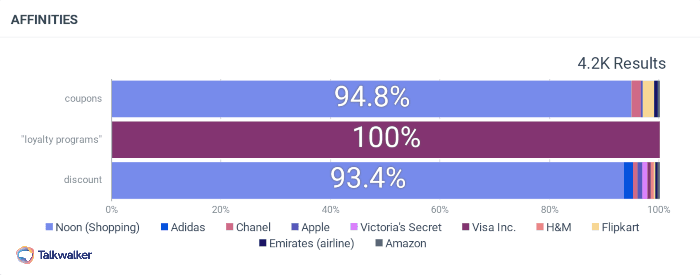

Consumer trends in the UAE show that shoppers have become more price conscious than ever, and have been continuously seeking ways to save, whether through loyalty programs, coupons, or simply limiting their spending. Albeit one of the world’s most vaccinated countries against COVID-19 so far, UAE consumers remain hesitant to go back to life as it was before, and await major public health milestones that go beyond lifting restrictions.

Consumers in UAE are associating 'coupons', 'loyalty programs', and 'discounts' with major brands.

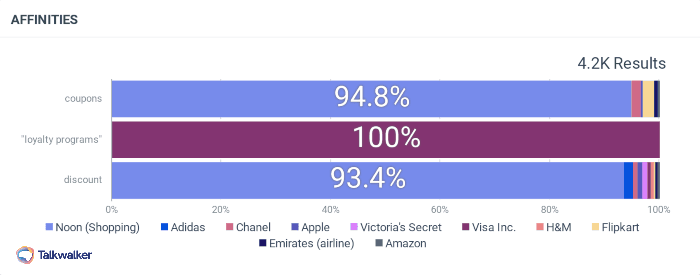

On the bright side, this paradigm shift in consumer behavior accelerated digital transformation within companies, with some referring to COVID as the Chief Transformation Officer, forcing them to innovate towards a contactless economy. Furthermore, UAE consumers have become digital natives where they rely on social media platforms, review sites, and video testimonials before making an informed decision.

According to Hootsuite’s latest ‘We are Social’ report, UAE internet users first discover brands through search engines, social media ads, or retail websites, and then go on to research that brand on those same channels, in addition to consumer review sites. Indeed, 52.1% of UAE internet users go to social media when researching a brand.

To make things even more interesting, the data from the report also shows that UAE online buyers have spent $1.68 billion on fashion and beauty products, followed by $1.52 billion on toys, DIY and hobbies, and $1.27 billion on travel, mobility, and accommodation (could be explained by expats going back to their home countries).

To provide a bit of context, consumers in the UAE are some of the most nationally diverse across the GCC, with only 11.5% being local Emiratis and the rest consisting of expats and immigrants with varying levels of income. Up until the pandemic hit, retailing in the UAE was closely tied to social habits. Malls have become public spaces where they not only provide consumers with their necessities, but also provide them with a social experience, a source of entertainment, and (most importantly) air conditioning.

Buy now, pay later

Consumers have long enjoyed the flexibility offered by zero-interest instalment payments. However, with the sudden surge of e-commerce in the UAE, they are now benefiting from a new product offered by fintech startups: buy now, pay later. Aptly named, the product poses itself as an alternative to cash-on-delivery methods which significantly dropped during the pandemic, in fear of transmitting the virus through repeated payments.

As a matter of fact, UAE consumers have already embraced typical mobile payment platforms such as Apple Pay and Google Wallet to pay for their in-store purchases. Banks and fintech players have simplified the payment process and promoted their industry-grade security measures in order to gain access to one key element in business: consumer behavior data.

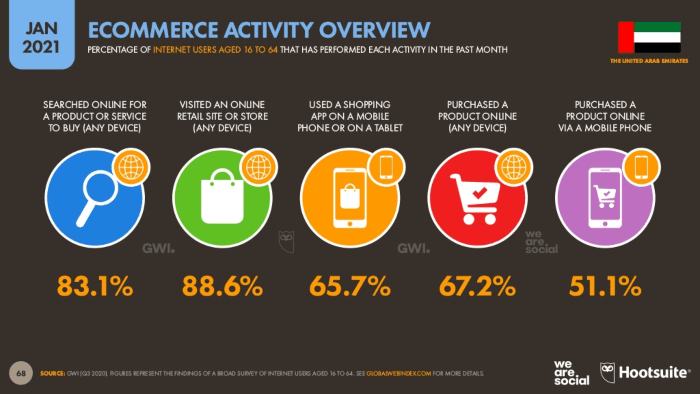

Observing the number of mentions of ‘buy now pay later’ (magenta) VS ‘cash on delivery’ (purple) in the UAE over the past 12 months.

Looking at the data it does appear that ‘cash on delivery’ has the most share of voice in the UAE digital space, though looking closely it seems as though the conversation revolves around why brands should adopt online payments and how to implement a contactless customer journey.

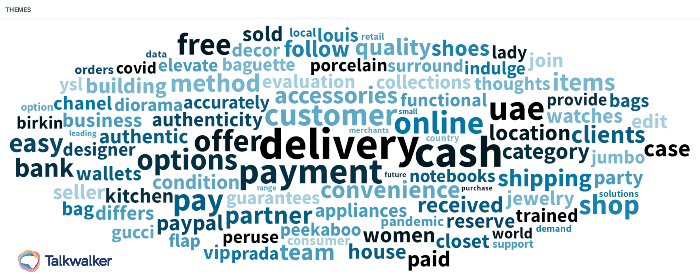

Top themes surround ‘cash on delivery’ in the UAE for the past 12 months.

Don’t get caught off-guard, know your customer base

The rise of super apps

Despite having a new set of expectations, consumers are always looking for convenience, a one-stop shop that just works. Whether it’s ride-hailing, ordering a pizza, or booking a cleaning service, UAE consumers are now loving the idea of installing only one app on their smartphone, which entails signing up once, putting your credit information once, and getting used to one customer experience.

One way to think about it is by comparing it to the transition from high-street to a mall.

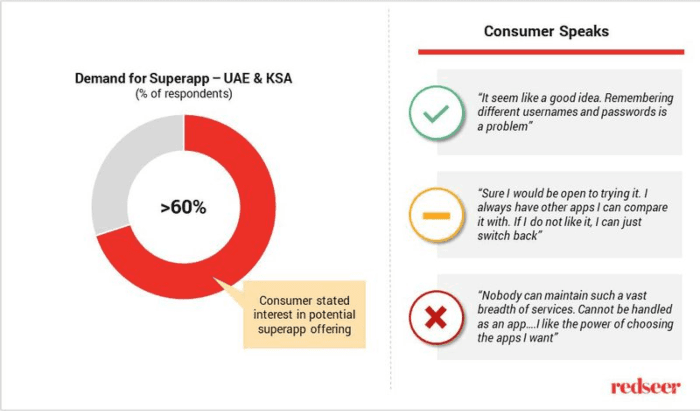

Consumer confidence towards Super apps remains relatively unstable, image source: Redseer

Nonetheless, super apps like Careem or Halan remain relatively nascent to make a conclusive argument about their efficacy, especially with no clear value proposition being presented.

See how consumer intelligence could supercharge your brand

From global to local

With global supply chains coming to a halt, it was inevitable that some products would go missing from retail shops, whether foods, electronics, or clothes. Add that to the fact that most consumers have become increasingly aware of their consumption behavior, the UAE consumers are prioritizing local brands over international ones, especially in perishable food items like dairy and cheese.

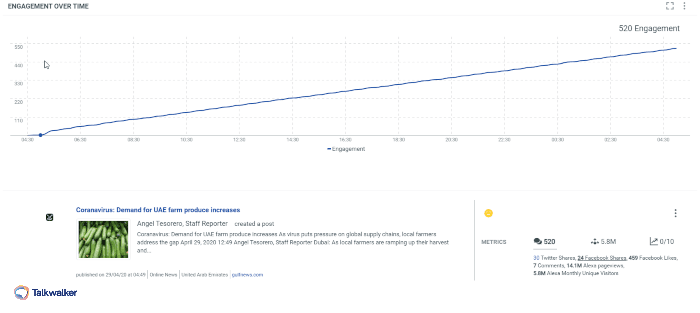

The most engaging articles related to 'buy local' in the UAE during the past 12 months.

Brands and consumer-facing businesses must be aware of these shifts in consumer behavior that have been accelerated by the pandemic. With UAE consumers fully embracing online retail channels, retailers have no other option but to adapt and leverage consumer intelligence gained from data analytics, to put consumers first and meet their expectations.

Yet, while brands must prioritize their consumers' needs, they need to do so within an integrated strategy that considers a hybrid shopping model, where consumers are combining in-store visits with online research.

As mentioned earlier, brands that have taken quick measures towards agility and resilience will be much more capable of targeting digitally savvy consumers within an increasingly competitive market where customer loyalty is king. The pandemic has re-written the contract between retailers and consumers, and the latter are more than ever calling the shots and reimagining expectations.