Social Media Trends 2025

Informed agility is the name of the game in the fast-moving world of social media.

How to win on social media in 2025

Social media is evolving faster than ever. And top-performing social teams prioritize agility using social listening, creativity, and AI to focus on what truly works. In 2025, success will belong to those who adapt, experiment boldly, and use data to fuel meaningful engagement and drive measurable impact.

The message is clear: embrace informed agility and turn the chaos of social into an intentional, thriving space for your brand.

Data sources for unparalleled insights

- A commercial survey of 3,864 marketers across 99 countries and 16 industries

- Primary interviews with social marketing practitioners and leaders

- Primary data supplemented by Talkwalker

- Secondary research from Statista, Deloitte, Forbes, NielsenIQ, The Social Intelligence Lab, and others

What are the top social media trends for 2025

#1 The Creative Disruption Trend | #4 The Micro-virality Trend |

#2 The Outbound Engagement Trend | #5 The AI Content Trend |

#3 The Social Performance Trend | #6 The AI Strategy Trend |

Social media trend #1

Social teams push creative boundaries

Creative opportunities on social platforms have inspired brands to shake off traditional brand conventions — even if it means diverging from their usual brand voice. Now, social teams are prioritizing bold and entertaining content that better delivers what their audiences want to see.

And it’s paying off: Teams that embrace creativity are more likely to say they have a “very positive” impact on the business than those who don’t.

So dare to let your content entertain, surprise, and delight — even if it means rewriting the rules of brand consistency. After all, social media is the playground for innovation.

Social media trend #2

Brands find new audiences in the comments section

More and more, brands are strategically engaging with creator content and making waves in the comments section to reach new audiences and foster community.

But outbound engagement (as this tactic is called) goes beyond casual replies. It’s a calculated move that positions brands in front of fresh eyes while building meaningful connections. After all, successful outbound engagement hinges on authenticity as creators become more selective about partnerships that align with their values.

In short, don’t just comment — connect. Focus on cultivating real relationships with creators and their communities to stand out in crowded social media spaces.

Teams that embrace creativity are more likely to say they have a ‘very positive’ impact on the business than those who don’t.

Social media trend #3

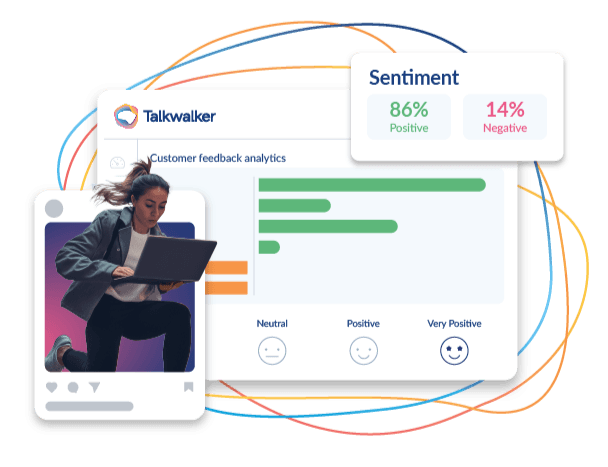

Listening transforms social into performance marketing

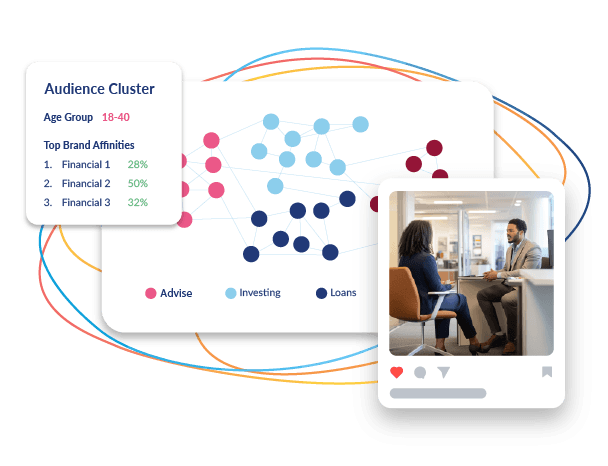

Thanks to social listening, social media marketing can now deliver insights beyond, “vanity metrics” such as likes and shares. Real-time data from social listening helps brands understand their audience, identify market gaps, guide product development, and even boost sales. This gives social pros data that can be directly tied to ROI — something that traditionally belonged to performance marketing.

Social listening provides so much value, in fact, that organizations now rank it as their second highest priority on social, just after audience engagement. And social marketers who master listening are becoming revenue powerhouses (and unlocking bigger budgets) thanks to data-driven insights and measurable business impact.

Social media trend #4

Social listening makes micro-virality more meaningful

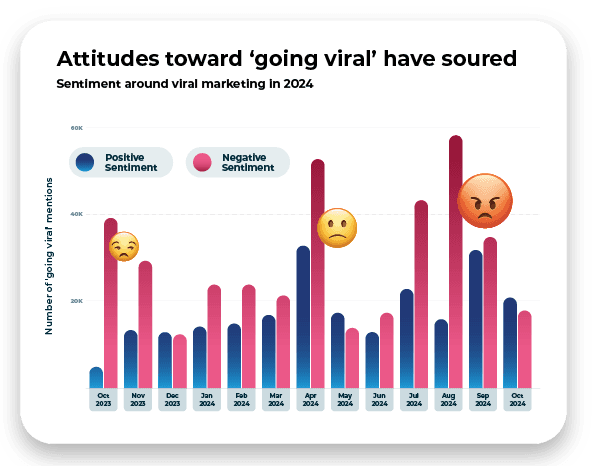

Gone are the days when chasing viral moments was the ultimate goal — especially as sentiments around “going viral” have increasingly soured. Today, social marketers prioritize authenticity over fleeting fame by wisely tapping into trends and cultural moments that are relevant to their brand.

And with social listening, it’s easier than ever to identify trends that resonate with specific audiences. Social listening tools provide the real-time data needed to evaluate trends, revealing whether they’re gaining traction, peaking, or fading among the people your brand cares about.

So now there’s no excuse for blindly jumping on random mainstream trends. Instead, use social listening to craft focused, audience-centric content that drives meaningful engagement.

Insights from social listening help us look at our content with a new perspective.

Social media trend #5

Generative AI officially joins the social team

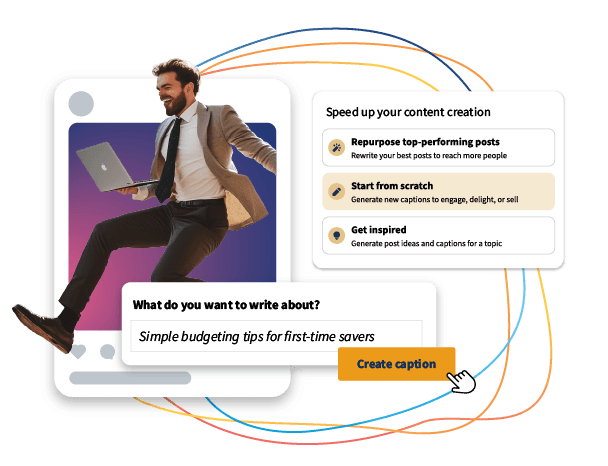

Generative AI has evolved from an experimental tool to a must-have asset in social media marketing. What’s driving this shift? The relentless demand for fresh, scalable content.

Our research found that brands should aim to make between 48 and 72 posts per week across platforms — a workload that’s better suited to AI tools than a single, multi-tasking human. Even industries with strict compliance regulations (like healthcare and finance) are adopting AI for content creation, showing how mainstream and essential it’s become.

So get on board. As generative AI becomes a cornerstone of social marketing teams, brands that fail to adopt it risk falling behind as social content creation reaches hyperspeed.

Social media trend #6

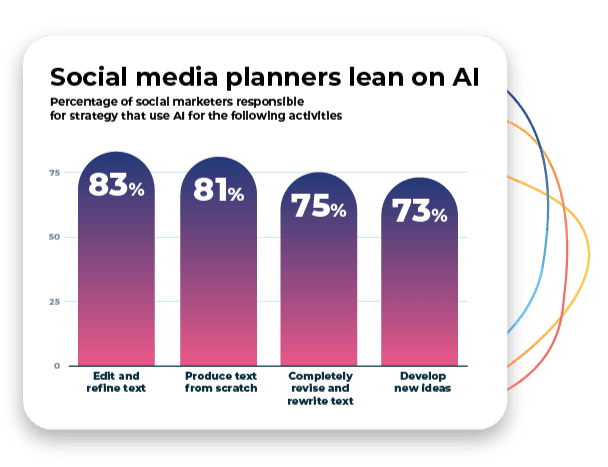

AI becomes a thought partner for social strategy

While AI has become essential for content creation, it’s also reshaping social media strategy at the highest levels. Over three-quarters of C-level executives and VPs responsible for social strategy are now using AI to assist with social media activities. And they’re using it even more than those responsible for execution.

This shift is fueled by the rapid integration of AI into tools for analytics, campaign management, forecasting, and more. And with AI delivering real-time insights and executive summaries, strategic planning has never been more efficient.

If you haven’t yet, now is the time to embrace AI as a thought partner. Organizations that do will drive agility, efficiency, and innovation — unlocking transformative results for their business.

More than three-quarters of C-level executives and VPs responsible for social strategy are now using AI to assist with social media activities.

Download the full report now

* indicates required fields