DOWNLOAD NOW: 2020 Marketing Manager Playbook

Financial services can be a highly personal field. People are sensitive about money management, and banking and financial institutions establish relationships with customers through face-to-face interactions when they can. Without people going into a bank to do business with a teller or meet with an advisor, financial service companies have to figure out how to provide warmth and a personal touch during a time when all of their customers feel more isolated than ever.

Understanding what people are worried most about right now can help brands form a plan of action during this industry upheaval. By examining conversational trends, financial service brands can address customers' concerns and implement practices that will help their clients feel more secure right now.

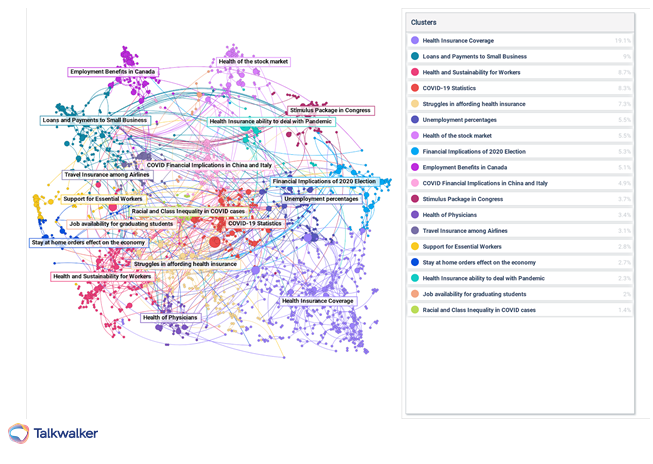

Talkwalker’s Conversation Clusters shows the most discussed topics around FinServ in the time of COVID-19.

I checked out FinServ industry themes that we’ve seen trending the most here at Talkwalker to understand how the online narrative is developing, and what brands are doing to react. Here are the topics that are driving the conversation:

Insurance coverage and cost

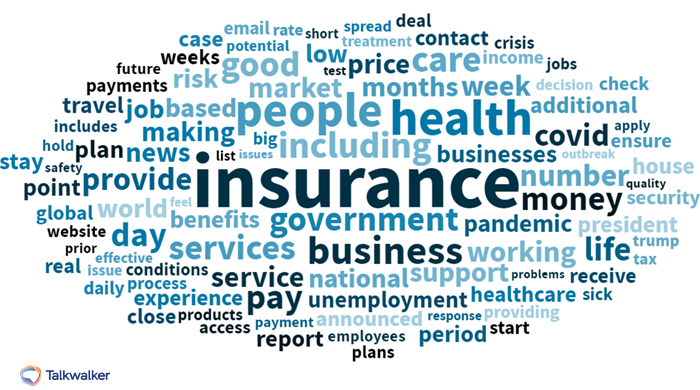

With turbulence in every industry causing uncertainty around employment security recently, insurance coverage has been one of the key conversation drivers for financial services. People are worried about losing their jobs and their health insurance, or concerned that their employers will cut coverage benefits to save on business expenses.

Concerns about job loss and the COVID-19 pandemic are closely tied to the insurance conversation online.

Many of the insurance providers in the US have been using social media to soothe customers’ concerns and answer their questions about coverage. I saw FinServ brands changing policies to help customers, like Wells Fargo deferring home and auto insurance payments. Others are partnering up with healthcare organizations to provide resources to medical professionals, like Farmers donating PPE and COVID-19 testing supplies, showing that financial service organizations are using this as an opportunity to support their communities and customers out in the field:

Farmers is proud to support the @SpectrumHealth COVID-19 Response Fund to help the organization with PPE supplies, employee wellness resources and childcare assistance. Thank you #HealthHeroes for all you do. #FarmersCares #InThisTogether pic.twitter.com/wXixJVVjdN

— Farmers Insurance (@WeAreFarmers) April 14, 2020

Farmers Insurance teamed up with healthcare provider Spectrum Health to provide supplies to medical professionals in need.

Will these partnerships continue after coronavirus has passed? If working together benefits both parties during this time, we could be seeing a shift in strategy that will impact marketing campaigns to come in 2020.

The stock market

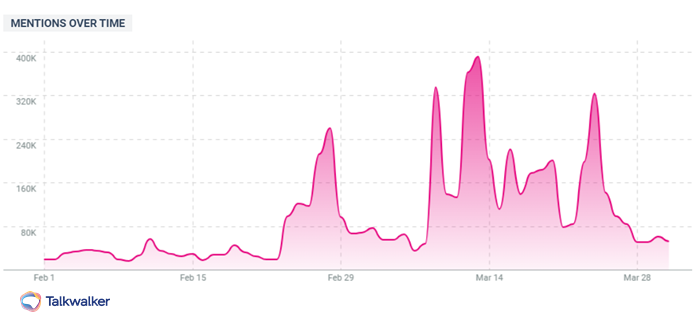

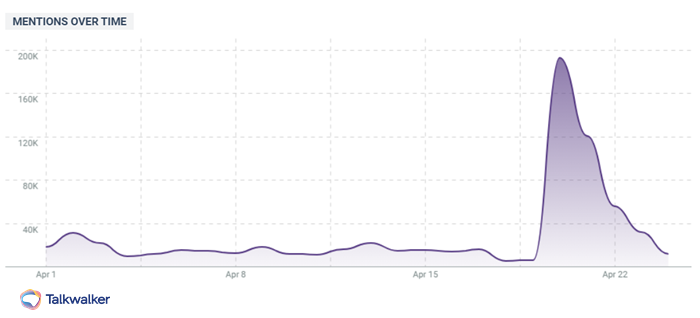

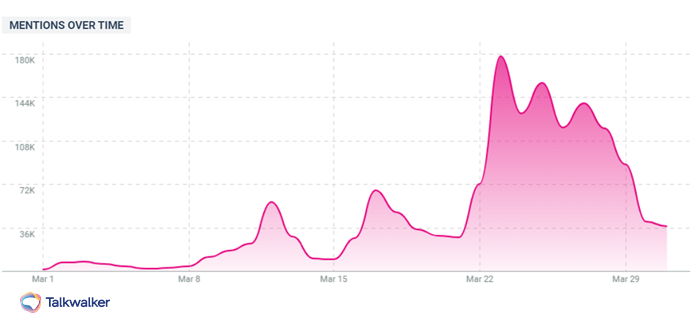

Uncertainty in the face of the pandemic has had a dramatic impact on the global economy. As early as February, before concerns about COVID-19 really stretched worldwide, there was an uptick in conversation online about the virus and its implications for international stock trading:

People voiced concerns about coronavirus and the global economy for weeks before the pandemic became an international issue.

Sentiment around the stock market has also been negative, with many people expressing their frustration around bailouts for financial institutions when everyday folks are worried about how they are going to pay their bills:

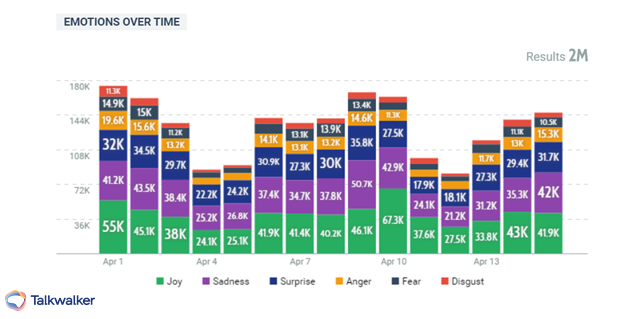

Fear and Sadness are large emotional drivers in conversation around the stock market this month.

What’s one big thing everyone is discussing in April? Oil prices, which fell dramatically over the last several weeks as transportation needs dwindled, are on everyone’s mind:

With less people traveling across the globe, oil is seeing a big decline in demand. The dramatic dip in prices at the gas pump recently has people talking.

The stock market has continued to have its ups and downs - while some investors are slowly returning and improving financial outlooks, only time will tell how much COVID-19 continues to impact the worldwide economy this year.

Get your COVID-19 industry report

Unemployment

Coronavirus has wreaked havoc in virtually every field, causing a catastrophic unemployment situation that the US has not seen since the Great Depression.

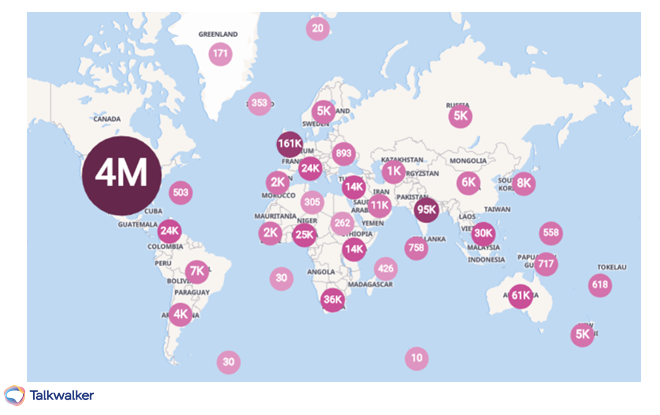

Conversation trends show that “unemployment” is being talked about worldwide, but it’s especially present in the US.

Limitations on travel, services, and day-to-day activity have caused companies in every arena to change how they do business. Industries that rely heavily on foot traffic, like retail and hospitality, are looking at a rocky road to recovery.

Some brands are weathering the storm well, like CPG and tech companies that are seeing a new, immediate need for their products with customers.

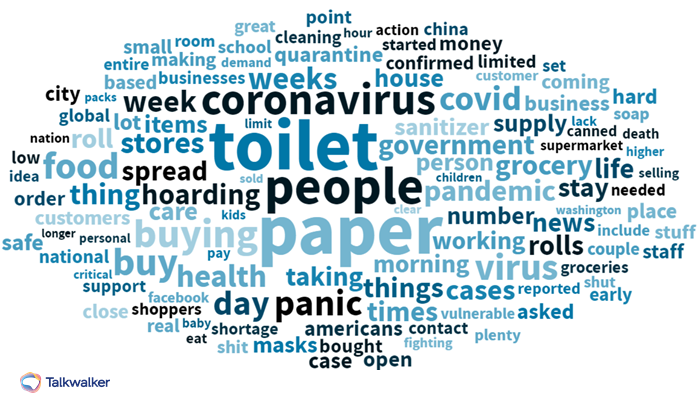

Mentions around panic buying show consumers are concerned about finding “toilet paper” and “food" during the pandemic, while “supply” and "shortage" mentions show the strain that brands are feeling with increased need for their products.

Brands that are doing their part to ease customers’ minds and contribute to a solution during the upheaval are getting positive engagement online, and are being seen as leaders who are helping society stay the course. For FinServ companies, that means making sure clients are feeling secure about their services. Charles Schwab, for example, has used their social platforms to share how they are addressing clients’ current concerns around the safety of their personal information and financial stability:

Schwab prioritizes protecting clients from schemes and tactics fraudsters are employing during this global pandemic: https://t.co/qJExzrPYKH

— Charles Schwab Corp (@CharlesSchwab) April 23, 2020

Brands that are actively engaging with anxious customers and being authentic about their own struggles are going to be seen as trustworthy in a post-coronavirus landscape, and consumers will remember the companies that made a concerted effort to help them during this time.

Economic stimulus

While a lot of the trending topics around banking these days are a bit of a downer, one thing that is driving some positive sentiment online in the US is the economic stimulus plan. In March, many people were talking about the need for an aid package for an increasing number of unemployed people and struggling businesses:

As financial outlooks began to worsen, conversation around implementing a “stimulus package” grew.

When a stimulus package was announced in the US, there were mixed reviews. Some people saw it as welcome relief, while others voiced that it was too little too late.

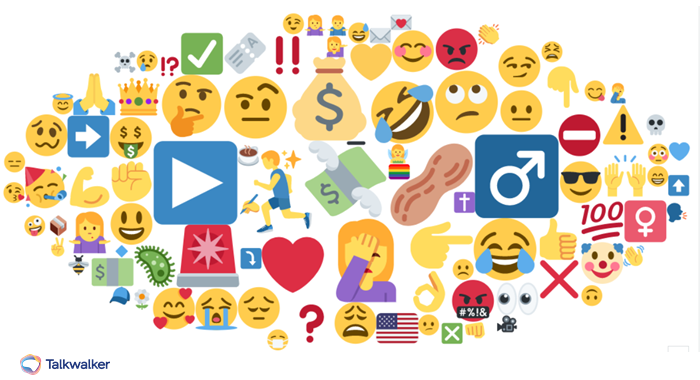

Emojis that people are using to talk about their stimulus check online show that both excitement and frustration are common themes.

Good or bad, it’s clear from the conversational data that an economic stimulus package was necessary to help both consumers and companies feel like they are getting back on track.

Monitoring social trends for your brand should always factor into your financial services marketing strategy, but with the onset of the coronavirus pandemic it has become essential to stay aware of what people are talking about. It will be interesting to see how companies in industries like financial service continue to react to the changing needs of their customers, and how the market will adapt long-term to these innovations.