The state of the at-home food delivery market in 2020 is strong. To say the least.

Since March 1 we have seen a tremendous growth in mentions across all styles of food delivery.

In this report I will look at the delivery industry conversation between four distinct types of food delivery. They are:

1 Restaurant prepared food delivery. Think Uber Eats or Postmates.

2 Meal kits prepared at home. Think Blue Apron or Freshly.

3 Grocery delivery. Think Peapod or Instacart.

4 Vegetable box delivery. Think The Farmers Box or Misfits Market.

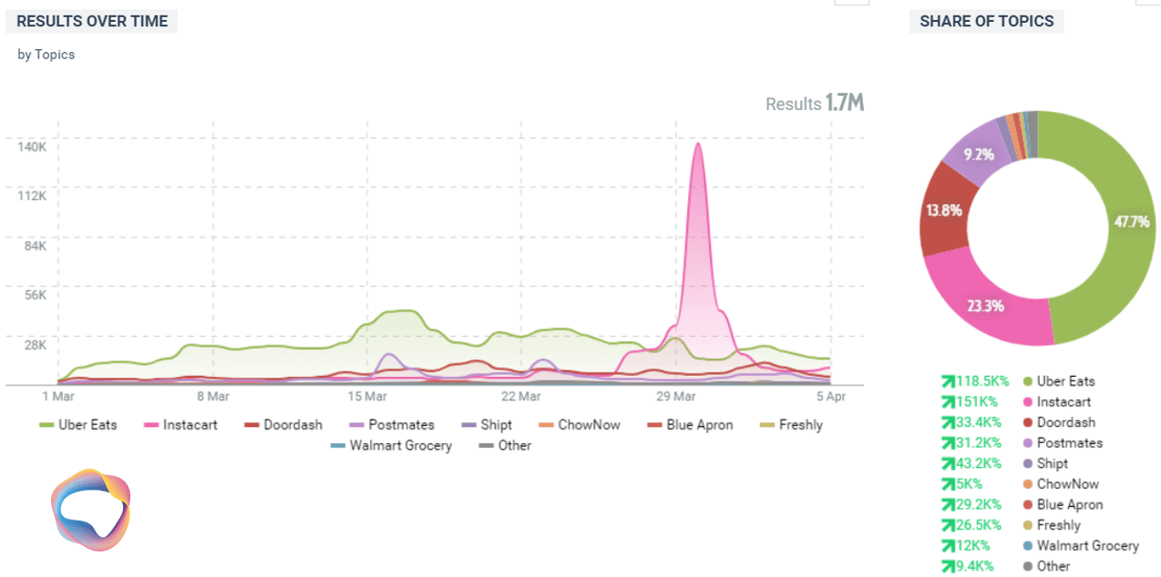

Mentions on social media across food delivery services in March

Mentions have skyrocketed, at a minimum 1700% percent since last month, but for a brand like Instacart as much as 11,000%!

Further on as we dig deeper into this subject some of the percentage increases are truly staggering - figures like 20,000% more mentions than last month. These numbers boggle the mind and their magnitude can’t fully be comprehended.

For the most part you can assume that these themes ranged from non-existent a month ago (contactless delivery) to simply a data point to monitor during normal times. For most of these companies, issues that might arise from time-to time during normal business like shortages, or frequently mixed up orders, or no delivery availability are something to be studied and worked on in a thoughtful manner.

None of them have the luxury of time to be introspective, for most it is all hands on deck as they deal with the crush of demand in new sign-ups and volume.

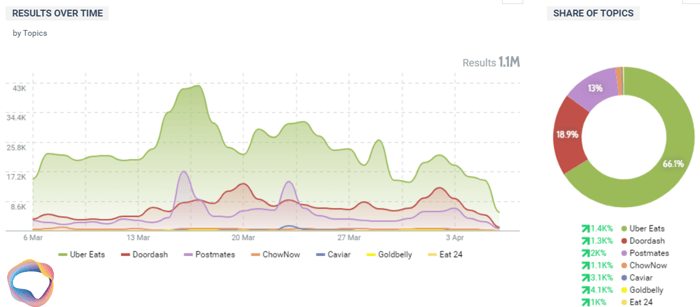

Restaurant delivery

Restaurant delivery mentions over the last month.

Restaurant delivery services are seeing huge increases in mentions on social media in the last month. I can certainly attest to this activity by looking out my window - there’s a steady cadence of deliveries arriving at all hours of the day - even if all the Chinese restaurants are closed.

All of them have over 1000% more mentions since this time last month. What’s interesting is that the mentions seem to be increasing in volume, but also, spiking. So while there’s generally more mentions of these delivery services there are also peak days as people react to the news whether that’s a national headline or reaction to a new brand policy or something else.

Uber Eats had nearly 43,000 mentions on March 16th alone. That’s double the increased volume they were already seeing as people began staying home. They also made headlines as they began to explore grocery delivery across the globe.

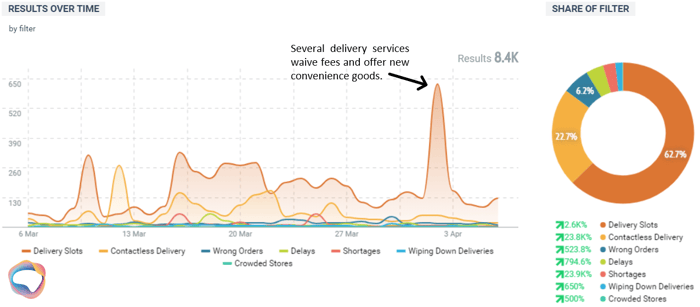

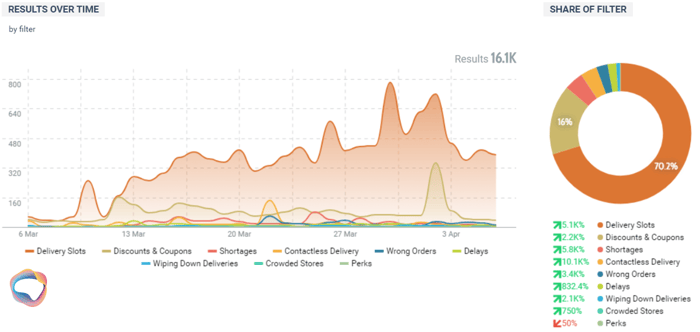

Themes in restaurant delivery for the last month

Topics important to restaurant delivery customers last month.

Looking at various themes across all these 1.1 million mentions of restaurant delivery services we can filter away to leave us with 41,000 conversations that specifically focus on topics important to customers today.

So today I've learned never to use @DoorDash. Ordered @ChipotleTweets from the app. Tried to call the driver after waiting 30 minutes past delivery time and of course the driver number is disconnected.

— Hashashon (@hashashon) April 2, 2020

These themes include new pandemic-specific terms and practices that most customers didn’t know they would be demanding only a month ago. These terms include things like contactless delivery, sanitizing deliveries, or even just being able to get a delivery slot has become a challenge in places.

Themes in restaurant delivery for the previous month.

That is true of restaurant delivery services too, as getting a delivery slot now makes up nearly 16% of the total conversation when discussing issues related to the industry. That number is notable, though not quite as dire as the situation for grocery deliveries. We also note that 7% of the conversation includes customers discussing contactless delivery, the idea that fewer contact points gives less opportunity for germs to spread.

Those new orders are generating a raft of new data points too, as Uber Eats has shared the most popular delivery order for each state. Other restaurant delivery services have started activating their own campaigns that specifically address the global crisis.

Teamed up with @postmates in order to giveaway $50 in credit to 5 people once a week throughout the month of April. Make sure to leave the email associated with your account in the comments for a chance to win pic.twitter.com/jLQgbzZrp2

— Brother Nature (@BrotherNature) April 2, 2020

For instance, Postmates is working with influencers to share credits for food.

. @postmates and i want to support those who need extra help right now

we will be sending postmates credit to some of you who need it. just dm me <3

and just a little reminder to support your local restaurants and businesses

love u guys & praying for all of u

— emma (@emmachamberlain) April 3, 2020

During normal times, long delivery times during peak hours were a regular problem to be monitored and addressed in a piecemeal manner. Small operational tweaks could result in noticeable improvements over time. That same mentality now needs to scale for restaurant delivery services, as well as their clients -- the restaurants they serve.

Takeaway for restaurant delivery services

Generous compensation to delivery workers will be needed to get labor to meet demand.

Clear messaging about hygiene and public health. Show what you’re doing to keep staff and customers safe. Then show what you’re doing to support local businesses. Use data to understand pain points and craft messaging that resonates with worried customers.

Compassion and understanding will help soothe irate customers.

Many companies will find a consumer base that is more compassionate, more forgiving of mistakes, and more willing to make sacrifices.

It’s up to the brands to not squander that goodwill. They must step up and meet the challenge.

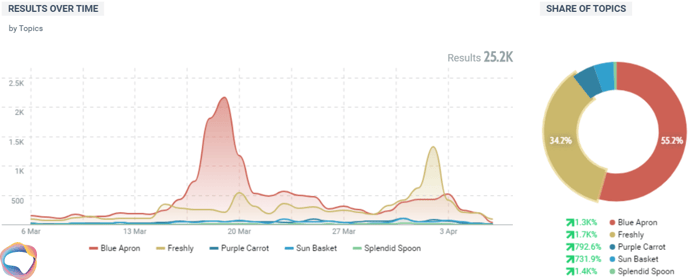

Meal kit delivery

Meal kit mentions for the previous month.

Meal kits are another important way to deliver food to homes, and they too have seen a surge in demand and mentions since last month. They include a recipe, and pre-portioned ingredients for customers to make at home.

Giants in the sector like Blue Apron or Freshly are seeing mentions increase 1300% or more since last month. Their stock prices are following this trend too. Smaller players like Purple Carrot and Sun Basket are also seeing a lift with over 700% more mentions than last month.

Even if these brands profit from the momentum, they are in a complicated business. Meal kits subscription churn rates are high because food is perishable and because it is quite costly for Millennials to live from meal kits for weeks on end. Meal kit brands need to tell a relevant story again and again and they need to continuously drive fresh traffic to their apps and websites in hopes of permanently converting new customers.

How do they play their social media strategy?

Freshly, one of the big players, leads the conversation with visually appealing and clever tips on how to stay healthy and by teaming up with other food companies for cause-related marketing.

View this post on InstagramA post shared by Freshly (@getfreshly) on

Freshly’s immunity shot related Instagram posts are working well for the brand with 2008 likes.

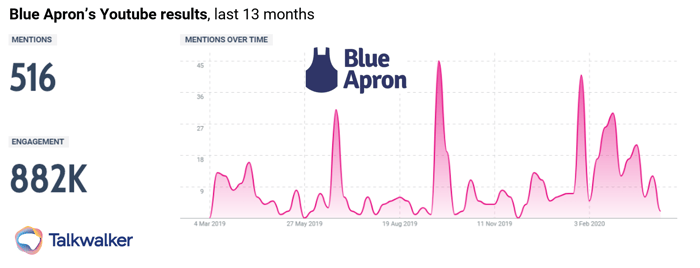

Freshly’s competitor Blue Apron’s biggest social media success is based on their YouTube cooking influencer partnerships.

With 516 mentions on YouTube in the last 13 months, they earned 882K engagements (shares, likes, comments) and nearly 20 million views.

Blue Apron’s impressive 882K engagement on YouTube in the last 13 months.

Blue Apron dominates the meal kit delivery YouTube referral segment featuring Ryland Adams’ cooking classes, grossing 7,846,522 views and 213.3K engagements

How are the niche players doing?

Purple Carrot, a plant-based meal kit company, shows customers that plant-based food can be visually as appealing as classic food and that plant-based meal kits offer so much more choice.

Purple Carrot’s Instagram post showing crispy carrot ravioli generated 2810 likes.

Sun Basket, an organic, sustainable and responsibly sourced meal kit caterer, has rather a niche share of voice but a well-curated social media appearance.

The brand delivers back-to-basics meal kits and thrives with essential life tips, its union with Feeding America but it misses huge engagement on these actions.

What drives meal kit conversations these days?

Meal kit delivery themes for the past month.

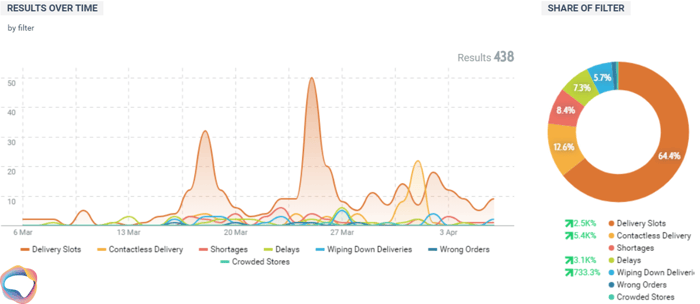

The global meal kit delivery discussion is dominated by crisis-driven topics such as; issues getting a delivery slot, getting delivery without touching anybody or facing product shortages:

64% of all meal kit conversations online are generated by delivery slot issues. During the actual intense delivery period, people care less about what they have on their plates than when they can get it delivered.

12.6% of the conversation is driven by the contactless delivery topic, showing that health hazards are a top priority.

8.4% of conversations are based on shortages, a surprise for customers to discover an out-of-stock situation and items missing from their meal kits.

Waited till midnight to try and snag a delivery slot on @FreshDirect for April 9th only to see this at 12:02am pic.twitter.com/J03SOZwgn8

— Neil Duggan (@neej) April 2, 2020

Instacart delivery issues are frequently discussed on Twitter.

Key takeaways for meal kit delivery companies:

Be visually appealing and authentic. Post tastefully cooked meal shots that look fresh and healthy, relatable, and yummy. Instagram is the perfect catwalk for these appealing visuals.

Be inspirational. Be a nutrition leader by giving easily understandable nutrition tips on social media channels. Lots of people need to learn how to cook at home. Take them by the hand.

Be cause-driven. When talking about food, you want to help the ones who are starving. Freshly bonded with food giant Nestlé to feed those in need. That adds credibility to your brand and shows that your brand stands for more than just your bottom-line, especially these days.

Be prepared. Slot delivery issues and new types of food deliveries will stay top of mind for the next few months, and how you handle those issues now, how you react, and the response to it will all have an impact on your brand perception.

All you need to manage a social media crisis

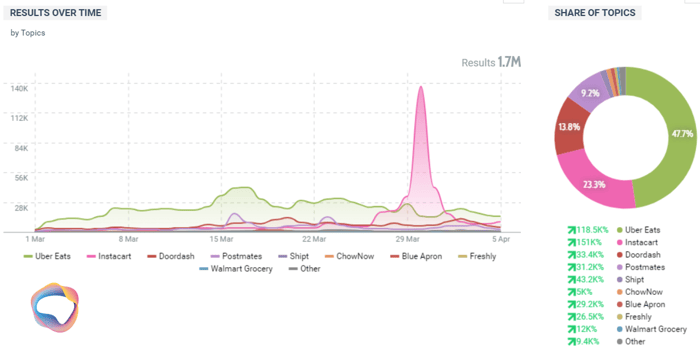

Grocery delivery

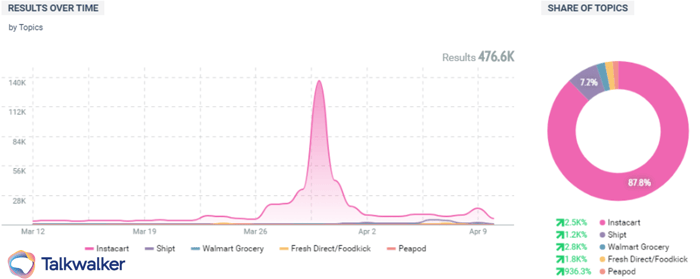

Grocery delivery services mentioned on social media over the previous month.

When you can’t get out to get groceries, you need them delivered.

Social media mentions of grocery delivery brands have exploded. Globally, social media mentions of major grocery delivery companies skyrocketed in March 2020 by a mesmerizing 33,000% to 411K, coming from very low February mentions (1.2K). Engagement reached 3.9 million shares and likes, from 25.8K engagements the previous month.

Grocery delivery went from “nice to have” to “must-have” within a month.

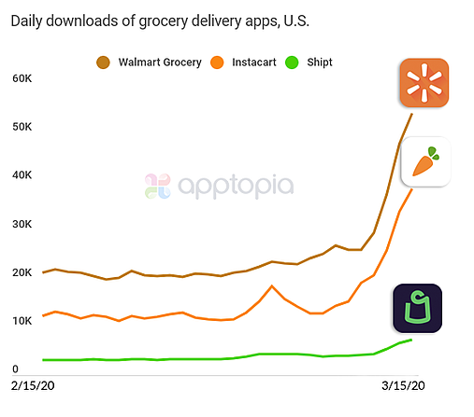

With March 2020 app download surges of 218%, 160%, and 124% for Instacart, Walmart Grocery and Shipt respectively, online delivery apps seem to be booming as well.

Grocery delivery apps, by daily download from mid-February to mid-March.

What's trending?

Grocery delivery brands are generally struggling with an intense social media wave underlining their fragile work conditions and recent delivery issues. As a response, Instacart tried to showcase its new corporate safety measures and default tip feature to help its workforce.

Looking at brand hashtags within the US grocery delivery market we can see workers issues are the main trending theme.

Instacart tries to reply by posting tweets about their revised worker safety measures and default tip features, with minor engagement though.

Our priority is to safely serve the Instacart community. Today we’re announcing new safety measures including manufacturing & distributing our own hand sanitizer to shoppers & launching a new customer tip default feature to help shoppers earn higher tips. https://t.co/mR0eBA71TP

— Instacart (@Instacart) March 29, 2020

After backlash, Instacart announces new safety measures and default tip features for its workforce.

Looking at grocery delivery brand emotions, customers are mostly praying to receive their delivery. Anger and frustration are also heavily mentioned.

US grocery delivery emoji cloud in March 2020.

One bright spot for the sector?

Elderly customers are often expressing their joy online when the delivery person knocks at their door.

Got my very first grocery delivery a few days ago. I’m 70 and didn’t want to risk the store. Thank you to Craig from Shipt, a Meijer partner. I know this may seem like a small thing, but it made a huge difference to me.

— 2amtrash (@Clementinezoe) April 5, 2020

Shipt consumers expressing their joy online for getting their groceries delivered.

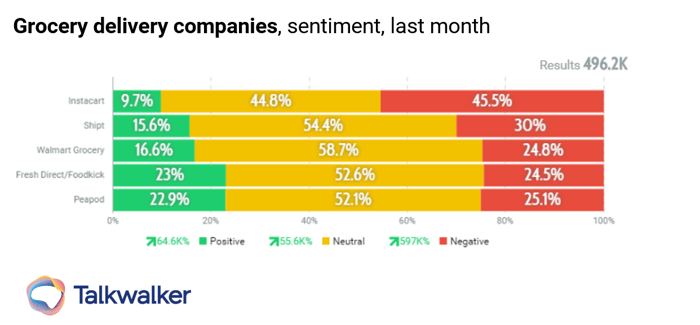

Sentiment analysis is a mirror of online emotions. While smaller grocery delivery companies have a more or less equilibrated online sentiment given the circumstances, major players like Instacart face a less positive sentiment, with a net sentiment of -64%. This is similar to the story we are seeing play out with other food delivery services.

Sentiment around grocery delivery companies for the previous month.

MARKETING MANAGERS: Get this handy playbook now.

On the positive side, grocery company customers regularly post about strange delivery situations, where two worlds seem to connect that were not meant to connect.

Every once in a while I think of the Instacart guy who interpreted 3 pounds of mushrooms as 3 individual mushrooms and how he handed them to me so gently and I hope he is doing well and is happy. I feel such tenderness for him.

— roxane gay (@rgay) August 11, 2019

Trending post about an awkward yet human Instacart delivery situation.

One of the key assets of grocery delivery brands’ social media campaigns are user-generated customer testimonials. These authentic and utterly human shout-outs to brands are like PR gold for businesses, especially during these trying days.

Ordered from Instacart today. Didn’t order toilet paper as I assumed there wasn’t any. My shopper texted me, “There’s toilet paper here. I got you some, let me know if you want it.” THAT is the leadership this country needs in a time like this. He would make a good president.

— JEN KIRKMAN (@JenKirkman) April 8, 2020

An Instacart customer loving her personal shopper.

Instacart is using the positive testimonial on its social channels:

View this post on InstagramA post shared by Instacart (@instacart) on

Instacart post on Instagram using a customer-generated shout-outs.

Some grocery delivery brands are being mentioned by political leaders during press conferences in social media posts, underlining how quickly they have shifted to critical infrastructure. Opportunity for these companies should follow.

We are using every tool we can to remind people to #StayHome.

Starting this week, @FreshDirect will include a paper flyer with deliveries with this crucial message.

You can help too.

Any service can print the flyer & include in deliveries. #GoPaperhttps://t.co/HTWqS2nXYK

— Andrew Cuomo (@NYGovCuomo) April 7, 2020

FreshDirect gets positively quoted in a post by the New York state governor.

View this post on InstagramA post shared by FreshDirect (@freshdirect) on

FreshDirect is sharing the news on social media that their customers donated money to the New York Common Pantry.

What topics are being discussed about grocery delivery?

Grocery delivery themes for the previous month.

I’ve been losing weight and my secret is not being able to get an instacart delivery slot

— Andrew Schiavone (@aschiavone) April 13, 2020

68.3% of all grocery issues are delivery slot issues, with customers not being able to get a delivery scheduled.

16.5% of the discussion is triggered by discounts & coupons, a topic that keeps trending given the cash crunch felt by households.

11.5% of topics are about contactless delivery, showing that health hazards are important, but not as important as getting a delivery slot.

Key takeaways for grocery delivery brands

Know your audience. If grocery delivery was a niche business for the workaholics, it is now an essential service for the sick and the elderly. By analyzing your audience precisely, you will be able to adapt your tone of voice and adjust your brand message accordingly.

Be human and caring. Getting food delivered keeps people alive. Your communication style should show that you care about everybody, that your brand is inclusive and human-centric.

Address issues. Not talking about pain-points is not an option. To reduce customer churn and to stay ahead of hidden consumer needs, keep track of all customer data and turn their feedback and reviews into valuable insights for future campaigns and messaging.

Turn your customer data into actionable insights

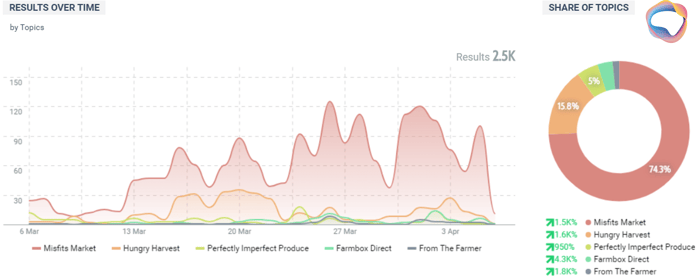

Vegetable box delivery

One final way to get food delivered to the home in recent years is through vegetable box subscriptions. These can range from Community-Shared Agriculture boxes (CSA boxes) which are too small and varied to include in a meaningful way in this report, and their more corporate equivalent which are branded boxes of vegetables and fruits. Some may be labelled “ugly” or deemed unworthy of shelf display in grocery stores, and a vibrant secondary market has sprung up shipping these vegetables to less aesthetically-minded consumers.

As we can see, the mentions in this segment have similar skyrocketing increases to other food delivery options we’ve looked at, though overall the volume is a lot smaller, reflecting their smaller Share of Voice and Share of Market overall.

Mentions of vegetable box delivery services over the previous month.

To no one’s surprise, Americans eat twice as much meat as they do vegetables. Vegetable-specific produce boxes therefore make up a smaller share of the overall market than some more general, or convenient (pre-proportioned) food delivery options.

Misfits Market leads here with nearly 75% of the conversation, with it’s next competitor Hungry Harvest only capturing 16% of the total Share of Voice.

These smaller operators are simply trying to hang on under a tidal wave of new demand for their services. While the volume of conversations, and presumably orders, is much smaller than their meal kit and grocery delivery peers, at scale the effect is the same.

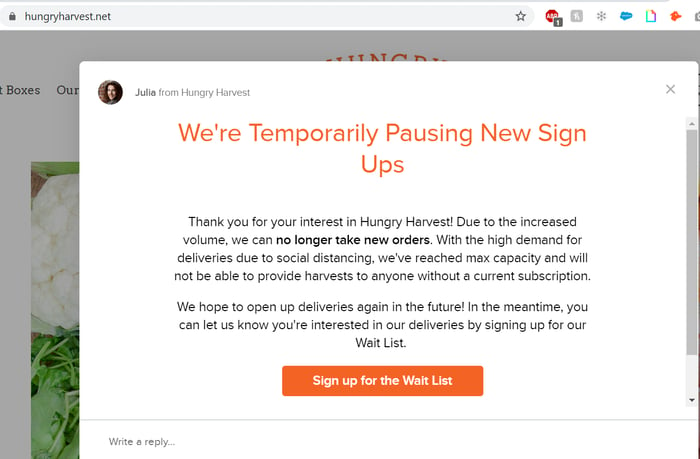

Hungry Harvest has had to pause new sign ups due to so much demand.

Some have had to pause new sign-ups to focus on existing customers, choosing to fill up a wait list for new revenue.

Topics important to vegetable box (and meal kit) customers over the previous month.

Here too delivery slots make up a majority of the mentions with other issues like contactless delivery and shortages combining for 21% of the conversation.

Sentiment analysis shows that in light of the challenges faced by these services, customers are being understanding - they have a net sentiment of 24%, which could be far worse (net sentiment runs from +100% to -100%)

Key takeaways for vegetable delivery box brands

Understand the moment: These products were always facing a tougher sell, but now they’re facing too much demand. As Americans become less active, look for vegetable sales to grow. This is a moment to seize for these companies. Find new supplies from restaurants or anywhere else, but don’t squander this chance.

Listen to your loyalists: Serve your customers who always supported you. Use social media monitoring and listening to understand what their needs are, and prioritize reaching them. They’ve always counted on you, and now you don’t want to let them down. In fact, you have always counted on them too.

Delivery doubles down

Across America in both urban and rural settings, food delivery is quickly becoming essential infrastructure. No one is more surprised by this than the industry itself, who is grappling with overnight changes that have the ability to determine the winners in their industry for the next several years, if not longer.

Most of these services recognize this, but are limited in how many changes they can implement, how much demand they can keep up with, and how much labor they can hire. If they can figure out this balancing act they may have an opportunity to keep winning delivery orders in a post-pandemic scenario from these new customers.

Whether they win them through superior messaging, convenience, price, or just goodwill leftover from this moment in time when these services were there for customers, it’s up to how these delivery services play the hand they’ve been dealt.