Download the CPG household dashboard template

Clean home vs. clean environment

In our recent Shape Tomorrow white paper, we looked at what consumers wanted from the world’s biggest brands, and it was clear that their demands were split into 3 distinct categories -

- Self-focused demands (64%) - Areas of improvement which will directly impact the consumer, and their social bubble, on a personal level.

- Society-focused demands (35%) - Areas of improvement that will directly impact your consumers’ society.

- Global-focused demands (1%) - Areas of improvement that will directly impact the environment.

Consumers don’t discuss household brands quite so openly, so instead, we had to broaden the search to understand the industry consumer demands. Then the picture becomes clearer.

- For cleaning products, the biggest conversation drivers are evenly split between eco-friendly and high quality.

- For diapers and nappies, high quality is again a key conversation driver, with eco-friendly still present but less of a priority (3x fewer conversations than for high quality).

- For air fresheners and deodorizers, high quality is again a key conversation driver, with eco-friendly slightly further down the list.

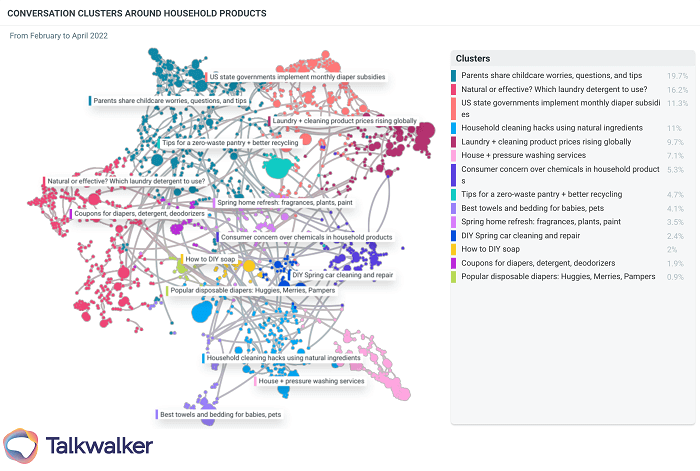

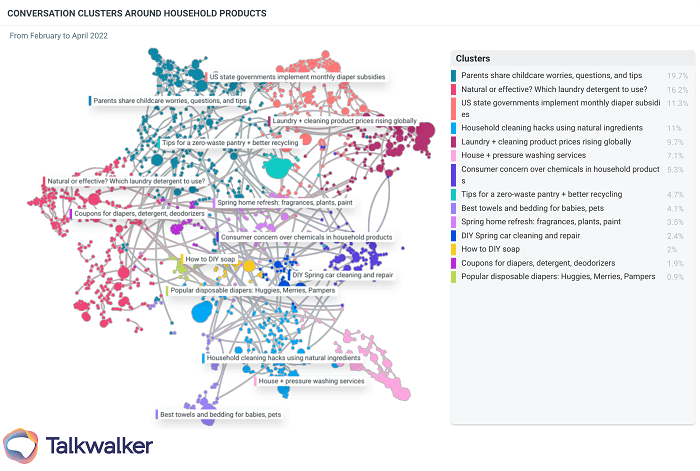

People want quality, and sustainability. Then if we dig deeper into the conversations, through our Conversation Clusters, we can see that price is also a key purchasing decision factor.

Conversation Clusters allow us to see how all the online conversations around household brands interconnect.

The message is clear. Consumers want affordable, high-quality household brands that do the job, but not at the expense of the environment.

The lockdown impact on household brands

The COVID-19 pandemic had a huge impact on the global economy. With the virus spreading rapidly across the globe, there was an implementation of strict lockdown regulations resulting in supply chain disruption, which of course also affected household CPG brands and products. However, with health and cleanliness becoming an important topic, many products relating to cleaning and health saw an increase in sales even as other industries were affected negatively

In 2020, the global household cleaning products market size was USD 33250 million and it is expected to reach USD 44340 million by the end of 2027, with a CAGR of 4.2% between 2021 and 2027. There has been enormous growth within the industry as consumers prioritize keeping their homes clean and virus-free.

Meanwhile, there’s rising inflation with many products increasing in price, yet wages aren’t keeping up. This means consumers are looking to reduce expenditure, squeezing as much as they can from each paycheck.

But as the world recovers, and returns to ‘normality,’ savvy consumers are now looking towards the future, with an eye on other potential global crises. This has led to more focus on eco-friendly solutions and sustainability.

So CPG household brands need to find a balance between these three sometimes-contradictory demands. A future solution could be found by analyzing the past.

Sustainability - Back to the future

Many new sustainable solutions aren’t new at all. Many consumers are looking back to solutions from the past to be more environmentally friendly.

Cleaning hacks

Cleaning hacks continue to create engagement across social media, as consumers look for more natural ingredients to clean with, rather than potentially harsh chemicals.

There were 117K mentions of cleaning hacks or tips over the last 13 months, with an average of 31.6 engagements per mention. Of those, both vinegar (24.6% of conversations) and baking soda (21.6% of conversations) were recommended for use.

Brands are now engaging in this trend. Many garner engagement and brand loyalties, by encouraging consumers to share their tips, helping connect their products with this sustainable growth. Or better still, brands can prioritize these ingredients in their products in the future, to boost sustainable sales.

The first day of Spring (March 21) saw a major spike in conversations about home cleaning, spring cleaning, and many CPG items. And what was the most popular online conversation? Natural, eco-friendly ingredients that can be made at home into cleaning products.

Frosch is a German brand now found across the world. Sustainability is a key part of its business, which is why it consistently promotes more natural ingredients in its products. The example above focuses on the inclusion of natural baking soda in its household cleaner.

Reuse before (or) recycle later

Another challenge faced by many consumers is how to incorporate sustainability into their household routines.

The industry has historically been quite reliant on plastic, providing easy yet safe storage of various cleaning chemicals. Though many products are now recyclable, there’s still a heavy reliance on plastic packaging.

Many brands are now switching to reusable packaging to reduce their environmental impact. This isn’t a new idea - I’m old enough to remember milk and soda being delivered in reusable glass bottles.

There are two “new” solutions for this. One is to offer reduced packaging refills, while the other is to remove plastic from the supply chain completely, with refillable/returnable bottles available in stores.

New Vending Machines In Malaysia Can Refill Liquid Detergent, Hand Sanitiser & More https://t.co/4itXH0Y7nm

— Rahah Ghazali (@rahah_ghazali) February 22, 2022

This article launching vending machines to refill washing detergents and hand soaps in Malaysia, was shared across social media, and garnered 1.4K engagements. This demonstrates the rising demand for this type of sustainable solution.

The diaper gripe

One major question in the CPG household industry is what to do about diapers. In the 1950s, 1% of parents used disposable diapers. Now, over 90% do. Which leads to 18 billion disposable diapers ending up in landfills each year. If we look to the past, reusable diapers should be on the rise.

This topic divides parents. While we all want to be more sustainable and minimize the environmental impact, there’s only so much each individual can do. As a parent of 3 under-3s, my family uses over 100 diapers per week, which would be nearly impossible to manage if we used reusable diapers.

This goes back to what was identified in the Shape Tomorrow white paper. Consumers are pulled in different directions when it comes to what they expect from brands, and often the self-focused demands win over.

Diapers are particularly divisive. Reusable diapers, while having less environmental impact, go against the rising focus on hygiene. They need to be stored carefully before washing, and then require hot washes and stronger detergents to clean them, which isn’t particularly eco-friendly.

So what can brands do about disposables?

Again, it falls down to either changing the product before use, or finding ways to recycle it afterwards. Conversations around biodegradable diapers are increasing, with brands using natural elements in their diaper production, such as bamboo and plant fibers.

The other option is finding a way to ensure diapers don’t make it to landfill. The latest way is to recycle old diapers into additives for tarmac for roads. This helps bring a second life to the product, and reduces the overall environmental impact.

A highway paved with recycled diapers may change the cloth vs. disposables debate https://t.co/4GfsKjgxge

— The Washington Post (@washingtonpost) February 19, 2022

This article gained over 4.4K engagements, demonstrating how concerned parents are about the environmental impact of reusing diapers.

What do consumers want for household products?

Consumer expectations of the household goods sector will continue to evolve. Many will look to the past to find new sustainable and affordable solutions, but to keep ahead, brands should also look to the future.

Consumer intelligence helps you to understand consumer expectations as they happen, enabling brands to predict future trends. Check out our dashboard below to get a taste of the intelligence and insights Talkwalker can bring to your CPG product and marketing strategy, or click the free demo button to test the platform yourself.