Although businesses are aware of the importance of consumer insights, many might be unsure of how to begin approaching the large volumes of data out there. They might struggle with data silos, a lack of technical know-how and difficulty in accessing the data. We will look at different ways social listening can provide key insights into consumer behavior, specifically when it comes to snacking trends in Asia Pacific. With a strategy that is backed by both timely and relevant consumer data, brands will be better positioned to withstand the ups and downs in the business environment today.

Analyzing conversations at scale to derive consumer insights

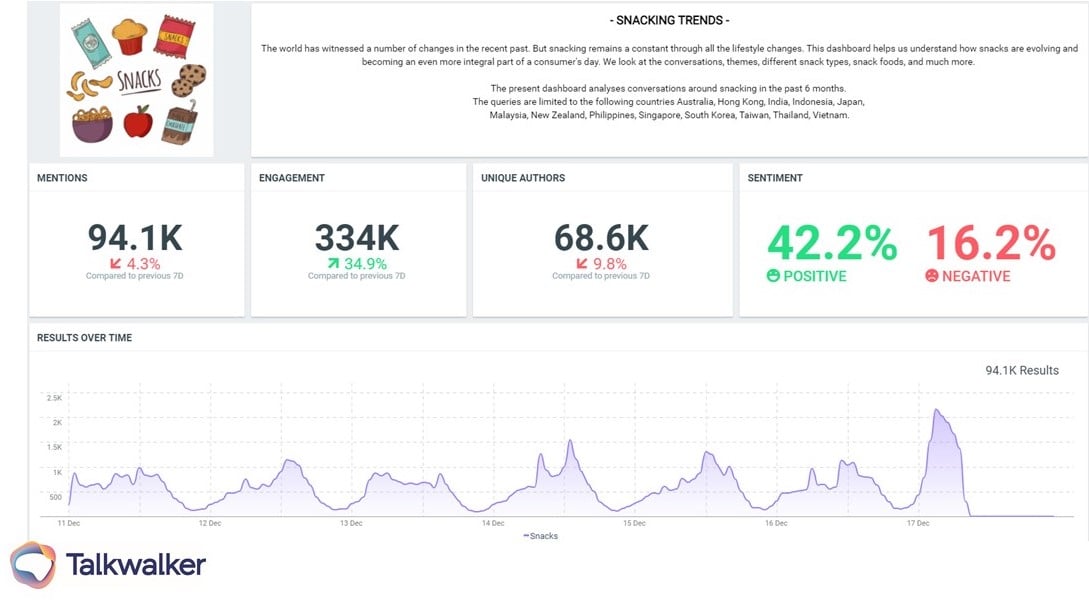

When we look at the snacking trends in Asia Pacific, we can see that the topic is highly talked about by consumers in the region, with 94.1K mentions in the past 7 days alone. Unsurprisingly, a large portion of these conversations are positive in nature. This large volume of data presents a great opportunity to further explore the trends driving these conversations, and dive deeper into the snacks preferences of consumers across the different countries in Asia Pacific.

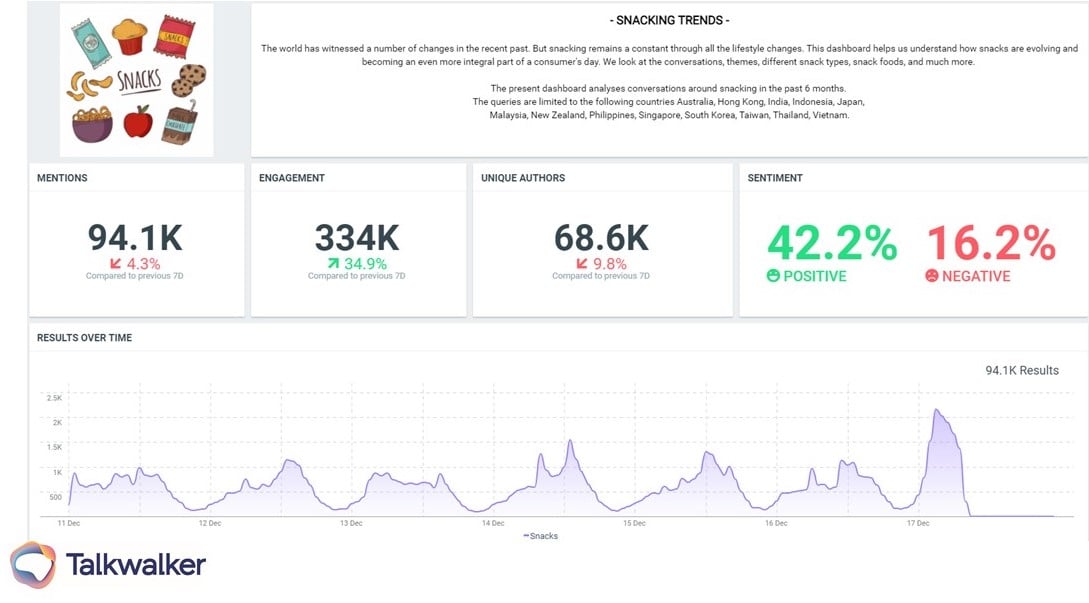

Best time to snack

The chart below shows the preferences across the different countries when it comes to the time of the day when snacking is most popular. We can see that in Indonesia, midnight snacks are extremely popular, in comparison to evening, morning, afternoon, or snacks on the go. On the other hand, in India, the preferred time of the day to snack is in the evening. This data highlights the cultural differences across countries in Asia Pacific, although midnight snacks appear to be popular across most countries. Snacks on the go also seem to be the least popular in the region, possibly due to the pandemic. Many people have been spending most of their time at home, and would be more cautious about using their hands to eat while out and about in public.

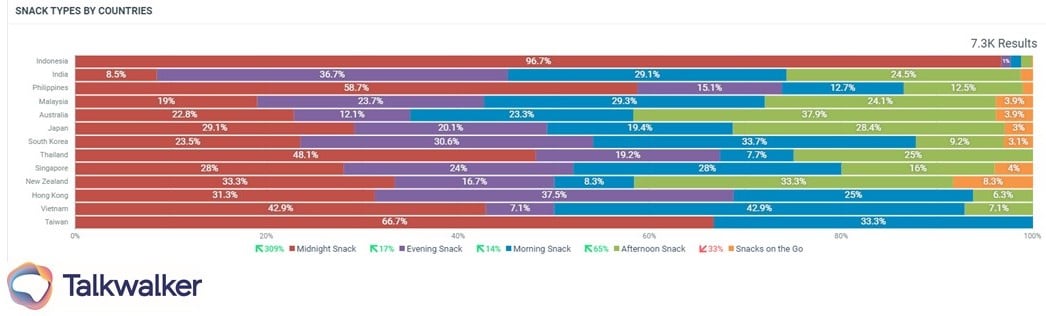

Favorite type of snack

Another way to use the data to understand snacking trends across the region is to observe the snack foods that are popular. In Japan, cakes, pastries and pies appear to be the most popular snack food, with mentions regarding such snacks taking up to 87.8% of the conversations. In Indonesia, jelly and jam appear to be the most popular snack type, followed by pudding.

Such information allows brands to better position their products for consumers in the different countries, rather than assuming that a one-size-fits all strategy would work for the entire Asia Pacific region. As these examples have shown us, consumer preferences vary significantly across the region.

Top drinks in the region

Social listening also highlights the types of drinks that are popular amongst consumers in Asia Pacific. Here, we can see that coffee and tea are the most talked about beverages, along with chai, milk tea, and latte. Having a view of consumers’ top choices allows brands to look further into any ongoing trends within the industry that are driving these choices, and then leverage on these trends when pushing their respective products.

Top chocolate brands

It is also worth looking into the specific snack brands that are dominating consumers’ conversations. In this case, we can see the chocolate brands that are most talked about - Crunch, Munch and KitKat, which are of course classic favorites in Asia.

Image insights per country

Billions of images are being shared online every day - making it integral to the process of data analysis. Here, we see the top snacks-related image uploads from Singapore. By considering such visual insights in addition to textual insights, businesses can have a more wholesome view of the trends out there and compare the differences across countries.

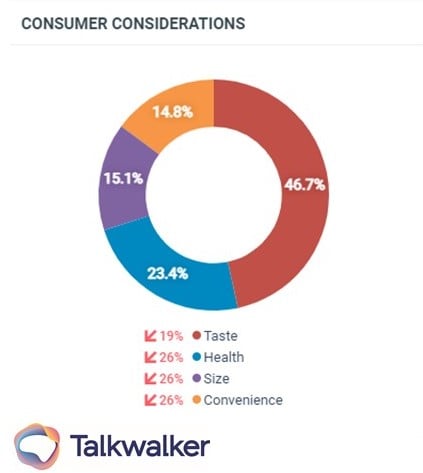

Key consumer considerations

Another way to dissect the data when analyzing consumer insights, is to see what are the most important factors that consumers consider when looking at a type of product. In the case of snacks, the chart below shows a split of the most important factors to consumers - taste, which appears to be the most important, followed by health, size and lastly, convenience. By understanding what consumers care about the most, businesses can push products that are most likely to appeal to the majority of consumers and craft the most effective messaging.

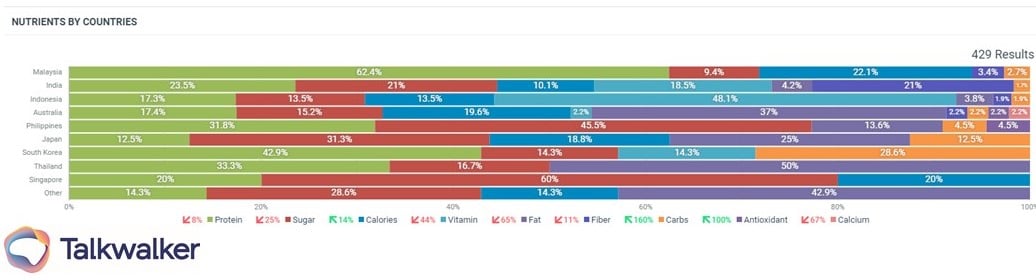

Nutritional factors

We can analyze the data to see what nutritional qualities are important to consumers in the different countries. In Thailand, fat content of snacks is by far the most talked about nutritional quality, clearly highlighting that it might be a significant concern for consumers. In Indonesia, the vitamin content is the most significant aspect of their snacks or what they want to see in their snacks. This data would be useful for brands when it comes to highlighting certain qualities of their products that are in line with what consumers in a specific country are most particular about.

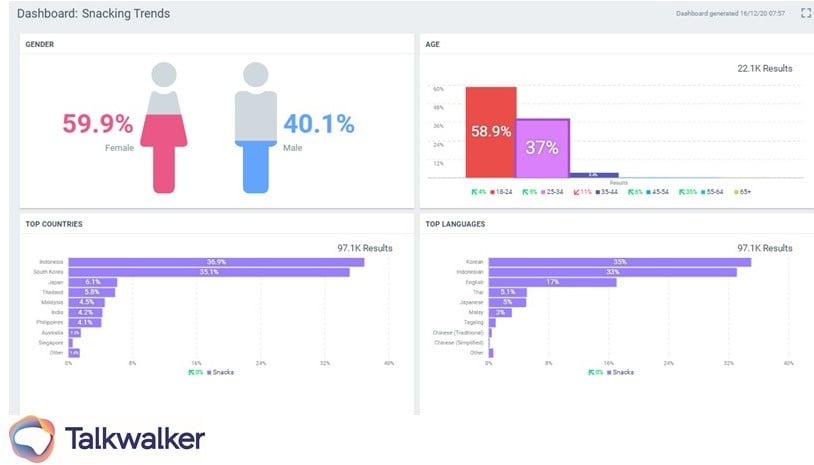

Know your target audience

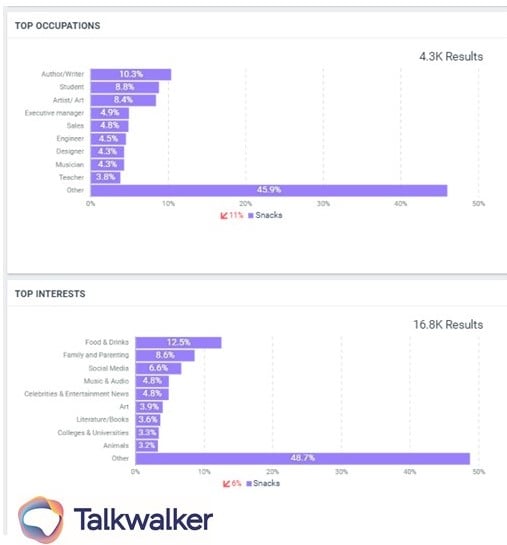

When understanding your consumers, it is crucial to know who they are - are they mostly male or female? Are they mostly from a particular age group? What languages do they speak? With social listening, it is also possible to dive even deeper to understand their top interests, as well as the type of occupations they have. With this knowledge, businesses can have a better picture of the people they’re pushing their products to and assess if it’s the right fit for them.

Although the insights highlighted above are specific to the snacks industry in Asia Pacific, they display the potential of data when it comes to making business decisions that are backed by consumer insights. This level of analysis can be done in basically any industry via social listening. Looking at how 2020 saw many unprecedented changes that nobody expected, businesses should always look to data when crafting their 2021 strategy. With a strong understanding of their consumers based on regular, real-time analysis of conversations, businesses will be able to ensure that they make decisions that are most suited for their target audience.