Top consumer trends in the Netherlands

Consumer trends in the Netherlands highlight a shift towards buying local brands and shopping both online and offline.

March 8, 2021

What are Dutch consumers saying about your brand?

Like many areas around the world, Dutch consumers have significantly reduced their spending in almost all categories, according to a recent study published by McKinsey. Also, according to the same study, ‘almost a quarter of Dutch consumers report they are living paycheck-to-paycheck and delaying planned purchases’.

E-commerce is the name of the game

Many Dutch consumers have adjusted their purchasing behavior by trying new local brands and shopping methods both online and offline. The pandemic may have accelerated the adoption of ecommerce in the Netherlands for good.

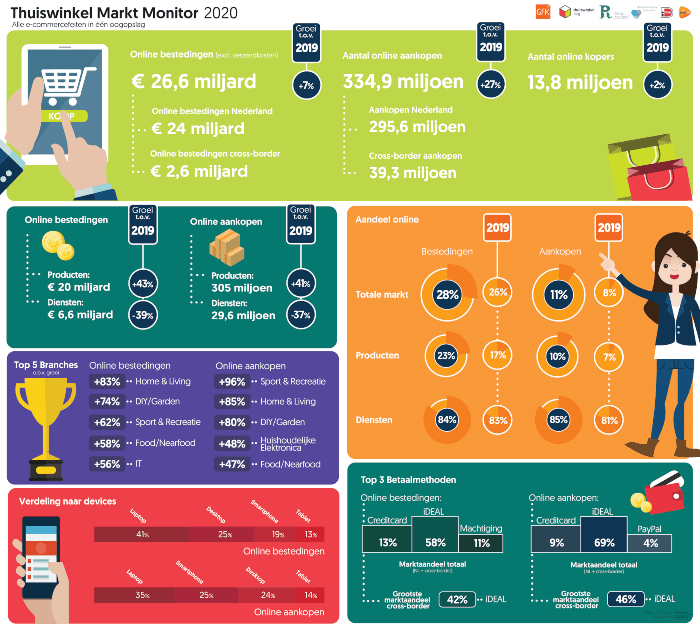

Indeed, the Thuiswinkel Markt Monitor estimates that Dutch consumers made online purchases worth up to €26.6 billion euros in 2020, a 7% increase on the year before. What is even more interesting is that €24 billion of those purchases were made within Dutch borders (brands). The report also shows that the main reason behind such an increase is because the Dutch consumer had increased their number of online purchases from 10 to 24 on average.

Source: Thuiswinkel Markt Monitor 2020

During 2020, Dutch consumers spent 43 percent more than 2019 on online purchases, with the number of online purchases also increasing by 41 percent. Looking at what Dutch consumers were buying online, it became clear that they prefer tangible products rather than services or online subscriptions.

It goes without saying that Dutch consumers were also under strict lockdown measures due to COVID, which explains their spending in home & living (83%), DIY/garden (74%) and sports/recreation (62%). It appears that Dutch consumers were busy renovating their homes and indulging in DIY projects, previously put on hold. Furthermore, Dutch consumers have decreased their spending on travel packages by 72%, compared to 2019, with individual airline tickets showing a decline of 37%.

Speaking about consumer behavior, I looked at We are Social’s and Hootsuite’s latest Digital 2021 report and noticed that the biggest growth occurred in food & personal care (29.2% increase), then digital music (22.2% increase), and third, video games (20.7% increase). The increase in popularity of video social media platform TikTok has led to an increase in demand for athleisure outfits and all things related to wellness and physical activity.

As of January 2020, the Netherlands had around 16.2 million internet users, which increased to around 16.47 million users as of January 2021 (a net 1.3% increase). In terms of social media usage, 88% of the total Dutch population are active social media users, and are using WhatsApp, YouTube and Facebook to make informed decisions about purchasing a product. Specifically, Dutch consumers rely on influencers’ opinions and comments from fellow buyers to research a particular product. This could be attributed to the notion that Dutch consumers appreciate honesty and transparency rather than a flashy marketing campaign that might be perceived as ingenuine.

For marketers and communicators, the Dutch market poses a particularly complex challenge, especially with consumers being very much ad-aware and mature in the sense that they might not want to share their data with providers.

Don’t speak Dutch? Don’t stay in the dark

Sustainability and ethical consumerism

If there is one thing that is known about the Dutch community, it would be that they prefer things sustainable (although not necessarily willing to pay extra for it). Generally speaking, Dutch consumers make informed purchase choices about products that are pragmatic, healthy and ethically responsible.

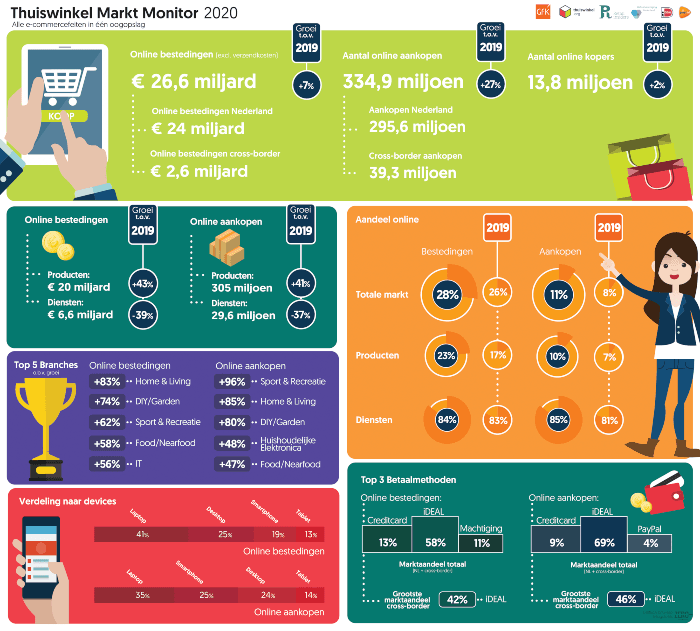

With health and mental wellness becoming a priority to many individuals around the world, it’s interesting to witness that Dutch consumers are increasing their consumption of vegan products and fruits/vegetables. Furthermore, sentiment analysis shows that environmentally-friendly products are well perceived by Dutch consumers.

There’s a positive trend around ‘milieuvriendelijk’ (environmentally friendly) in the Dutch market during the past 13 months.

Digging deeper into the data, the Dutch organic produce market was estimated to be $1.08 billion in 2019, which represents 2.2% of global demand with a per capita consumption of $62.54. While this appears to be promising, the growth rate is expected to slow down over the next few years. According to the NL Times, “organic products only have a market share of 3 percent [in the Netherlands], it seems impossible for the Netherlands' agriculture to increase to 25 percent organic by 2030 as is stated in the so-called Green Deal.”

On another front, the second-hand market is having a moment with Dutch consumers. With the proliferation of social media and other online channels, Dutch consumers are giving new life to their old items, whether it’s clothing, bicycles, or electronics.

Industry experts believe that revenue from the second-hand market will reach around $388.1 millions and is “expected to absorb even more of the traditional retail market in the future”. Big win for slow fashion supporters!

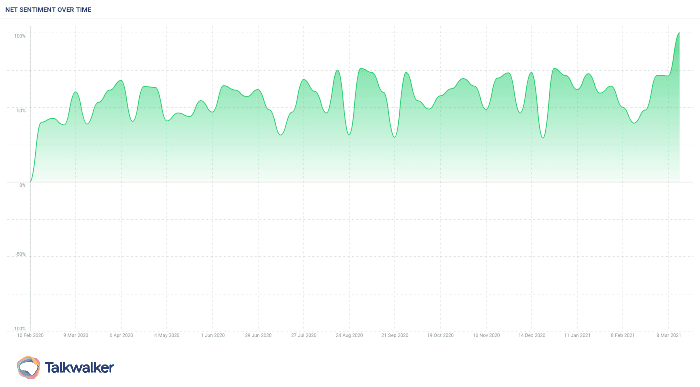

Number of mentions of ‘tweedehands’ (second-hand) during the past 13 months had exceeded 75,000.

iDEAL is a big deal

According to the same report by Thuiswinkel Markt Monitor, Dutch consumers have preferred ‘iDEAL’ over other payment methods, increasing from 60% to 69% of domestic online purchases in one year. However, iDEAL payments only make up 46% of payments for cross-border payments, ahead of credit cards (22%) and PayPal (16%).

In conclusion, consumer trends are constantly shifting and therefore require continuous monitoring and analysis. For brands to effectively predict market behavior and to react accordingly, they need real-time data from various sources in order to adjust their strategies and seize unforeseen opportunities.