Social listening that dives deep beneath the surface

TRUSTED BY OVER 2500 OF THE WORLD'S MOST IMPACTFUL BRANDS

Make Social Intelligence a core component of your success.

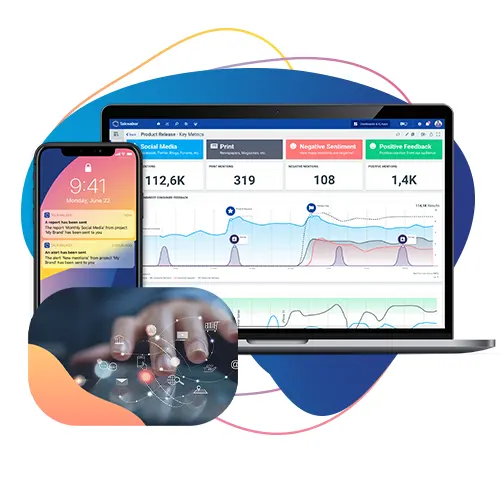

- Tap into billions of online consumer conversations across social, blogs, forums, and news sites in order to protect, measure and promote your brand.

- Monitor results in real time and get instant access to up to 5 years of historic data.

- Find the most relevant and impactful insights using advanced AI-powered sentiment analysis.

Not your old-fashioned social listening platform.

- It’s not all about text - get access to a new generation of consumer insights thanks to our image, video, and speech recognition technology.

- Track over 40,000 brand logos, objects, and scenes in social images and videos.

- Monitor over 60M new videos each day for critical brand mentions.

- Keep your finger on the pulse of your brand with smart, automated alerts for any unusual activity.

Be ready to respond to the consumer.

- Save 40% of time with automatic report creation and distribution.

- Build customized dashboards to share insights efficiently with your teams.

- Integrate Social Intelligence directly into your social media management (e.g., Hootsuite, Khoros, Facelift) and business intelligence (e.g., Tableau) tools for better workflows and data democratization.