UK Social Media Statistics: Key Insights for Businesses 2025

The UK social commerce market is set to more than double. Explore key 2025 social media stats to track trends and best practices.

June 1, 2025

![Featured image for UK Social Media Statistics: Key Insights for Businesses [2025]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fjiz1qmszsogv%2Fblog-featured-asset-87deea8e-f974cdb1%2F062decd5417787fa50ed459634c3ce5c%2Ffeatured-87deea8e.webp&w=3840&q=75)

- Key UK social media statistics

- Social media usage statistics in the UK

- Social media marketing and advertising statistics in the UK

- Facebook marketing statistics in the UK

- Instagram statistics in the UK

- TikTok statistics in the UK

- Reddit statistics in the UK

- Twitter/X statistics in the UK

- Pinterest statistics in the UK

- YouTube statistics in the UK

- LinkedIn statistics in the UK

- Influencer marketing statistics in the UK

- Social media buying behaviour statistics in the UK

- The top social media trends in the UK

This guide breaks down the latest UK social media statistics for 2025. You'll find actionable data

on platform usage, content preferences, and emerging trends.

Use these insights to refine your social strategy and make smarter decisions about where to focus your resources.

Key UK social media statistics

Social media usage in the UK has reached 54.8 million people as of early 2025, about 79% of the population. This slight decrease from 82.8% in 2024 signals market saturation.

The UK social commerce market is projected to more than double, reaching £16 billion by 2028.

UK users spend a remarkable amount of time on TikTok. The average active user spends 49 hours and 29 minutes per month on TikTok's Android app. This is more than double the time spent on YouTube (19 hours and 10 minutes) and triple the time on Facebook (16 hours and 45 minutes).

63% of UK marketers use AI for written content creation, including social media content, while 72% of them also trust AI more than they did last year.

53% of social media users the UK are also worried about brands/companies using AI in social media advertising.

Over half of UK adults (52%) now use social media for news, up from 47% in 2023.

Key takeaways

Social media usage has plateaued. With 9 in 10 Brits on social platforms, growth has reached its limit. It’s time for platforms and marketers to focus on engagement quality.

TikTok's dominance shows a clear shift toward immersive, vertical video formats as the key engagement method.

AI creates a trust gap on social platforms. Despite widespread marketing adoption, consumer skepticism about AI in advertising requires brands to balance automation with authenticity.

Social media usage statistics in the UK

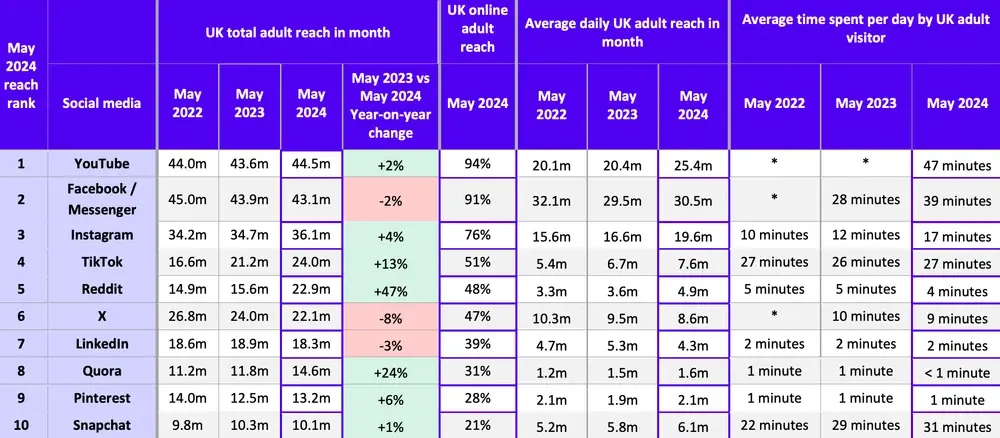

7. On average, adult internet users in the United Kingdom spend 5h 36m browsing online each day, and 1h 37m using social media platforms.

8. Active social media users in the UK typically engage with about 6.4 platforms monthly, showing diverse platform usage.

9. 91% of UK online adults use Facebook and Messenger combined, making it Meta's most widely used service. The number of Facebook users remains strong despite market maturity.

10. As of January 2025, there were over 55.9 million Facebook users in the UK, an increase of 21.9% compared to 45.85 million users in September 2020.

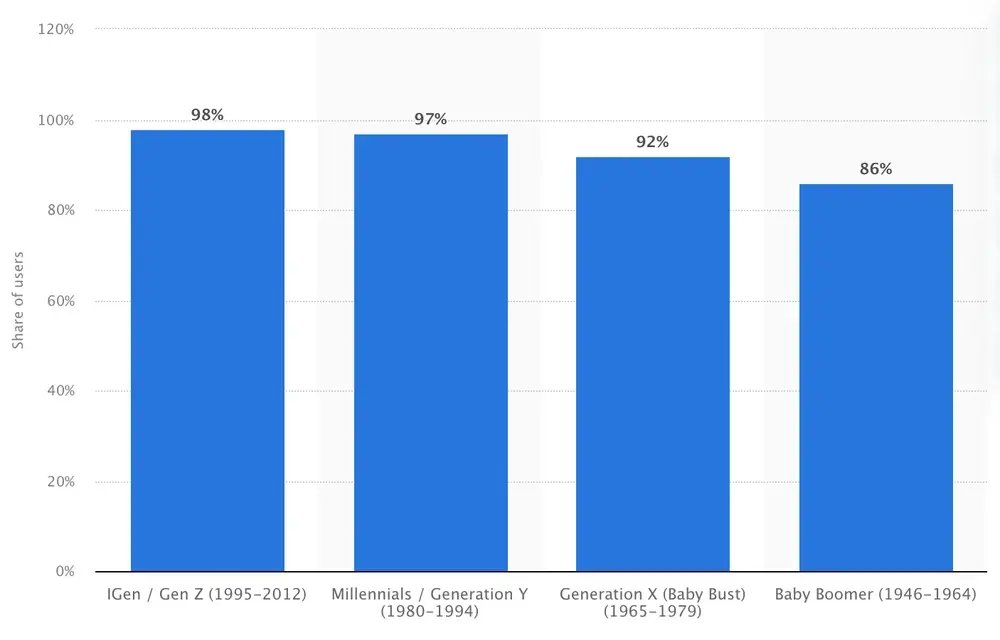

11. Social media reaches 97-98% of Gen Z and Millennial internet users—almost every person in these age groups.

Source: Statista

12. Reddit has overtaken X to become the fifth most popular among social media platforms in the UK, demonstrating shifting platform preferences.

13. 63% of 8 to 11-year-old children in the UK report using social media, raising ongoing concerns about early platform adoption.

Key takeaways

Multi-platform behavior is now standard. Time spent across platforms suggests brands should focus resources where their target audience is most active, not just on the most popular platforms.

Facebook maintains exceptional audience reach across demographics, making it vital for broad campaigns—despite being often dismissed as "outdated"

Platform shifts reveal changing user priorities. Reddit's rise over X shows UK users increasingly value community discussion and interest-based networks over celebrity-driven content.

Social media marketing and advertising statistics in the UK

14. 85% of UK retailers say social commerce is their fastest-growing sales channel, highlighting the importance of shopping features on social platforms.

15. Mid-market brands list YouTube (55%), Instagram (54%), and TikTok Shop (54%) as their key focus channels. While enterprise retailers prioritize Facebook (57%), Instagram (48%), and TikTok Shop (48%).

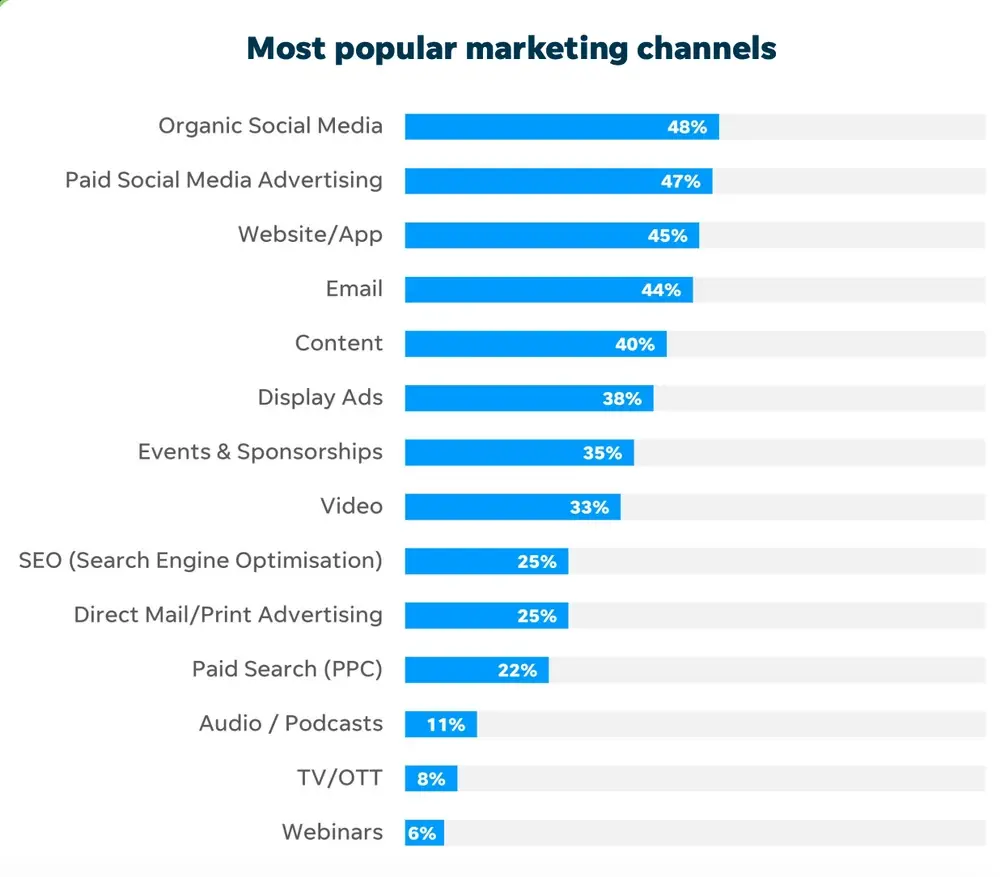

16. 48% of marketing professionals in the UK include organic social media in their marketing strategy and 47% of them also use paid social media advertising.

Source: Localiq

17. 27% of UK marketers expressed a need for more training in social media, revealing a skills gap despite widespread adoption.

18. In 2024, 53% of all online display ad spending in the UK was on social media platforms, with the remainder going to banners and video ads on non-social sites.

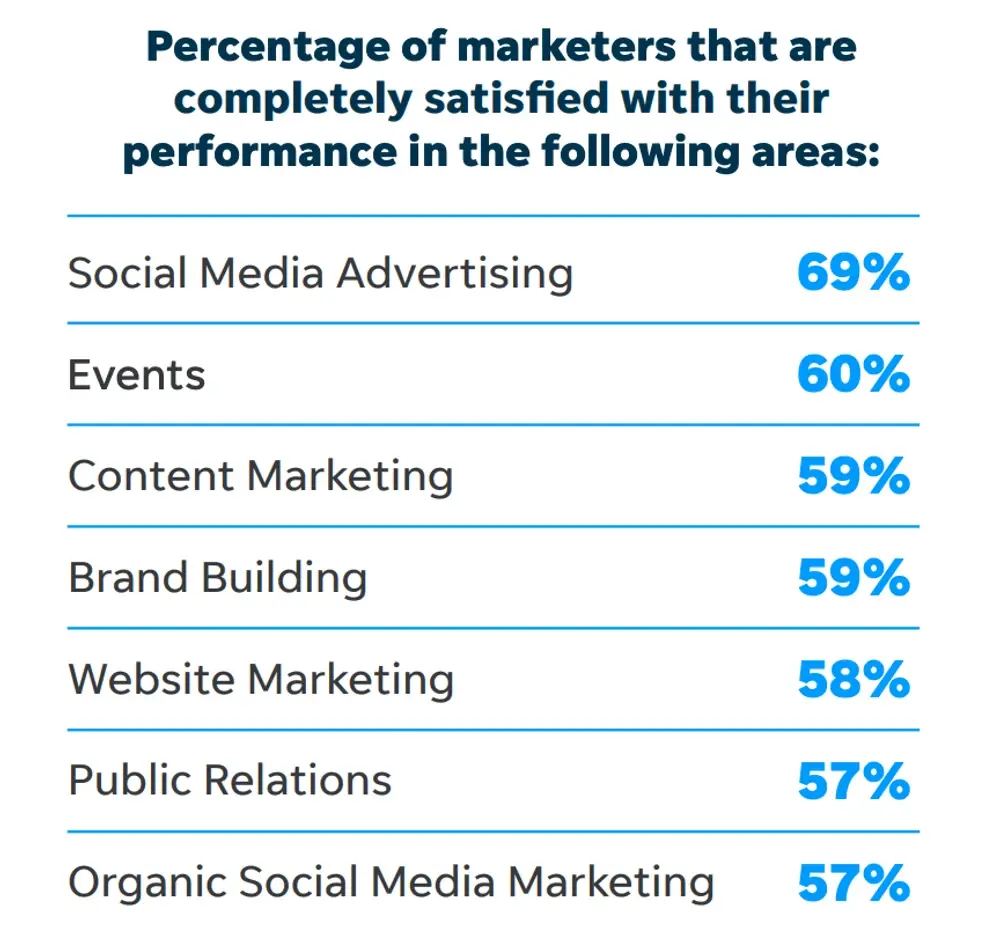

19. Social media advertising enjoys high satisfaction metrics, with 69% of UK marketers expressing satisfaction with its performance compared to other channels.

Source: Localiq

20. YouTube has become an advertising giant in the UK, with advertising reach of 54.8 million people (79.0% of the total population).

21. Both Pinterest and LinkedIn significantly expanded their ad audience in the UK last year. Pinterest's UK ad reach grew +14.7% to 15.5 million users, while LinkedIn's ad audience jumped +15.4% to reach 45.0 million registered members.

22. 50% of social media users in the UK want to select the advert topics they are shown on social media, highlighting the importance of personalization in social media marketing.

Key takeaways

Mid-market brands gravitate toward video and commerce-enabled platforms like TikTok and YouTube, while larger retailers still rely heavily on Facebook and Instagram.

Social media now absorbs the majority of display ad budgets in the UK, with YouTube leading in ad reach, confirming the need for video-first creative strategies.

Emerging platforms like Pinterest and LinkedIn are gaining advertiser attention, reflecting growing demand for niche targeting and professional audiences.

Facebook marketing statistics in the UK

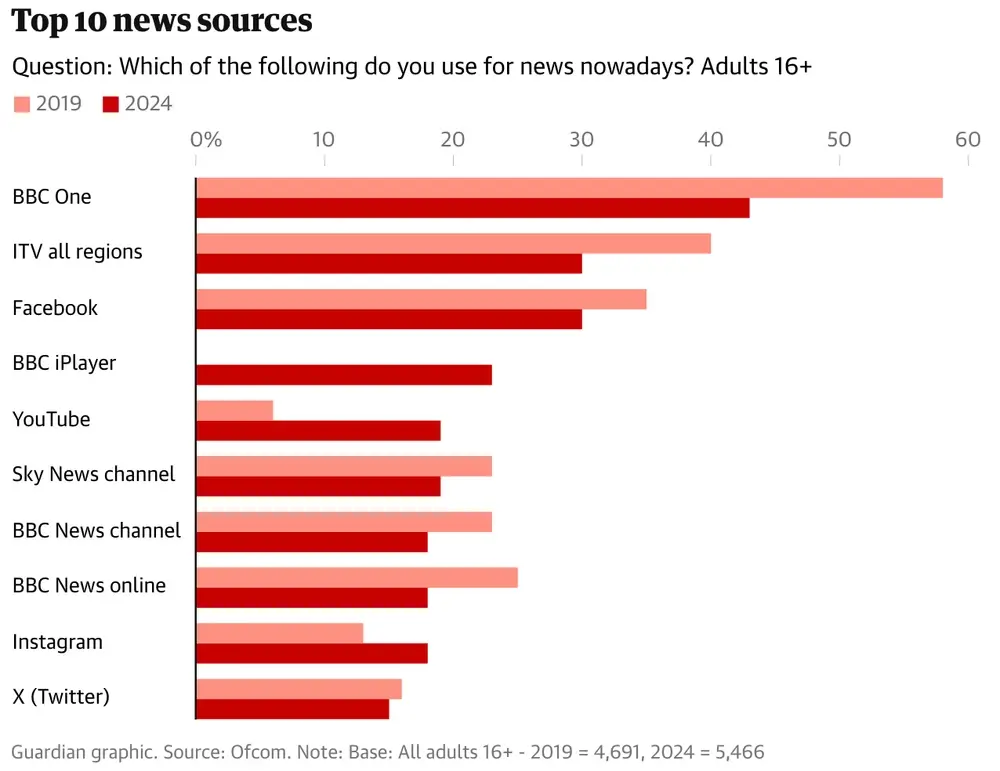

23. Facebook ranked as the third most used source of news in the UK in 2024, outperforming established media providers like Sky News Channel, Channel 4, and The Daily Mail.

24. It maintains the second highest reach ranking with 43.1 million users (91% of UK online adults) after YouTube.

Source: Ofcom

25. The average time spent per day by UK adult visitors was 39 minutes in 2024, a significant increase from 28 minutes in May 2023, showing growing engagement despite platform maturity.

26. In March 2025, Facebook's share in social network website visits reached 66.54% in the United Kingdom, which is still below its all-time high of 87% market share in January 2017.

27. Facebook UK Limited generated around £211 million in revenue in 2015. By 2019, that figure had surpassed £1 billion and continued climbing to nearly £2 billion by 2021.

28. Users aged 25 to 34 years old make up the largest segment of Facebook's user base in the UK, accounting for 24.7% of all users. The 35 to 44 age bracket represents the second-largest demographic, followed by those aged 18 to 24.

Key takeaways

Facebook continues to deliver strong daily engagement and high reach, especially among adults aged 25 to 44, reinforcing its relevance for sustained awareness campaigns.

Its significant role in news consumption makes Facebook valuable for brands leveraging timely or educational content, particularly in B2C verticals.

Engagement time is increasing despite market maturity, suggesting the platform is successfully adapting to retain user attention in the UK market.

Instagram statistics in the UK

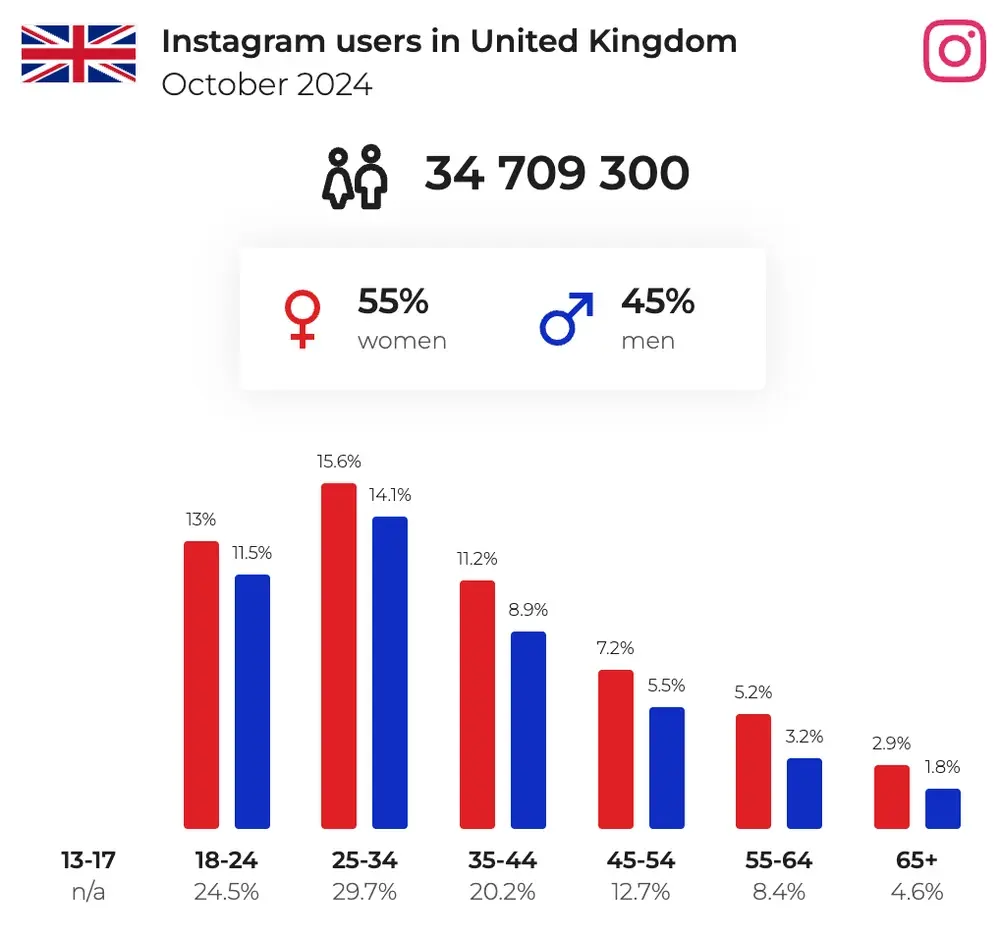

29. In January 2025, there were almost 34.71 million Instagram users in the UK. User numbers rose quickly between January and February 2023 and have remained relatively stable since.

30. 30% of marketers in the UK plan to increase spending on the platform, while 24% intend to decrease it, and 24% want to maintain current levels.

31. The largest share of Instagram's user base consists of individuals aged between 25 and 34 years old at 29.7%. This is followed by users aged 18 to 24. People over 65 are least likely to use the platform, making up its smallest user segment.

32. Women dominate Instagram's demographics in the UK, accounting for 55% of users based on recent research by industry providers.

Source: NapoleonCat

33. 81% of UK retailers leverage Instagram for their business, making it one of the most widely adopted platforms for retail marketing.

Key takeaways

Instagram remains essential for retailers. With strong usage among 18-34-year-olds, it’s an ideal platform for lifestyle and visual-first products.

Marketer budgets are split on Instagram investment, reflecting pressure to prove ROI. Instagram campaigns should be anchored in clear objectives, not just aesthetics.

Retail adoption is exceptionally high, with the majority of UK retailers using the platform, confirming its position as a key channel for product discovery and social commerce.

TikTok statistics in the UK

34. TikTok had 24.8 million users aged 18 and above in the UK in early 2025.

35. 1.5 million UK businesses use TikTok to promote their products or services.

36. Purchase intent is high among the platform's active users, with 52% of weekly TikTok users interested in shopping on or from TikTok in the next 3 months.

37. Brand awareness through TikTok is driven by community connection, with 3 in 5 TikTok users following brand accounts for reasons related to belonging: staying close to a brand they love, feeling part of the brand's community.

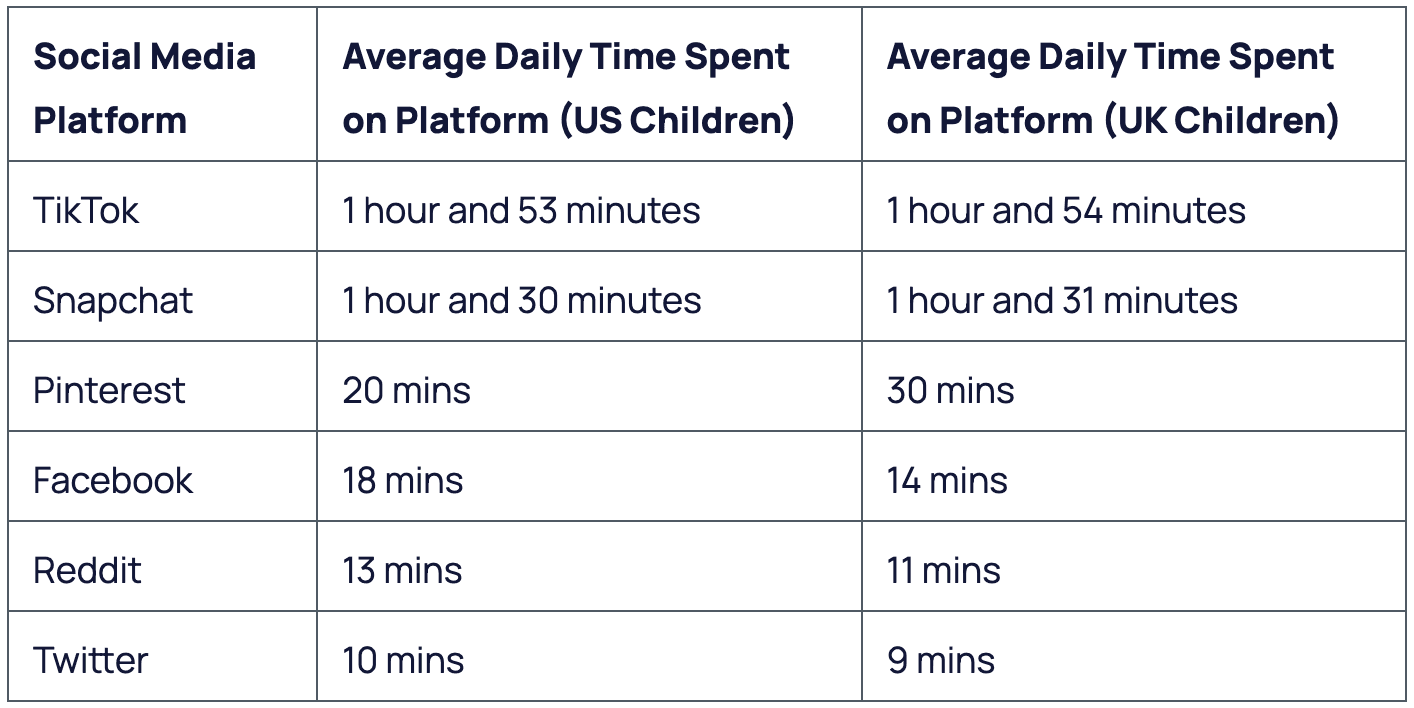

38. Platform usage is particularly high among children in the United Kingdom, who spend an average of 1 hour 54 minutes daily on TikTok, making it their #1 most-used platform.

Key takeaways

UK users lead global TikTok engagement, making it a key platform for visibility, particularly among Gen Z and younger Millennials.

Community-driven interactions show TikTok's strength in building affinity, not just awareness. Social media marketing performs well when it focuses on authentic community building rather than pure promotion.

The platform's commerce potential is substantial, with over half of weekly users interested in shopping through TikTok.

Reddit statistics in the UK

39. Reddit is booming in the UK. It grew 47% in just one year, reaching 22.9 million UK adults (48% of online adults) in 2024. It's officially bigger than X and LinkedIn, making it the UK's fifth most popular social platform.

40. Most UK social media users (73%) know about Reddit, even if they don't all use it regularly.

41. The UK is Reddit's second-biggest market globally, behind only the US (with a notable gap). There are 34.2 million total Reddit accounts in the United Kingdom.

42. Only about 6.87% of Reddit's ad customers are UK businesses, showing many companies haven't jumped on board yet.

Source: Aftership

Key takeaways

Reddit's surge shows UK users want real conversations in interest-based communities, not just flashy content.

Being Reddit's second-largest user base globally gives UK brands a rare home-field advantage on an American-founded platform.

Lots of users know Reddit (73%), but barely any brands advertise there (under 7%). Which makes it a sweet spot for reaching engaged communities without fighting for attention.

Twitter/X statistics in the UK

43. Twitter (now X) is losing ground in the UK. Its reach dropped 8% in a year, now hitting about 22.1 million UK adults monthly (45% of online adults). Reddit officially overtook it in 2024.

44. There were around 17.6 million active X users in the UK in 2024, according to Statista.

45. The platform skews younger than many think. About 24% of UK X users are Gen Z, while Millennials make up 36%. Gen X accounts for 31%, and only 10% are Baby Boomers.

46. Education levels are interesting too: 29% of Twitter users have a bachelor's degree, and 22% have further education qualifications.

47. X still has dedicated fans. Almost 80% of UK users check it daily, 15% visit several times weekly, and just 3% log in once a week.

Key takeaways

X's declining UK reach suggests brands should reassess its role in their campaigns and consider whether their target audience is still active there.

Despite dropping numbers, engagement among remaining users is intense, making it valuable for real-time commentary and quick-response messaging.

The platform's user base is more educated and younger than commonly assumed, creating opportunities for sophisticated, timely content.

Pinterest statistics in the UK

48. In March 2025, Pinterest held just 7.9% of social media visits, way down from its peak of 23.2% back in 2019.

49. Yet brand awareness remains strong at 83% among UK social media users.

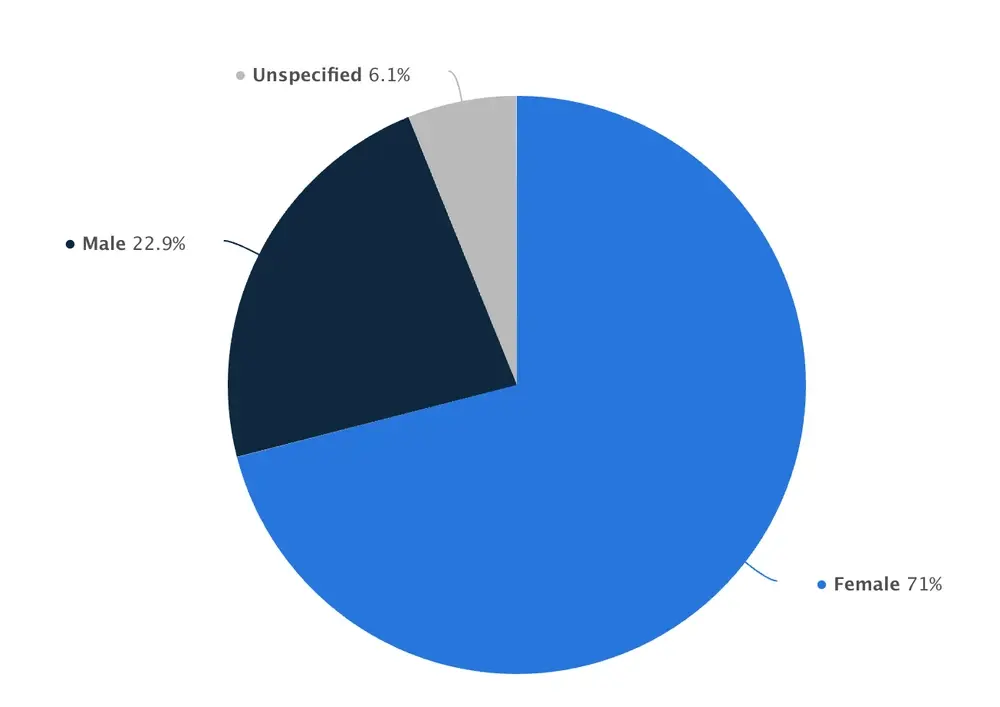

50. The platform's demographics are dramatically female-skewed. About 71% of Pinterest users in the UK are women, with only 23% men.

Source: Statista

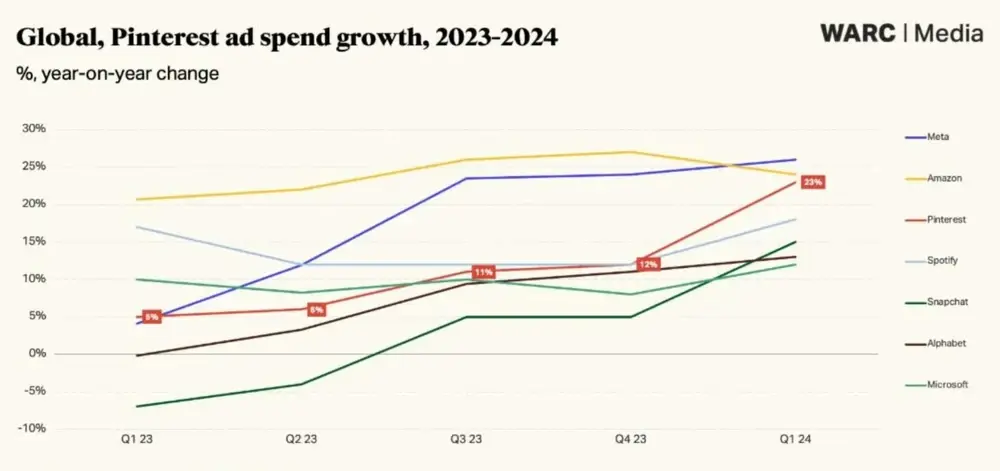

51. Pinterest isn't a small player in the ad world. Its Q1 ad audience growth rate hit 23%, beaten only by Meta and Amazon. Industry forecasts predict Pinterest's global ad revenue will reach $4.2 billion in 2025.

Source: MediaCat

Key takeaways

Pinterest's visit share has declined over time, but its high brand recognition gives it staying power in the UK.

The overwhelmingly female user base (71%) makes Pinterest exceptionally valuable for brands targeting women, especially in visual categories.

Pinterest’s ad revenue is growing faster than most platforms, showing strong commercial performance despite it being a rather niche platform.

YouTube statistics in the UK

52. YouTube dominates the UK. It's used by more than 44 million UK adults, making it the most popular social platform in the country.

53. An incredible 94% of UK online adults watched YouTube in May 2024. It's become as essential as television, serving as the go-to for music, entertainment, how-to guides, and more.

54. The gender split is almost even. About 52% of YouTube users in the UK are women, with men making up the remaining 48%.

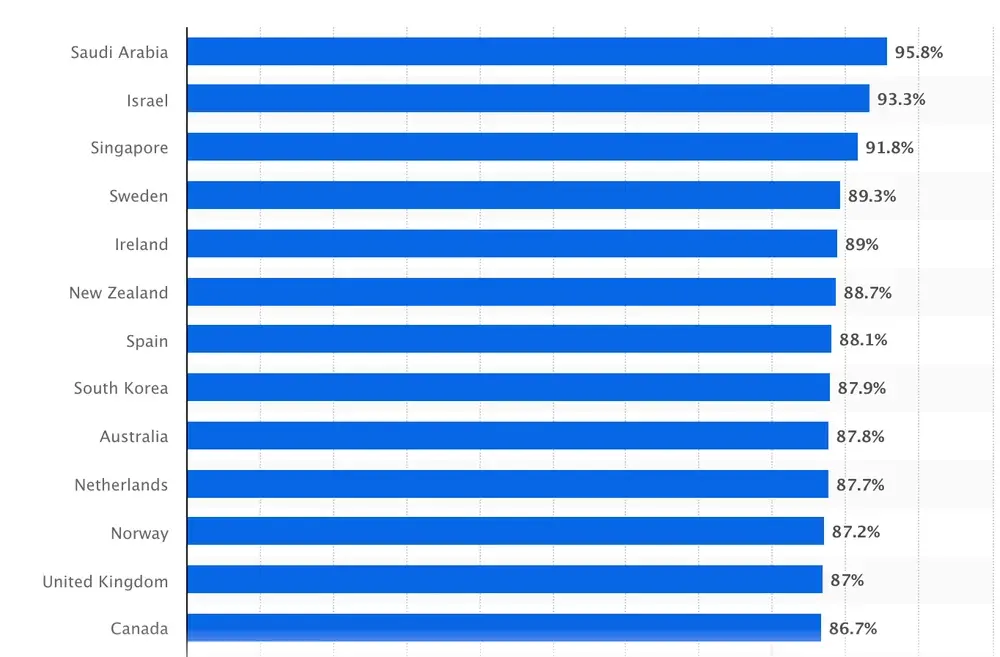

55. The UK ranks among the top countries for platform penetration, with 87% of the total population using YouTube as of February 2025.

Key takeaways

YouTube is now the UK's undisputed #1 social platform, with near-total reach across online adults, making it essential for any content-driven brand strategy.

Usage spans all groups and interests, reinforcing its role as a full-funnel platform from discovery to education and entertainment.

The balanced gender distribution (52% women, 48% men) makes YouTube a neutral territory for reaching broad audiences without significant demographic skews.

LinkedIn statistics in the UK

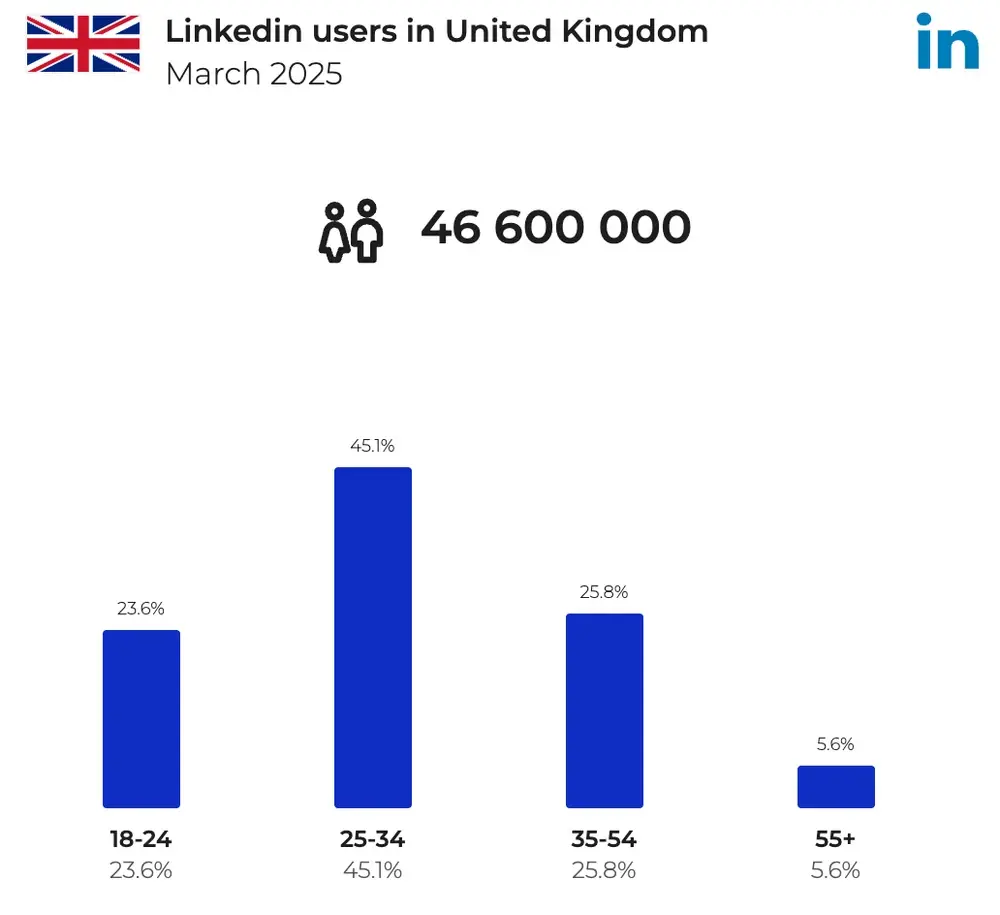

56. LinkedIn keeps growing steadily in the UK. There were around 44.6 million LinkedIn users in the United Kingdom in January 2025, up slightly from 44.4 million the previous month.

Source: NapoleonCat

57. The platform saw consistent growth throughout 2023 and the first half of 2024, showing it's still expanding its user base.

58. 45% of UK LinkedIn users are 25-34 years old. About 24% are in both the 35-54 age bracket and the 18-24 group, creating a young but professionally diverse community.

59. Brand awareness is high, with 82% of UK social media users recognizing LinkedIn as a platform.

Key takeaways

LinkedIn continues its steady growth in the UK, with a large, age-diverse user base. This makes it valuable for employer branding, B2B marketing, and recruitment campaigns.

The platform's core audience is young professionals (25-34), but there’s significant representation across all working age groups. This allows for targeted professional content across career stages.

High brand recognition (82%) and consistent user numbers growth make LinkedIn an essential part of the professional content mix for UK businesses.

Influencer marketing statistics in the UK

60. The UK influencer marketing scene is booming. Industry projections show it reaching £1.3 billion by 2029.

61. Brands are spending big: £820 million went to influencer campaigns in 2023, growing about 15.7% from the previous year.

62. Young Brits love following creators. About 84% of UK Gen Z social media users and 66% of Millennials follow at least one social media influencer. This gives brands massive reach through creator partnerships.

63. But trust is complicated. Only 28% of British Gen Z and 18% of millennials say they trust influencer ads. These are among the most complained-about ad formats in the UK.

64. After watching TikTok ads featuring creators, 61% of users believe the brand was directly involved in creating the content. This shows the blurring lines between sponsored and organic content.

Key takeaways

Influencer spend in the UK is growing fast, but trust remains a major challenge, particularly among younger users who demand authenticity in partnerships.

The huge gap between following and trusting creators (84% follow vs. 28% trust for Gen Z) means brands must prioritize long-term collaborations and transparent storytelling.

TikTok stands out for influencer effectiveness, with most users recognizing brand involvement in creator content.

Social media buying behaviour statistics in the UK

65. More than half (56%) of UK users have bought something directly through social platforms. Either by clicking shoppable content or checking out within an app. This jumps to 73% for people under 45.

66. Millennials lead the charge, with one in four purchasing through social channels at least monthly.

67. Social media shapes real-world decisions, too. In a January 2025 survey, four in ten respondents in the United Kingdom said social media inspired them to try specific restaurants while on holiday abroad. This influence is even stronger among younger travelers: over two-thirds aged 18-34 reported the same.

68. Mobile dominates the social shopping experience, with about 73% of social commerce purchases in the UK completed on smartphones.

Key takeaways

Younger audiences are driving social commerce growth in the UK, with nearly three-quarters of under-45s making purchases directly through platforms.

Social influence extends far beyond online shopping: it's shaping travel, food, and lifestyle decisions, making social a key part of broader brand discovery.

The mobile-first nature of social shopping (73% on smartphones) means brands must optimize checkout experiences specifically for small screens and on-the-go purchasing.

The top social media trends in the UK

Social media habits in the UK are shifting in a few important ways.

Short-form video is driving engagement, while users are looking for authentic content and a more community-focused experience.

It’s the same story we’re seeing globally.

Here’s what you can do to adapt:

Make video your primary content format: Create authentic visual stories that work without sound and capture attention in seconds.

Treat social platforms as a sales channel: Integrate social media shopping features into your strategy and optimize for mobile checkout experiences.

Balance AI efficiency with human authenticity: Use AI tools for content creation and planning, but maintain genuine voice and transparency.

Build communities, not just follower counts: The fastest-growing platforms (Reddit, TikTok) thrive on interaction. Create spaces for conversation and connection around shared interests.

Want to stay ahead of the changing social trends?

Talkwalker's social listening platform helps you track conversations, spot emerging patterns, and see what resonates with your audience. Request a free demo today to see it in action.