Coke vs Pepsi: Marketing strategies

The Coke vs Pepsi battle has been bubbling for years. How do their marketing strategies compare? Here’s a look at the World Cup, Super Bowl,...

January 29, 2024

Brands are under pressure to increase brand recognition and raise awareness. In this blog, we look at 2 of the world’s biggest brands for inspiration. Here’s the difference between Coca-Cola and Pepsi’s marketing strategies.Want to dive into the performance of your brand? Dive into social media mentions of your brand instantly with our free Social Search.

Try Free Social SearchCoke vs Pepsi | Battling CPG brands

Since their conception, PepsiCo and the Coca-Cola company battled for cola’s number 1 spot. Over the last few years, both brands have faced challenges. COVID hit the valuable restaurant industry, and now we’re facing a possible economic downturn.But they’re still going strong. Coca-Cola is the 10th most valuable global brand. Pepsi may be further down the list, in 91st position, but had a +17% brand value increase from 2022 to 2023.Despite this, the two brands have equal brand awareness. Joint first place with 95% of consumers asked able to recognize both the Pepsi and Coca-Cola brands.

Coke vs Pepsi | The Cola Wars

Invented within a decade of each other, Coca-Cola was always the more popular carbonated soft drink. While the brands peacefully co-existed for years, the Pepsi Challenge in 1975 rocked the taste buds.

Who wants to take the #pepsichallenge and play football with Messi, Pogba, Sancho or van de Sanden? Head over to TikTok and 'duet' with any of the team! All done to the beat of our custom track from Becky G and Burna Boy #pepsicoproud pic.twitter.com/vTbPbvm4dP— Sabine Selos (@sabineselos) March 2, 2021

The Pepsi Challenge has morphed over time.Considered by some to be a marketing ploy, the Pepsi Challenge was originally a blind taste test. It revealed consumers preferred the taste of Pepsi over Coca-Cola. Coke's shining star dulled and its market share declined.This led to the launch of Diet Coke and caffeine-free Coke!Consumers welcomed the diet and caffeine-free versions. But when Coca-Cola launched New Coke, in direct competition with Pepsi, consumers rejected it.Three months later, Coke returned to its classic recipe. Disaster averted. People got the classic back, and Coca-Cola continued to beat Pepsi's yearly sales.

Coke vs Pepsi | Social media

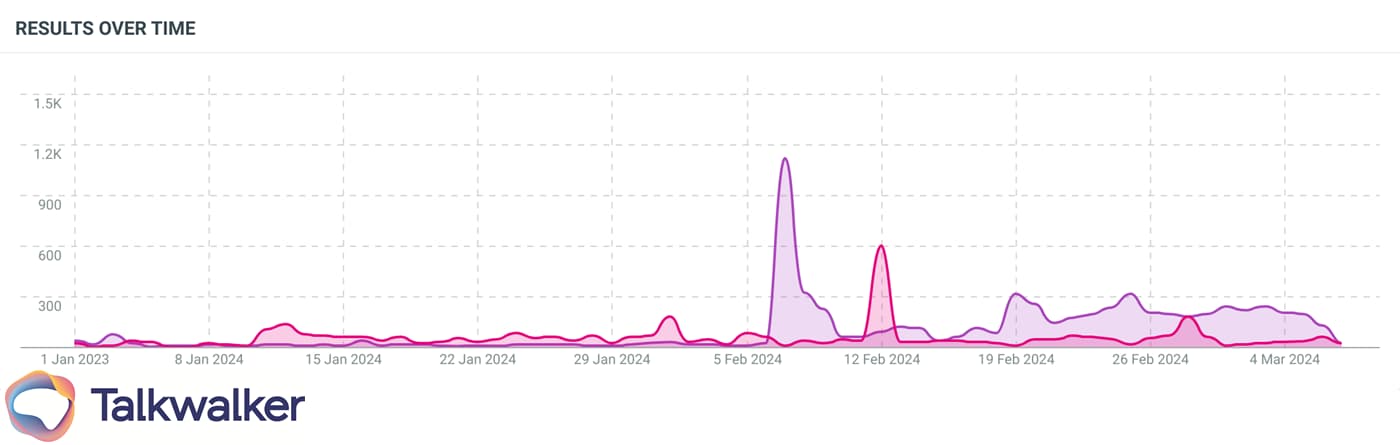

Social media is a key channel for both brands to convey their brand content to the young and thirsty crowd.Both brands invest heavily in teen music bands and celebrity endorsement. This dual strategy pays off as younger generations like to follow and comment on their pop idols online. Pepsi boasts 1.1 million fans on TikTok, compared to 915,000 fans for Coca-Cola.Coca-Cola started 2024 with a new campaign: New Guy. The ads highlight how families connect with the full range of Coca-Cola products.They also launched Coca-Cola Spiced in February.Coca-Cola Spiced gained 6,600 mentions since its launch. While the New Guy trailer has over 116,000 times.In return, Pepsi launched Wild Cherry in January. This gained them 3,600 mentions.

Mentions of the two new brand product launches, with Pepsi Wild Cherry in pink and Coca-Cola Spiced in purple. Talkwalker Social Listening

Coke vs Pepsi | Hitting All Generations

We can define both soda brands’ strategies as comparable and defensive. With a clear focus on the US for Pepsi, and a more international approach for Coca-Cola.The two brands have connections to sport, with Coca-Cola is still a main sponsor of the World Cup. On the other hand, Pepsi used to be a key sponsor of SuperBowl, but this ended in 2022. Instead, they will now ‘focus on streaming and digital platform advertising.’Soccer or football events are brand investments that target customers aged 30+, who have already decided their preferred beverage.

Music wins

The challenge is to connect with that 12 to 27-year-old Generation Z. These social media-savvy spenders, are still reaffirming their choices. One way to connect with them is through music.Both brands have a history of working with key music influencers. Coca-Cola is currently featuring Taiwanese singer-songwriter Eric Chou is some global commercials.Pepsi’s Music Lab shines a spotlight on the next generation of superstars. In 2023, they collaborated on Samy Hawk’s WILD video.

Coke vs Pepsi | Health and Sustainability

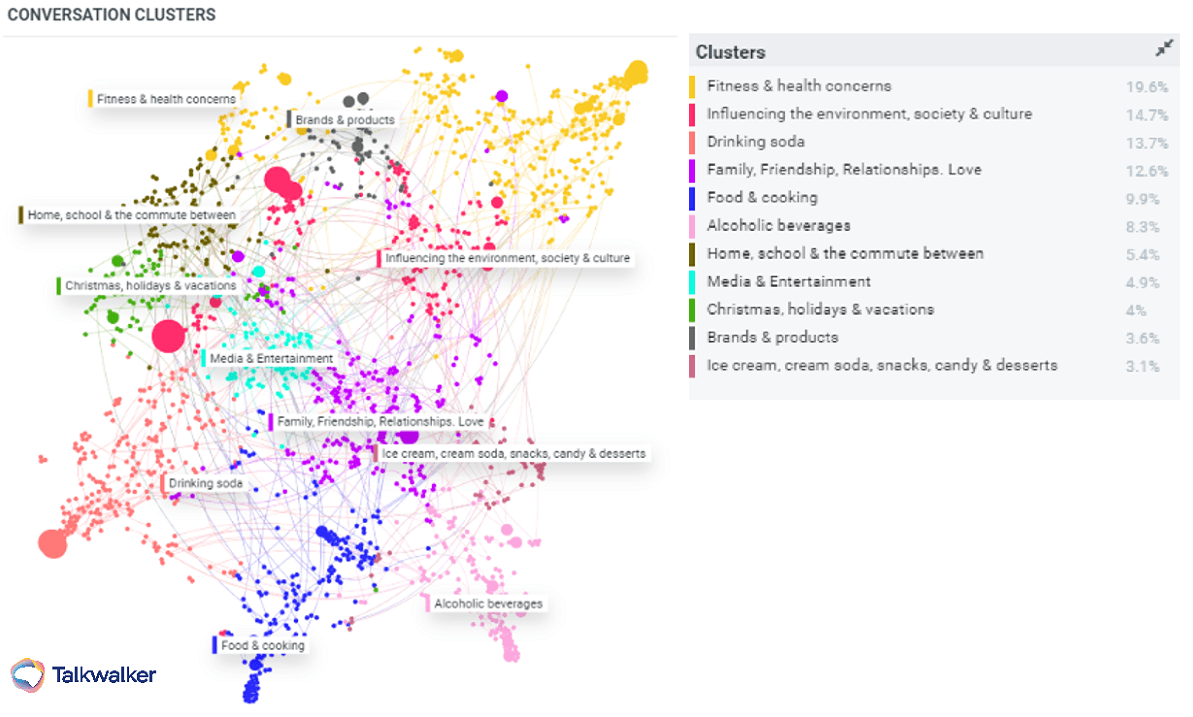

Conversation Clusters and theme clouds identify the overarching themes around an industry or topic. Identifying what's top of mind for consumers and finding emerging trends.

Conversation Clusters. Health concerns and fitness dominate topics. Talkwalker Social ListeningHealth concerns and fitness dominate consumer conversations in the soda industry. With underlying topics covering the environment, society, and culture.

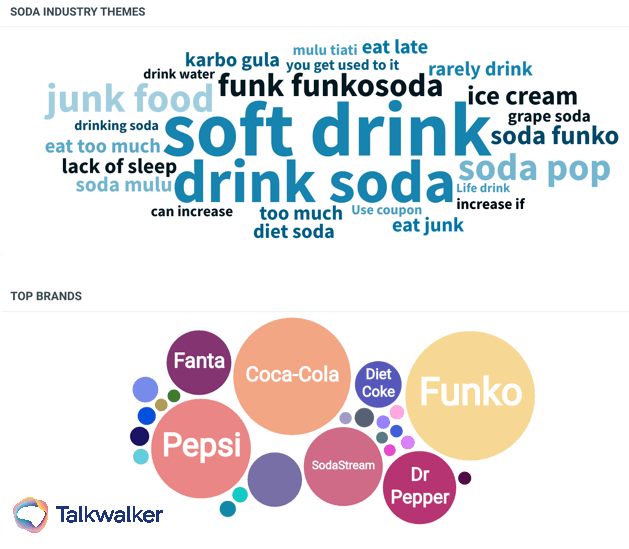

Soda industry - themes and top brands. Talkwalker Social Listening

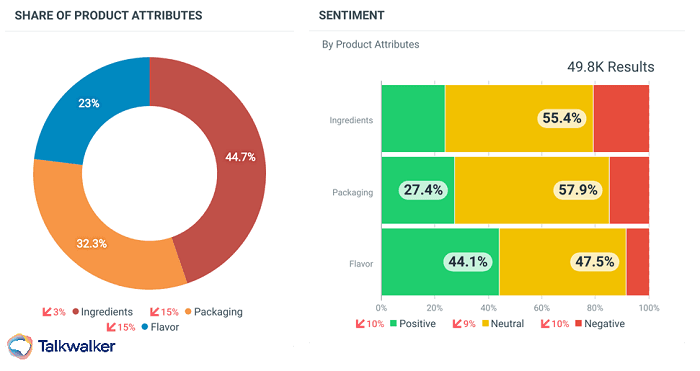

Positive sentiment for flavor, followed by sustainability. Talkwalker Social ListeningA healthy lifestyle is key to product attributes, with ingredients like sugar as the most discussed topic.Flavor dominates positive sentiment. With product packaging conversations around sustainability and the dislike of non-recyclable plastic.

Coke vs Pepsi | Tone of voice

Competing brands must maintain a unique brand identity. Coca-Cola and Pepsi each have their distinct tone of voice and language.

Coca-Cola

Like an over-excited puppy, Coca-Cola is happy, chatty, and fun.Big on community and togetherness, the brand talks to its audience as if "we're all in this together."As well as adapting to the pandemic, brands had to consider how to recognize social justice issues that arose. Such as Black Lives Matter. Pepsi, while not ignoring, took a step back, compared to Coca-Cola.Of course, Coca-Cola shares promotional content, but it wears its heart on its sleeve. It supports and donates regularly.Coca-Cola's social media strategy is all about community fun and support.

Pepsi

Pepsi is big on promotional content on social media. Posting contests, promo offers, event sponsorship, partnerships, etc.Pushing its product as a beverage to accompany food, the brand regularly posts recipes.To balance the promotional tone of voice, Pepsi uses chatty words to sound more human and engage with its audience - hey, oh, yeah…In its goal to stand out from Coca-Cola, Pepsi has created a brand persona that is a bit more grown-up.

Coke vs Pepsi | Visual Analytics

Using image recognition, we found Coca-Cola and Pepsi have some of the most prevalent logos in the industry.

Image recognition allows brands to identify their logo regardless of text mentions in posts.In just 2 months, we identified the Coca-Cola logo 769,000 times, and the Pepsi logo 641,000 times.

World Cup vs Super Bowl

This may be older data, but by comparing 2 similar events, we can compare the two brands’ sponsorship success.Coca-Cola has a long-standing relationship with the Fédération Internationale de Football Association - FIFA. A has a sponsor history with the World Cup dating back to 1978. While Pepsi has had links to the NFL since 2002.

.@pepsi vs. @CocaCola at the Atlanta Airport. Only Pepsi can use the #SuperBowl logo, but Coke still showcases its Atlanta ties. #SportsBiz pic.twitter.com/HQiyJdsiDa— Jeff Eisenband (@JeffEisenband) February 3, 2019

The 2018 World Cup’s first week generated 459 million posts, likes, and comments on Facebook. Compared to 2018’s Super Bowl which generated 185 million interactions.Coca-Cola knows how to get their money’s worth. The brand generated 766,000 cumulated brand mentions and 11.1 million engagements directly. Creating a total engagement ROI of 0.18 EN/$. PepsiCo’s NFL 20-year brand partnership costs them an estimated $90M per year in fees, including all their brands. Approximately 25% flows to the flagship brand Pepsi - $22.5 million - with 50% of this sum to the Super Bowl buzz. Ending with a yearly $11.25M cost-share for the Pepsi brand, only assigned to the Super Bowl.Add the 30-second Pepsi ad broadcasting cost of 5.25M - 2019 figures. Finally, the budget to exclusively sponsor the halftime show is around $5M. This would result in an estimated net Super Bowl investment of about $21.7 million for the brand.The Super Bowl 2019 generated 261,100 mentions and 1.6 million engagements for Pepsi over 30 days. For a total engagement ROI of 0.07 EN/$.Compared to Coke’s investment in the World Cup, Pepsi pays a huge premium to sponsor the Super Bowl. A heavy price to pay to rival Coca-Cola in the US social media market.

Coke vs Pepsi | Takeaways

The key to success is to bridge the generational gap with sound 360-degree marketing campaigns**.** It helps to combine both the frame (sports), to catch the older, and the content (music), to catch the younger.

Global brands can play a tactical national game to defend a strategic country's beverage market share. A global worldwide approach only sometimes makes sense for specific markets.

The bigger you are, the more defensive you get. Permanently track and understand how your close competitors are doing. And how your customers are reacting.

Celebrity endorsement associated with sports events may pay off for lifestyle brands. Still, the viral outcome can strongly differ from event to event as other factors may interfere with the brand message. Track this properly to take corrective measures.

To discover social media insights that will deliver impact for your brand, try our free Social Search now.

Try Free Social Search