What does the Labubu craze teach us about online trends? DATA

Here's what the Labubu craze reveals about the lifecycle of online trends — and how marketers can ride the wave from viral fame to lasting business impact.

September 2, 2025

![Featured image for What does the Labubu craze teach us about online trends? [DATA]](/_next/image?url=https%3A%2F%2Fimages.ctfassets.net%2Fjiz1qmszsogv%2Fblog-featured-asset-b5605afe-7197c34b%2Fb0b8ff4ad628aebe73091751342b61d9%2Ffeatured-b5605afe.png&w=3840&q=75)

Trends are a delicate challenge for marketers. Get them right, and you can capture new audiences, drive more engagement, and win business. Get them wrong, and your efforts get forgotten like yesterday’s news.

Knowing if a trend is on the up or down can help you decide if and when to jump on board. That’s why you need to understand how online trends originate, spread, and eventually die out.

Here, we analyze the lifespan of social media trends through the example of Pop Mart’s global phenomenon: Labubu.

Methodology

We used Talkwalker’s Social Listening to track how online audiences and publishers across 150+ million sources (social networks, websites, blogs, news sites, forums, and more) have been talking about Labubus. We analyzed the volume and sentiment of mentions over time as well as theme clusters that developed around the topic.

You can easily do similar in-depth research on your brand, competitors, or industry. Book a free Talkwalker demo today.

What is a Labubu?

Labubus are sharp-toothed, long-eared plush toys with vinyl faces, designed to double as keychains or bag charms.

Labubus are part of a collectible line from Chinese company Pop Mart based on artist Kasing Lung’s The Monsters story series. They were first produced in 2019. However, it was only this year that the collectibles really took off with the help of celebrities, influencers, and an ever-growing fanbase.

The success of Labubu is more than an online trend. In a recent half-year financial report, Pop Mart reported a nearly 400% rise in profits since the start of 2025. With share prices soaring to match, the Beijing-based toy maker is currently more valuable than traditional toy giants Mattel, Hasbro, and Sanrio.

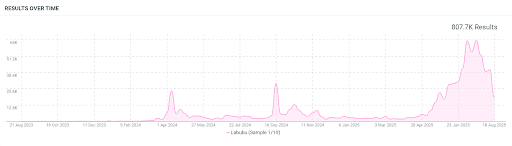

Mentions of Labubu over the last 24 months (Aug 21, 2023 to Aug 21, 2025); 10% sample; Talkwalker Social Listening

Here, you can see how online mentions of Labubu exploded over time. In August 2021, the brand name was barely reaching triple-figure mentions per week. Now, we’re seeing weeks with over 630,000 mentions.

One key element of Pop Mart’s strategy is blind boxes. Instead of choosing the exact toy, consumers gamble on chance, encouraging repeat purchases from collectors and adding excitement for casual buyers.

Blind boxes also fuel the booming trend of unboxing videos. While not new — think Pokémon cards, Kinder Eggs, or Mini Boglins from the ’90s — the tactic is resurging.

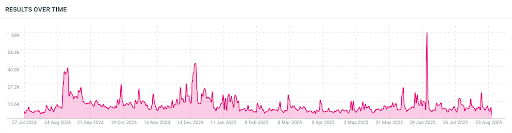

Mentions of blind boxes and related terms over 13 months (July 27, 2024 to July 26, 2025); Talkwalker Social Listening

Over the past 13 months, blind boxes (and related terms like “blind bags” and “mystery boxes”) generated 4.1 million mentions. Companies like Lego, Games Workshop, and Starbucks have all embraced the trend.

Labubu blind boxes are clearly enjoying a moment in the spotlight. But to understand how this happened, we need to understand the stages that shape a trend.

The anatomy of an online trend

Trends have an anatomy, with recognizable stages that you can spot with social listening. Depending on a specific trend's lifespan, they can unfold over several years or several hours.

The stages are:

1. The forming of a fanbase

Social listening signals: Low volume of mentions and high sentiment

The first people talking about your brand online are fans — satisfied customers or those who simply love your style, music, book, or product. They spark the initial conversations.

2. The catalyst(s)

Social listening signal: Sudden spike in conversations

The catalyst is an online event that pushes your brand from obscurity into the mainstream. It could be an influencer mention, a successful campaign, a news story, or anything else that gets people talking.

Brand wins and emerging trends can come from one or several catalysts, each helping your brand tap into new markets or audiences.

3. The virtuous circle

Social listening signal: A consistent growth in mentions

At this stage, trends grow organically. Influencers catch wind of it and create relevant content. Online audiences engage with it. Memes are created. News outlets cover the buzz, prompting more conversations. And the cycle continues.

4. The backlash

Social listening signal: Drop in net sentiment

Eventually, the trend reaches less welcoming audiences, including:

People uninterested in the trend and tired of seeing it

Cultures less accepting of its meaning

Competitors’ fans

Contrarians who reject what’s popular

Negative conversations from these groups drive sentiment down.

5. The status quo

Social listening signal: Fairly consistent conversation levels, smaller spikes in sentiment

After the hype fades, mentions settle at a more consistent level. Spikes may occur, but the conversation baseline becomes easier to benchmark—until the next catalyst appears.

The Labubu craze explained

Let’s look at how these trend stages unfolded for Labubu.

From fanbase to catalysts

Labubu needed not one but three catalysts to break into the mainstream.

Before April of last year, Labubu was still in the fanbase stage, with low mentions but high sentiment.

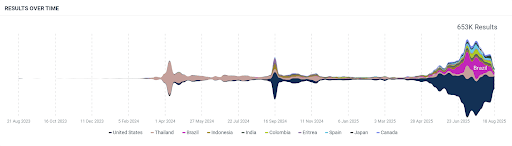

Mentions of Labubu over the last 24 months (Aug 21, 2023 to Aug 21, 2025), segmented by country; 10% sample; Talkwalker Social Listening

Catalyst 1: April 2024

The first real surge of conversations started in Thailand when K-pop band Blackpink’s star Lisa shared the latest Labubu box set on her Instagram profile. The post generated over 210,000 mentions in a single week, fueling broader national conversations.

Catalyst 2: September 2024

The second spike came from an uptick in influencer mentions, alongside more aggressive marketing efforts from Pop Mart.

At the time, 83.3% of conversations about Labubu came from Asia, but this second wave of online hype helped the brand gain traction in the U.S. It also sparked chatter around an unofficial Labubu cryptocurrency.

Catalyst 3: April 2025

Labubu finally went global as three things converged:

Blackpink’s new album announcement and Lisa’s White Lotus casting reignited interest in her Labubu collection.

A One Piece collaboration opened the brand to new fandoms.

Pop culture celebrities like Dua Lipa, Kim Kardashian, and Rihanna were spotted with Labubu dolls, cementing the plushie’s status as an iconic fashion accessory.

The Labubu virtuous circle

Labubu then entered the virtuous circle stage, with mentions growing steadily.

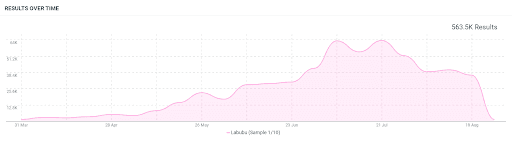

Mentions of Labubu over 5 months (Apr 1, 2025 to Aug 21, 2025); 10% sample; Talkwalker Social Listening

Between April and July 2025, celebrity endorsements and nonstop media coverage pushed online mentions to a high of 635,000 in a single week (July 21, 2025).

The Labubu backlash

Recently, mentions started declining as Labubu entered the backlash stage.

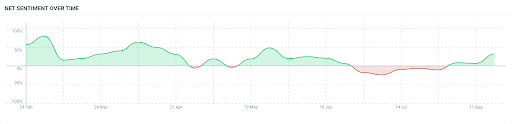

Net sentiment for Labubu mentions (Feb 24, 2024 to Aug 22, 2025); Talkwalker Social Listening

In the fanbase stage, net sentiment peaked at +78.8%. Over the last few months, it plunged into the negative, bottoming out at -24.4% — a rare dip for a brand not in crisis.

Why?

Cultural clashes

As Labubu spread globally, some cultures viewed the monster design as devil-like and harmful to children. This interpretation spurred negative commentary.

Consumerism critique

Others criticized Labubu as a symbol of microtrend-driven consumerism — buying just to keep up. Many believe Labubu will be discarded once the next craze arrives. Dubai chocolate and matcha are often cited as similar short-lived fads.

This ties into the concept of “consumer slop”: mass-produced products lacking substance, driven by FOMO and scarcity marketing. The term appeared 1,700 times over 13 months, peaking at 439 mentions after a recent New Yorker essay. While mostly tied to Gen Z, Pogs, Furbies, and Beanie Babies are earlier examples.

That said, only 41 conversations directly linked Labubu to consumer slop, and many online voices defended the toys as genuine collectibles. Others even framed Labubus as a rejection of digital collectibles like NFTs, highlighting their tangible value in a digital-first world.

Supply chain issues

Access and supply are also issues that have been surfacing in online conversations. Labubu toys are made in China and only sold in blind boxes, so Western buyers face difficulties buying the models they like, and counterfeits (a.k.a. Lafufus) are flooding the market.

Over the past year, 55,000 Labubu mentions included the word “fake.” While this amounted to less than 1% of all brand mentions, these conversations carried a net sentiment of -51.1%, dragging down the overall sentiment of online discussions about the figurines.

Resellers are also driving up the prices of Labubu (especially the limited edition products), which further lowers sentiment.

Supply issues may get worse if U.S. tariffs affect the brand. Recently, 3,000+ mentions tied Labubu to tariff discussions, with creators using the designer toy’s high demand as a symbol of global trade challenges.

Entering the status quo

Labubu is now entering the status quo stage, with mentions stabilizing.

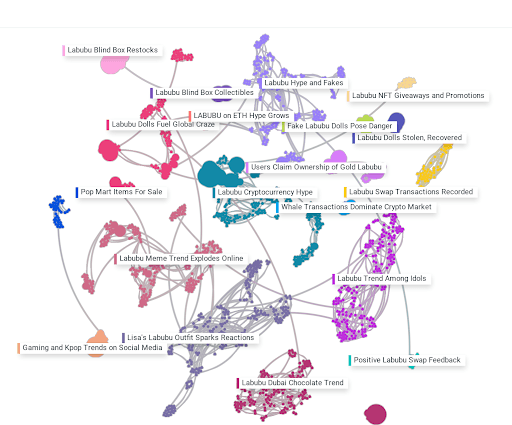

Conversation Clusters identify the main themes in online conversations about Labubu; July 26, 2025 to August 26, 2025; Talkwalker Social Listening

Conversation clusters from July–August 2025 highlight the key themes: Lisa’s influence, counterfeit risks, and brand collaborations. These are the conversations Pop Mart should monitor for opportunities and crises.

Will there be another catalyst? Pop Mart is working hard to create one, tapping into new audiences with brand collabs. Their recent partnerships with Vans and Coca-Cola are already generating strong online engagement.

What can brands learn from the Labubu trend?

Labubu’s global rise to fame offers several lessons for brands navigating today’s fast-moving trend cycles. Here’s how you can intentionally fuel and sustain trending moments (according to a toothy monster).

1. Early fans lay the groundwork

Before Labubu became a global craze, it quietly built a loyal core of collectors. These passionate early adopters sparked the first conversations, creating a foundation that Pop Mart could later amplify.

Takeaway: Nurture and engage your most dedicated fans—they are often the spark that ignites broader attention.

2. Catalysts drive exponential growth

Labubu didn’t go viral by accident. Its rise was powered by multiple catalysts: Lisa from Blackpink showcasing the toy on her social media, Pop Mart’s strategic marketing pushes, collaborations with franchises like One Piece, and celebrity endorsements from stars like Dua Lipa and Kim Kardashian. Each moment pushed the trend to new audiences.

Takeaway: Identify and leverage catalysts (influencers, cultural tie-ins, or brand collabs) that can propel your brand from niche to mainstream.

3. The virtuous circle amplifies itself

Once the momentum started, media outlets, influencers, and fans kept the cycle going. Each mention fueled more mentions, creating a compounding effect.

Takeaway: Monitor when your brand enters this “self-sustaining buzz” stage, and keep feeding the cycle with content, press, and activations.

4. Be prepared for backlash

At one point, Labubu’s sentiment flipped sharply. Critics cited cultural clashes and shallow consumerism alongside concerns about counterfeits and supply chains.

Takeaway: Every trend faces pushback. Anticipate criticism, understand the cultural context, and be ready with proactive messaging and community management.

5. Scarcity and play drive engagement

Pop Mart’s blind box strategy taps into FOMO, scarcity marketing, and the thrill of unboxing. This not only fuels sales but also generates millions of organic mentions around the shopping experience.

Takeaway: Build mechanics that make your products feel scarce, playful, and shareable. The buying experience can be just as trend-worthy as the product itself.

6. Trends move fast — be ready for the status quo

After explosive growth and backlash, Labubu is now entering a steadier “status quo” stage, where online buzz is leveling out.

Takeaway: Trends don’t last forever. Brands need to plan for what comes after the hype. Consider introducing new collabs, products, or product line extensions to keep momentum alive.

How to turn a trending moment into business with Talkwalker

A viral moment like the Labubu craze isn’t just hype — it’s an opportunity. With the right consumer intelligence tools, brands can turn buzz into real business results.

Here’s how different teams could use Talkwalker to make it happen.

Social media teams

Talkwalker’s Social Listening and influencer analytics help pinpoint the creators driving the most impact.

Instead of guessing who to partner with, social teams can see which influencers are already talking about the brand — then filter by reach, engagement, or mentions to find the perfect fit, even if they operate within a niche online community.

Talkwalker can even detect appearances in video and image content, regardless of whether the creator tagged your brand or not.

Executive leadership and strategy teams

For leadership, Talkwalker highlights where momentum is building across markets. By tracking conversation volume and sentiment by region, executives can spot growth opportunities and prioritize expansion.

For example, Talkwalker data illustrated how Labubu’s early traction in Thailand was followed by a surge in the U.S. — a signal for Pop Mart to invest in that market. Insights like these guide smarter go-to-market strategies and product roadmaps.

PR and communications teams

PR teams can use Talkwalker see which journalists and outlets are covering a trend. The Conversation Clusters and sentiment analysis tools reveal which narratives resonate, and which ones spark negativity.

With these insights, comms teams can get ahead of backlash by tailoring messaging to specific concerns, whether around culture or supply chains. Real-time alerts also make it easier to jump on opportunities — or manage a crisis before it escalates.

Product and innovation teams

Product teams can use social listening as a direct line to consumer feedback.

Analyzing mentions, reviews, and forums uncovers common complaints, feature requests, and usage patterns.

For example, the wave of negative sentiment around counterfeit Labubus could guide Pop Mart to tighten supply chains and protect its reputation.

All teams

Finally, competitive benchmarking helps teams track share of voice, engagement, and sentiment to spot gaps and opportunities, then measure campaign success in real time.

A brand like Pop Mart could use it to stack up their success against toy giants like Mattel, Hasbro, and Sanrio.

Trends generate attention — but with Talkwalker, brands can turn that attention into lasting business impact. To learn more about social listening and to see how you can track the trends around your brand, book a free Talkwalker demo today.

{{cta('261047136466','justifycenter')}}