Trend insights

What drove online conversations at the IAA 2025?

From EV breakthroughs to trade tensions — explore what dominated the online conversation around IAA 2025, and what it says about the auto industry’s future.

October 14, 2025

The Internationale Automobil-Ausstellung (International Motor Show or IAA) is one of the world’s largest automotive events, bringing together car manufacturers from around the globe for one action-packed week.

In this report, we explore what got consumers revved up, and how conversations around the event reflect broader trends in the automotive industry. What are people looking for in their next car? And what challenges are manufacturers facing? Read on to find out.

Methodology

We used Talkwalker Social Listening to analyze what captured people’s attention during IAA 2025. Our analysis included data from over 150 million sources, including social networks, websites, blogs, news sites, and forums. We measured the volume of mentions and sentiment over time and, used custom theme panels to identify top-performing brands and innovations from a curated list.

You can use Talkwalker to track trends and events relevant to your industry. Chat with our team to learn how.

A spike in mentions

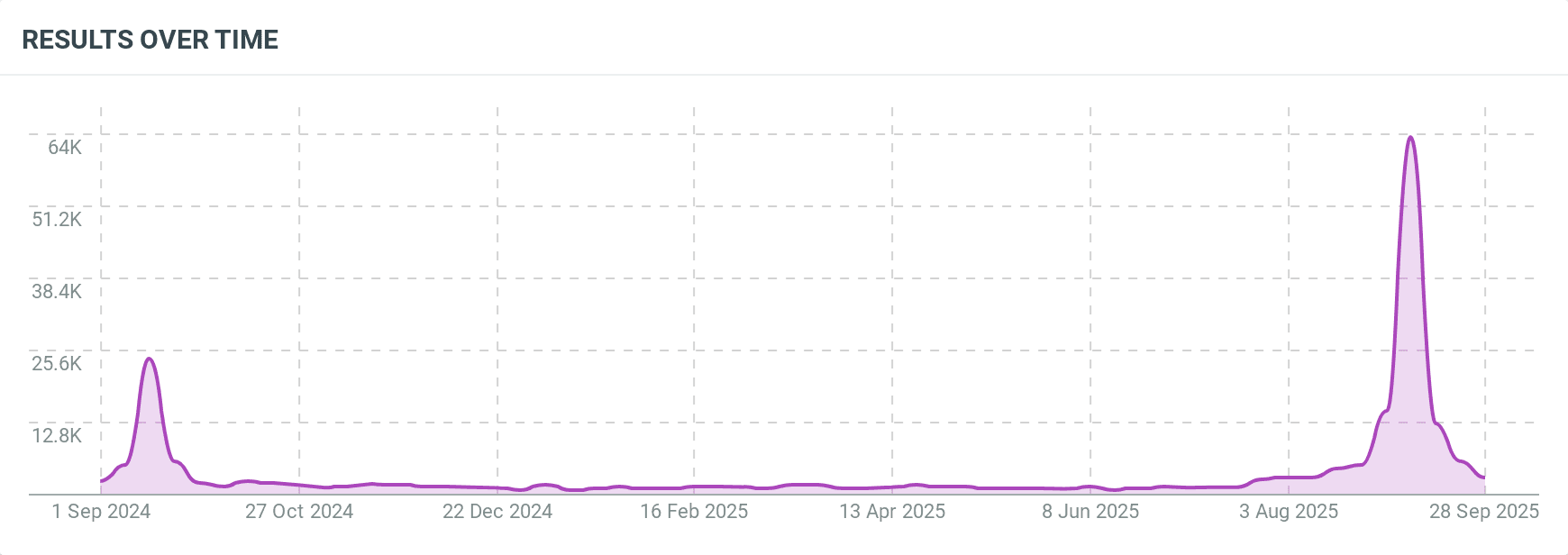

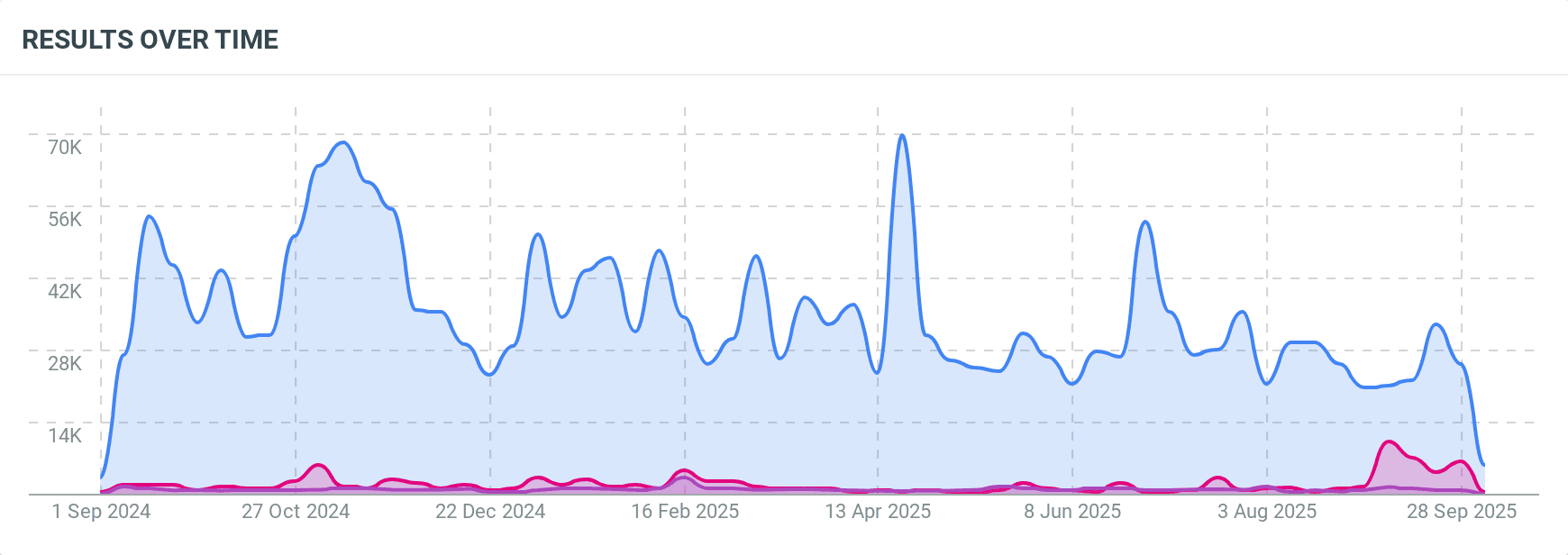

This year, there were 63.4K mentions of the IAA — a 165% increase year-over-year.

Mentions of IAA and related terms over 13 months, September 3, 2024 to October 3, 2025; Talkwalker Quick Search

Two key factors drove this spike in online conversations.

Consumer vs. commercial focus

The IAA spans two fairs each year.

IAA Mobility 2025 focused on passenger vehicles, drawing a broader consumer audience. IAA Transportation 2024, on the other hand, centered on commercial vehicles and attracted a more niche, B2B-focused crowd.

Consumer-oriented events naturally generate more online buzz.

Expanded data coverage

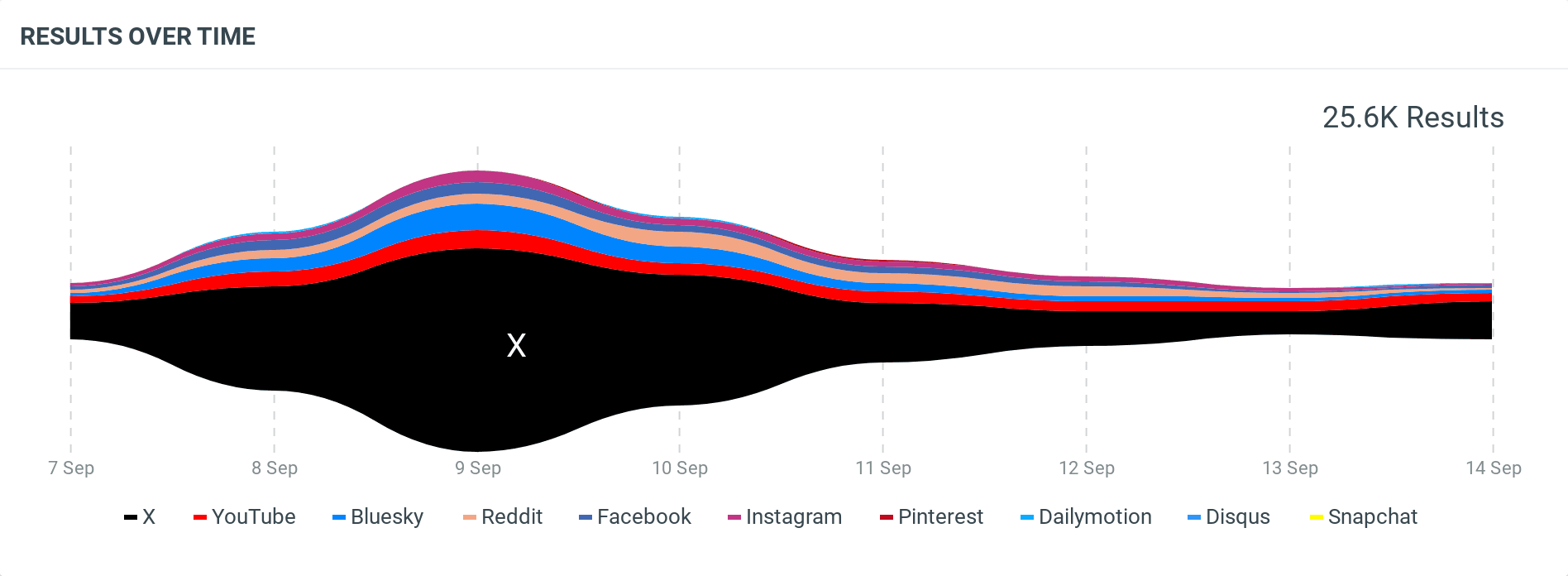

Talkwalker has significantly increased its data sources since the last event, uncovering more relevant conversations. During the week of IAA, there were 2.1K mentions on Bluesky, 1.7K on Reddit, and 1.2K on Instagram — and these sources were limited in 2024.

Mentions of IAA and related terms over 7 days, segmented by social media channel, September 7 to September 14, 2025; Talkwalker Social Listening

While X still accounts for a large portion of event conversations, including other platforms creates a more complete view of the IAA’s global audience and their online conversations.

Who’s talking about IAA 2025?

While the IAA is based in Germany, it brings together manufacturers and audiences from across the globe.

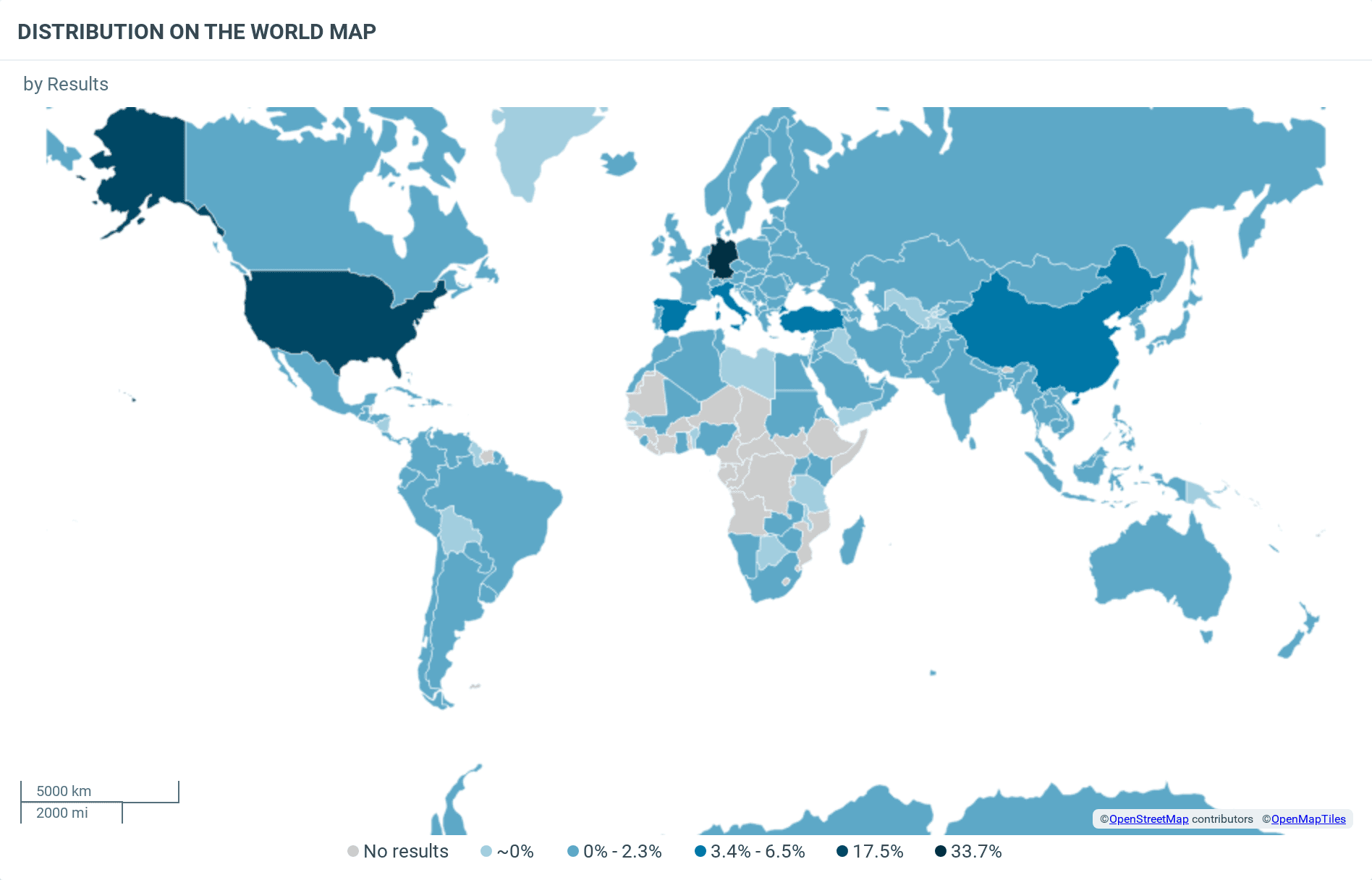

Mentions of IAA and related terms over 7 days, segmented by conversation origin, September 7 to September 14, 2025; Talkwalker Social Listening

Germany led with just over a third of total mentions (22.1K), followed by the U.S. (11.5K), Turkey (4.3K), China (3.1K), and Italy (2.2K).

Many of these localized discussions stemmed from national fanbases. In Turkey, enthusiasm centered on Togg’s T10F and T10X models. In China, conversations highlighted BYD’s Seal 6 DM-i and XPENG’s lineup.

The U.S. and Italy — both car-enthusiastic markets — ranked highly thanks to general excitement around the event and its new releases.

What stood out in IAA conversations?

Sentiment analysis

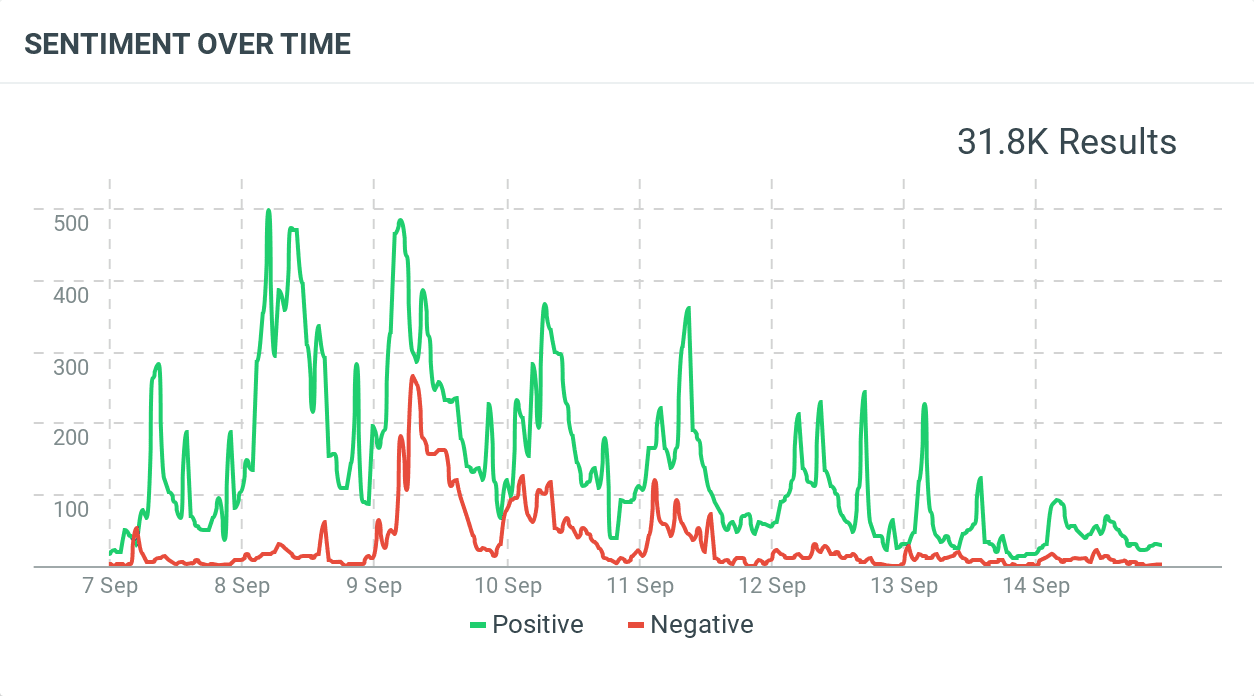

Mentions of IAA and related terms over 7 days, segmented by positive and negative sentiment, September 7 to September 14, 2025; Talkwalker Social Listening

Positive sentiment peaked on day one as brands unveiled new models. Negative sentiment spiked the following day, tied to discussions around the imminent combustion engine ban and its disruptive impact on the industry — which we’ll explore later.

The automakers racing ahead

By using Talkwalker’s custom theme panels, we identified the manufacturers that dominated this year’s IAA conversations.

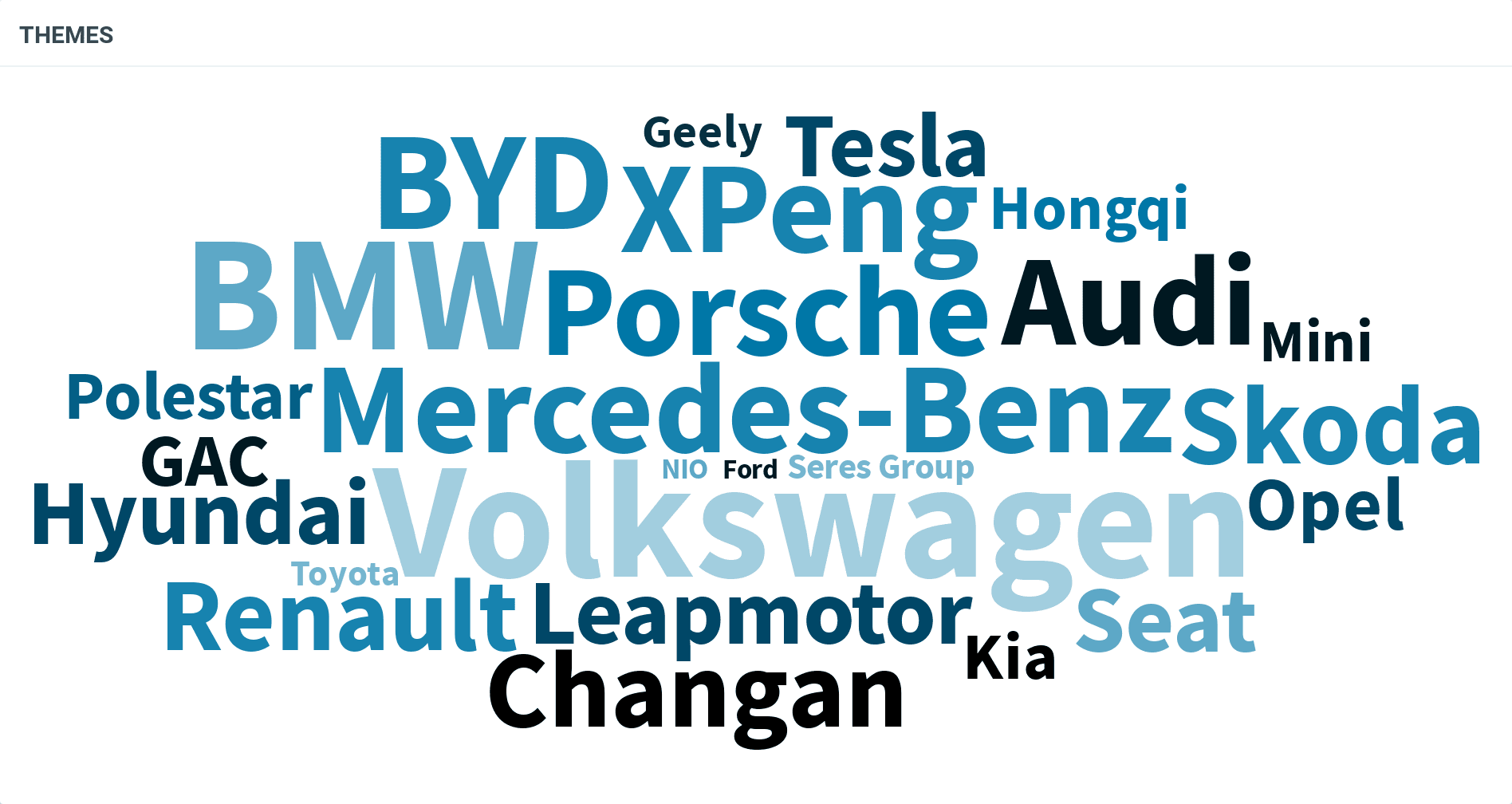

Word cloud showing the most mentioned brands in IAA conversations, September 7 to September 14, 2025; Talkwalker Social Listening

Volkswagen was the most discussed brand, with 4.5K mentions over the week — largely due to the launch of the ID. CROSS Concept, its new affordable electric vehicle.

Volkswagen also celebrated 50 years of the GTI with the premiere of the Golf GTI Edition 50.

BMW followed closely with 4.3K mentions linked to the Neue Klasse launch — the company’s vision for its next generation of vehicles, including the world premiere of the BMW iX3.

Third was BYD, which generated conversation around its Seal 6 DM-i and its growing reputation as a key player in the expanding Chinese EV market — seen by many as a threat to European manufacturers.

However, engagement metrics told a different story.

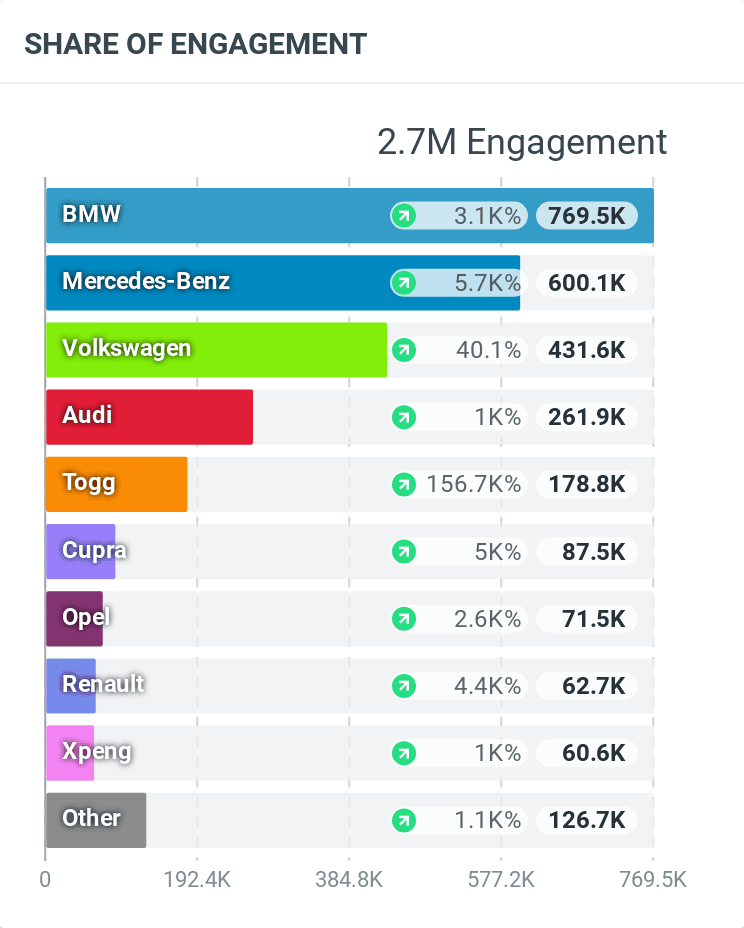

Bar chart showing the brands with the most engagement in IAA conversations, September 7 to September 14, 2025; Talkwalker Social Listening

European brands drove higher engagement overall. BMW led with 769K engagements, followed by Mercedes-Benz with 600K, driven by reveals such as the all-new electric GLC, CONCEPT AMG GT XX, and all-electric CLA Shooting Brake.

Volkswagen ranked third with 432K engagements. While BYD generated high mention volume, it lagged behind in engagement — suggesting fans were more responsive to European brands’ storytelling and launches.

…and some surprises from non-auto brands

IAA doesn’t just attract car manufacturers. Other brands also took the opportunity to connect their products to the automotive buzz.

Bosch promoted its hardware and software for next-generation vehicles.

Gran Turismo partnered with Opel to launch the Opel Corsa GSE Vision Gran Turismo, which generated 1.2K mentions. The car will appear in the PlayStation-exclusive game later this year.

Key innovations

With so many launches and prototypes on display, which innovations captured the most attention?

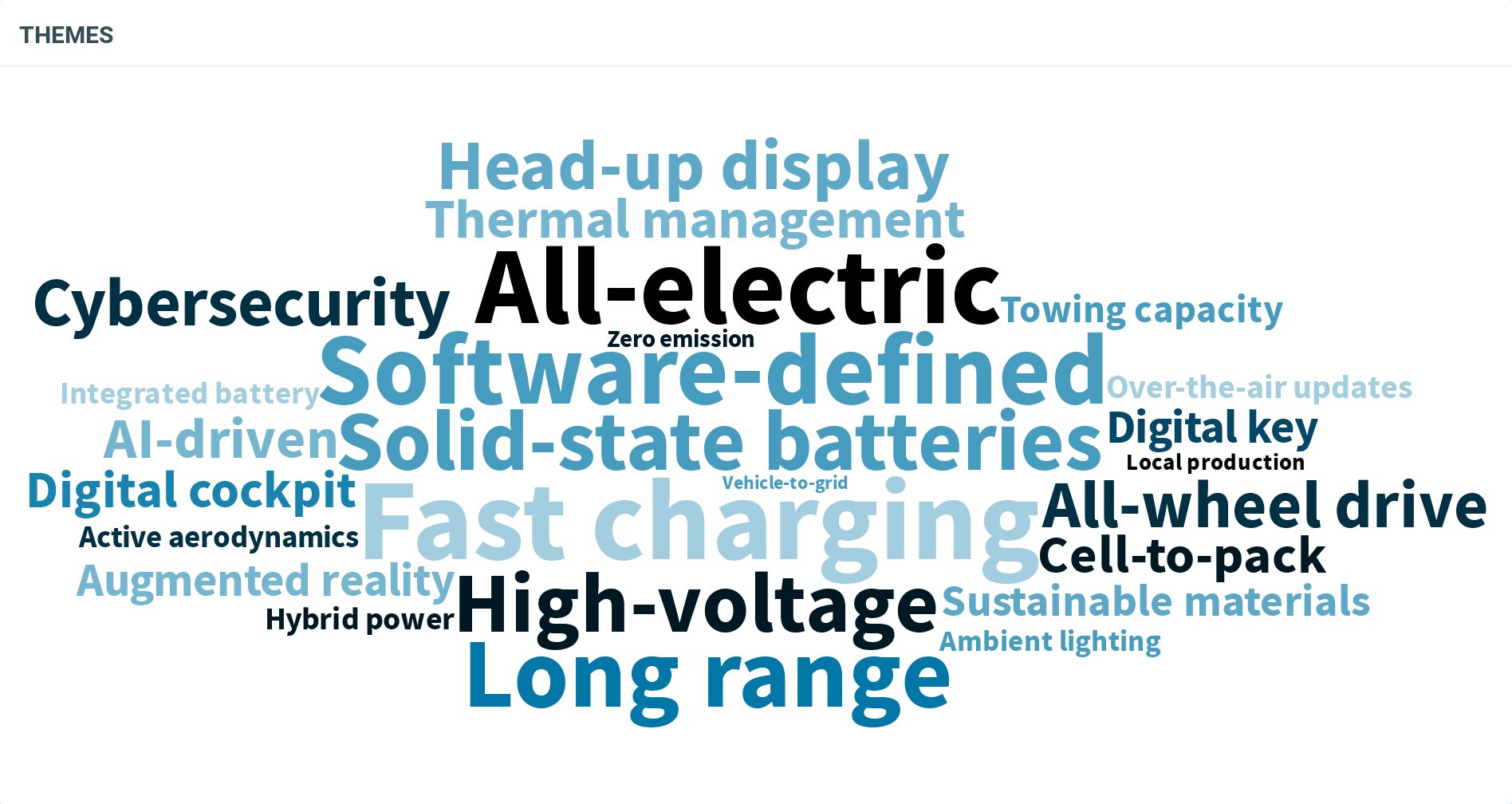

Word cloud showing the most mentioned innovations in IAA conversations, September 7 to September 14, 2025; Talkwalker Social Listening

As electric vehicles dominated the event, most mentions focused on EV-related innovations — from fast charging (the top innovation, with 1.8K mentions) and long range to more advanced technologies like solid-state batteries and cell-to-pack design.

Software also played a major role, with strong interest in AI-driven features and cybersecurity solutions like digital keys. Practical innovations such as ambient lighting, towing capacity, and all-wheel drive rounded out the top trends.

IAA trends as a reflection of global change

Because the IAA brings together major global automakers, it serves as a snapshot of the industry’s broader evolution. Local trends at the event often mirror larger shifts in the market.

The rise of electric vehicles

This year’s IAA placed a strong emphasis on electric vehicles — driven by regulations phasing out internal combustion engines in favor of cleaner alternatives.

In Germany, this initiative is known as the Verbrenner-Aus (“burner ban”), part of the EU’s climate neutrality goals, which will prohibit the sale of CO₂-emitting cars by 2035. With only a decade left, manufacturers are under pressure to transition now.

The Verbrenner-Aus appeared in 2.4K IAA mentions, with a net sentiment of -82.7%, reflecting widespread concern about job losses and economic impact.

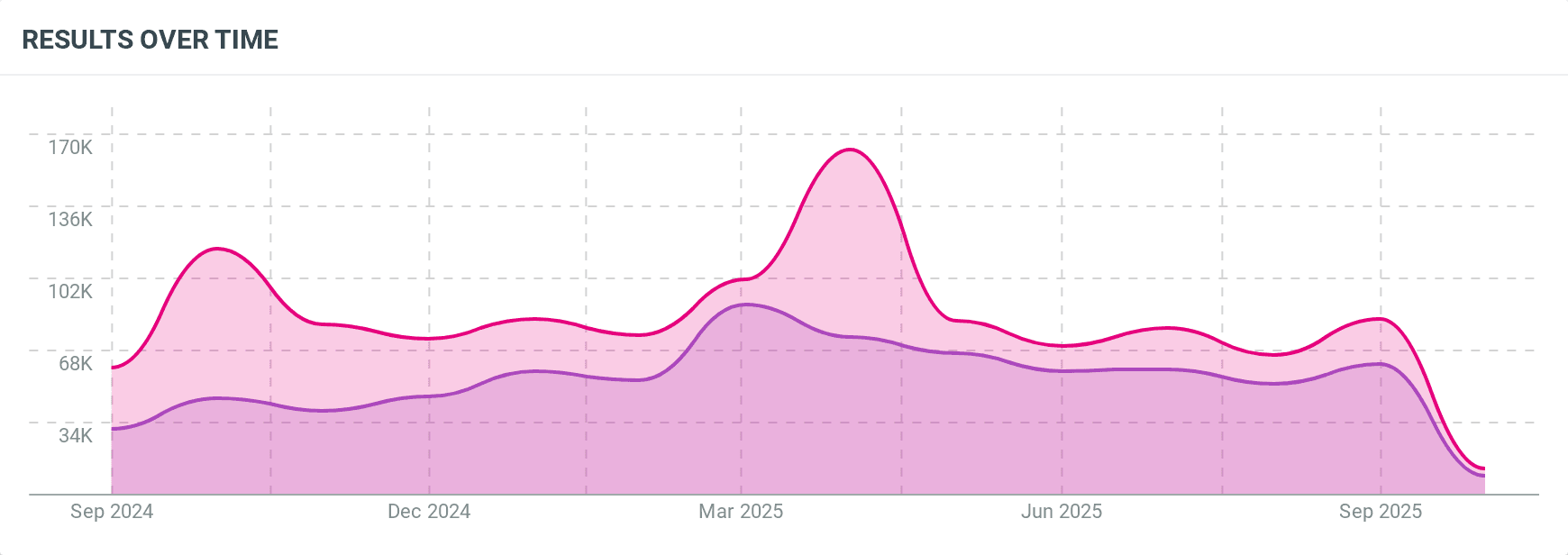

Over the past 13 months, Verbrenner-Aus was mentioned 107.5K times — mostly in Germany — with a net sentiment of -63.8%. In contrast, EU carbon reduction regulations were mentioned 186.5K times with a net sentiment of +52.1%, suggesting the rules themselves aren’t controversial, but their perceived consequences are.

Meanwhile, the broader “climate crisis” was mentioned 7.4 million times across Europe over the same period — showing the scale of public concern dwarfs debate around individual policies.

Mentions of the Climate Crisis (blue), EU Carbon Regulations (purple), and Verbrenner-Aus (pink) over 13 months, originating in Europe, September 2024 to October 2025; Talkwalker Social Listening

Despite resistance to some policies, the urgency of addressing climate change continues to dominate public discourse.

Trade tariffs

Trade tariffs remain a challenge for automakers, as shifting trade policies make some regions easier to access than others.

At IAA, tariffs and trade policies appeared in 908 mentions, with a +29.8% net sentiment — largely due to positive coverage of BYD’s plans to move EV production for the European market into Europe, reducing tariff exposure. Another article highlighted Hyundai’s advantage in selling to Europe rather than the U.S.

Trade tariffs have sparked 14.3 million mentions globally over the past 13 months, mostly negative. Still, IAA conversations showed that manufacturers are adapting quickly and finding ways to mitigate risk.

Growth of Chinese brands

Together, these factors fueled a noticeable rise in participation from Asian automakers — especially from China. Of all IAA mentions, 12.2K (19%) referenced China or Chinese brands, with 116 exhibitors from China (15.5% of the total 748 stands).

Mentions of Chinese cars in Europe remained steady over the past 13 months, aside from a spike in April 2025. BYD mentions, however, nearly doubled — from 30.9K in September 2024 to 61.1K in September 2025.

Mentions of the Chinese Cars (pink), and BYD (purple) over 13 months, originating in Europe, September 2024 to October 2025; Talkwalker Social Listening

Chinese automakers are gaining traction among European consumers — a trend that could pose new challenges for domestic brands in the years ahead.

What marketers can learn from the IAA's online coverage

Analyzing events like the IAA offers a window into audience sentiment and emerging market shifts. Because discussions cluster tightly around a single week, they create a condensed snapshot of broader industry trends.

Find out what drives engagement. Real-time conversations reveal what excites consumers most — whether it’s a product launch, a booth experience, or an innovation trend.

Treat events as microcosms. These shows reflect global trends in miniature. Studying event conversations helps marketers understand how larger industry changes affect specific audience segments.

Plan ahead. Insights from this year’s conversations can guide next year’s event strategies — helping brands address audience concerns and double down on what resonates.

Talkwalker Social Listening enables you to quickly and easily analyze any event instantly. Whether you’re looking for ways to get noticed at your next stand or just want to get more detailed consumer insights, it’ll help drive success no matter what road lies ahead. See it in action today.