PR Crisis Management: 8 Essential Steps and Real-World Examples in 2025

Discover the essential steps to prepare for, navigate, and recover from a PR crisis in 2025. Explore real-life examples and access a free checklist.

June 4, 2025

PR crises can damage your brand’s reputation in minutes.

They might happen to any company: whether it’s a major data breach, a product recall, employee misconduct, or a social media post gone wrong.

Because of social media, no business is too small (or too niche) to need a PR crisis management plan.

The key?

Delivering the right response, because how you react determines whether you bounce back quickly or suffer lasting damage.

This guide outlines the essential steps to prepare for, navigate, and recover from a PR crisis in 2025.

What is public relations (PR) crisis management?

PR crisis management means protecting your company's reputation when facing a public emergency.

It's a systematic approach to identify threats, prepare responses, and communicate effectively during crisis situations.

The goal?

Maintaining stakeholder trust and minimizing long-term reputation damage.

What is a PR crisis management plan?

A PR crisis management plan is a documented strategy that outlines exactly how your organization will respond during a reputation emergency.

It clearly outlines who does what, how they do it, and when, so your team can respond quickly and consistently when a crisis hits.

Effective crisis management plans include:

Clear team roles and responsibilities

Pre-approved message templates

Decision-making procedures

Stakeholder notification protocols

Communication channel guidelines

Monitoring and evaluation metrics

A standout example of crisis management is how Starbucks responded when two Black men were wrongfully arrested at a Philadelphia store in 2018.

Instead of downplaying it, the CEO publicly apologized, met with the men in person, and closed 8,000 stores for racial bias training.

It was fast, transparent, and action-driven—exactly what a strong crisis response should look like.

Let’s see how managing PR crises works in practice.

How to manage a PR crisis in 8 steps

When a PR crisis hits, you need a clear roadmap to follow.

Here's your step-by-step action plan.

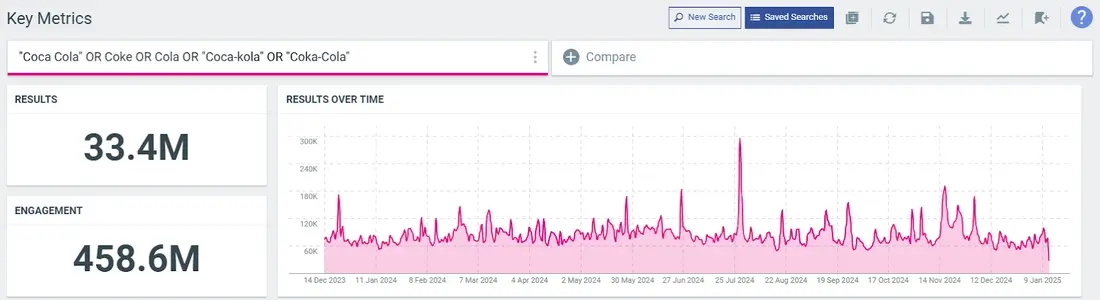

1. Track brand mentions and sentiment

Most PR crises show warning signs before they explode.

Regular monitoring gives you time to prepare, react proactively, and prevent social media crises from escalating.

It’s best to use specialized social listening tools to catch important mentions and trends in real time.

Make sure to track:

Direct brand mentions: e.g., "Coca-Cola."

Mentions of your products, executives, marketing campaigns: e.g., "iPhone battery issues" or "CEO statement on sustainability."

Overall sentiment and sentiment changes: look for sudden drops in positive sentiment.

Industry-specific keywords related to potential crisis situations: e.g., "data breach" for tech companies.

Modern tools like Talkwalker let you set this up once and see every conversation happening about your brand across online and offline channels.

You can then track online sentiment in real time and detect crisis indicators as they happen.

Whenever you spot concerning patterns or potential issues, immediately move to the next step: determining whether you're facing a genuine crisis that requires action.

2. Classify the crisis situation

From here, evaluate whether you're facing a genuine crisis that requires immediate action.

A true crisis situation goes beyond regular online reputation management issues and typically includes:

Negative media coverage in major outlets

Executive or brand callouts by influential journalists or social media personalities

Major product failures, safety concerns, or data/security breaches

Incidents involving employee misconduct or ethical violations

Issues that contradict your brand values or mission

For example, an unhappy customer complaining about Delta’s customer service is not a major crisis and can be handled via routine

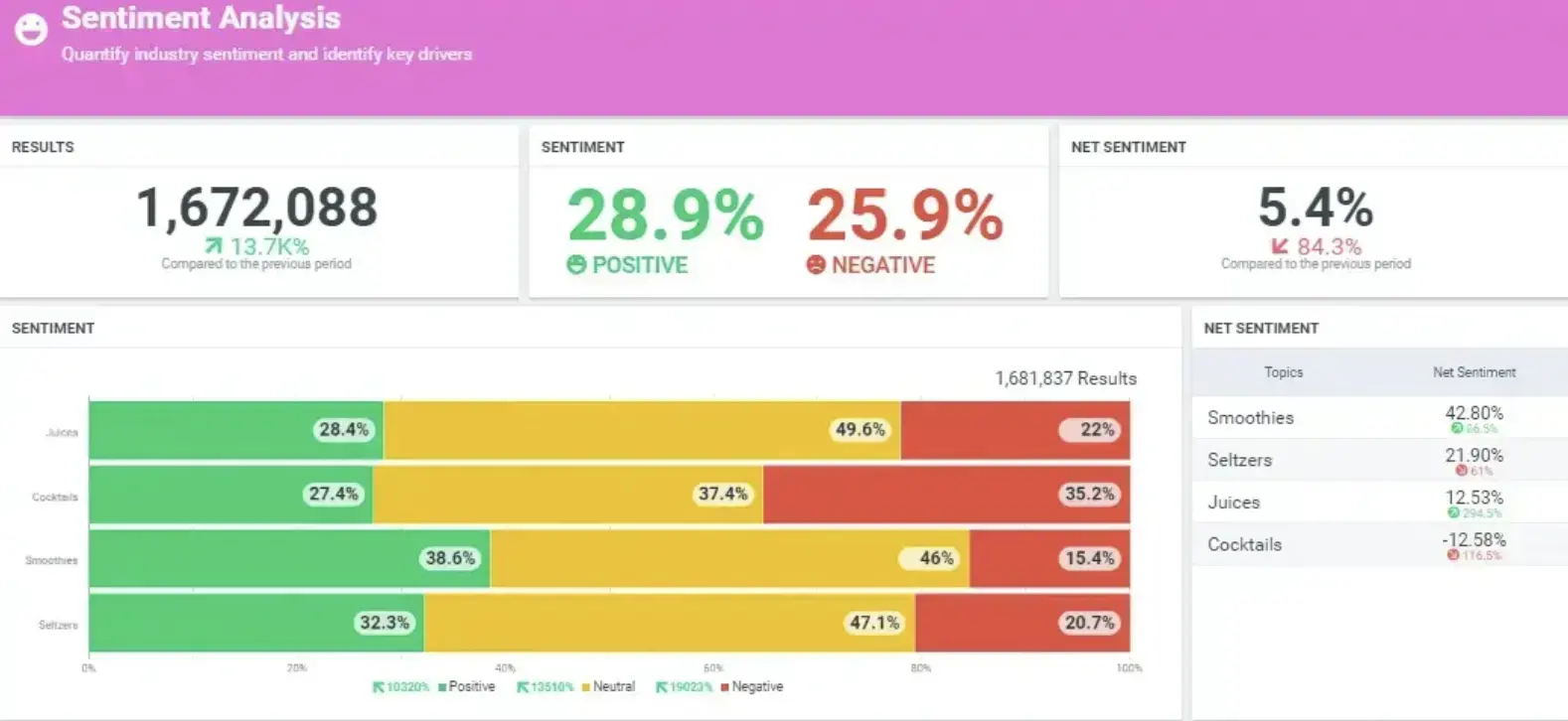

tool to evaluate the response. Here’s what to track if you’re using a tool like Talkwalker:

How your message is being received on various channels.

Which parts of your response people are questioning or criticizing.

Who's amplifying your crisis: journalists, influencers, angry customers with large followings.

Whether sentiment is improving or worsening.

Set up a quick rhythm of updates to your crisis management team and to the public: e.g., every hour during the first day if it's serious.

For example, Chipotle’s social media team often posts frequent updates when the brand faces food safety issues.

Finally, make yourself easy to reach:

Keep DMs open on all social media platforms

Have customer support ready and properly briefed

Create clear paths for people to ask questions

8. Follow up with real actions

Words alone don't resolve a crisis.

This is where many brands stumble: they make promises but fail to deliver meaningful change.

To be effective, your crisis response must include concrete actions that address the root cause of the problem.

Simply saying "we're working on it" isn't enough unless you:

Actually fix the underlying issue.

Document and share evidence of changes made, like screenshots, videos, and process updates.

Follow through completely on promised steps, whether compensation, policy changes, or system upgrades.

For complex issues, create and publish a transparent timeline showing progressive steps to keep stakeholders informed and demonstrate your commitment.

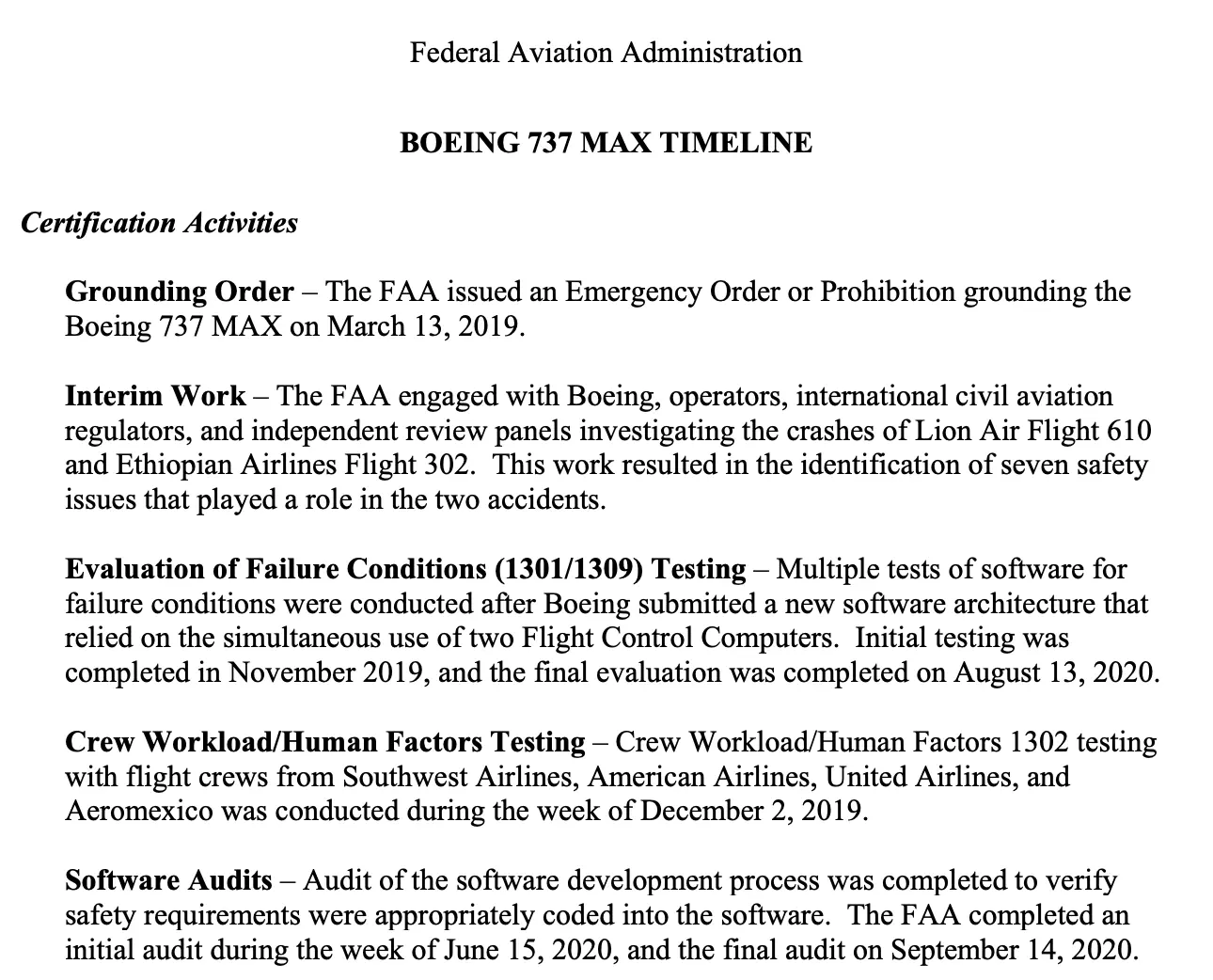

Boeing’s approach during the 737 Max grounding and safety crisis (2019–2020) is a great example.

The company created and published a detailed, transparent timeline outlining the sequence of incidents, ongoing investigations, and corrective actions, which was then regularly updated.

Finally, as the immediate crisis subsides:

Publish a comprehensive wrap-up statement or press release summarizing actions taken.

Conduct an honest internal review of your crisis management process.

Update your crisis management plan, contact lists, response templates, and approval chains based on lessons learned.

PR crisis management checklist

Use this quick checklist to cross out the action items during a potential public relations crisis.

Before a crisis hits

Set up monitoring tools to track brand mentions and sentiment- Create a crisis management plan with clear roles and responsibilities

__CONTENTFUL_MEDIA_16__ Develop response templates for common crisis scenarios__CONTENTFUL_MEDIA_17__ Establish approval workflows and decision-making protocols__CONTENTFUL_MEDIA_18__ Train designated spokespersons for different crisis types__CONTENTFUL_MEDIA_19__ Conduct crisis simulation exercises at least twice yearly

During a crisis

Monitor and classify the severity of the situation__CONTENTFUL_MEDIA_21__ Assemble your crisis response team quickly (within 30-60 minutes)__CONTENTFUL_MEDIA_22__ Create a "war room" with centralized communications__CONTENTFUL_MEDIA_23__ Decide on initial response type (holding statement, clarification, or full statement)__CONTENTFUL_MEDIA_24__ Draft your statement following best practices (clear, empathetic, action-oriented)__CONTENTFUL_MEDIA_25__ Get legal approval on all external communications__CONTENTFUL_MEDIA_26__ Publish your statement across all relevant channels__CONTENTFUL_MEDIA_27__ Monitor public reaction and sentiment in real-time__CONTENTFUL_MEDIA_28__ Update internal stakeholders regularly__CONTENTFUL_MEDIA_29__ Take concrete actions to address the root causeDocument and share evidence of improvements__CONTENTFUL_MEDIA_30__

After a crisis

Publish a wrap-up statement summarizing actions taken__CONTENTFUL_MEDIA_32__ Conduct a thorough review of what worked and what didn't__CONTENTFUL_MEDIA_33__ Update your crisis plan based on lessons learned__CONTENTFUL_MEDIA_34__ Revise response templates and contact lists__CONTENTFUL_MEDIA_35__ Continue monitoring for any lingering issues__CONTENTFUL_MEDIA_36__ Implement preventative measures to avoid similar crises

3 real-life PR management examples

Finally, let’s look at three real-world PR crises from recent years and how brands handled them under pressure.

1. Balenciaga’s teddy bear controversy

In November 2022, Balenciaga launched an advertising campaign featuring children holding teddy bears dressed in what appeared to be bondage gear.

The campaign immediately sparked outrage across social media, with many accusing the luxury brand of sexualizing children and promoting inappropriate content.

Response:

Initially denied responsibility and filed a lawsuit against the production company.

After a week of intense backlash, they changed course and issued apologies.

The company's CEO and creative director both made public statements taking responsibility for the "grievous errors.”

Announced new content validation procedures to prevent similar missteps.

Removed the controversial ads from all platforms.

Aftermath:

Balenciaga lost approximately 100,000 Instagram followers, fell out of the Lyst Index's top 10 fashion brands, and saw a significant decline in sales.

The delayed response demonstrated how failing to acknowledge responsibility promptly can damage brand image.

2. Glasgow’s failed Willy Wonka experience

In 2024, House of Illuminati organized a "Willy's Chocolate Experience" in Glasgow, Scotland, charging up to £35 per ticket.

The event promised an immersive wonderland with chocolate fountains, giant mushrooms, and Oompa Loompas.

Instead, attendees found a sparse warehouse with minimal decorations, no chocolate, and confused actors given AI-generated scripts.

Upset parents called the police when children began crying.

Response:

Organizers abruptly canceled the event after just a few hours.

Issued an apology blaming "unforeseen circumstances" and technical issues.

Promised full refunds to all ticket holders.

Failed to prepare actors or staff adequately for the event.

Aftermath:

The disaster went viral worldwide, inspiring memes, parodies, documentaries, and even plans for a movie.

The company faced severe public ridicule, and a Facebook group with 4,000+ members called "House of Illuminati scam" was formed.

The event became a cautionary tale about over-promising, under-delivering, and relying too heavily on AI-generated content without proper execution.

3. Delta’s upside-down plane landing incident

Source: NBC news

On February 17, 2025, Delta Connection Flight 4819 from Minneapolis to Toronto experienced a catastrophic landing accident.

During severe winter weather, the aircraft's right landing gear fractured upon touchdown, causing the plane to flip upside down and catch fire on the runway.

All 80 people aboard survived, but 21 were injured, with three critically.

Response:

Delta immediately activated emergency protocols and evacuated all passengers.

Provided prompt medical care for the injured passengers.

Offered $30,000 compensation to each passenger with no waiver of legal rights.

Maintained regular updates through multiple communication channels.

Cooperated fully with the Transportation Safety Board of Canada's investigation.

The CEO served as the primary spokesperson, demonstrating leadership during the crisis.

Aftermath:

Unlike many corporate crisis response examples, Delta's swift, transparent, and generous approach was widely praised by media relations experts. The compensation was seen as both a gesture of goodwill and a smart PR strategy.

This proactive approach helped minimize the fallout and preserve customer loyalty, though the airline still faced ongoing scrutiny during the investigation.

PR crisis management: The bottom line

The steps and examples we've covered show that effective crisis management requires preparation, quick thinking, and genuine accountability.

The most successful companies transform crises into opportunities to demonstrate their character.

Whether it's KFC's humorous apology or Delta's transparent compensation, successful crisis communication strategies share common elements:

Responding quickly with honesty

Explaining clearly what happened

Taking concrete actions to fix the root problem

Keeping stakeholders updated

Communicating with genuine empathy

The key? Listening to what people are saying about your business in real time and providing an instant response.

Discover how Talkwalker's monitoring tools can protect your brand.