Social media analytics

8 successful social media campaigns + tips for tracking success

The best social media campaign examples from 2025 — and what they teach brands about virality, creativity, and results.

October 20, 2025

The best social media campaigns in 2025 share a clear formula. They combine strategic platform selection with a distinct brand voice. Then they use unexpected creative angles to draw viewers in.

We analyzed eight standout social media marketing campaigns to see what tactics brought the best results. Each example includes practical takeaways you can adapt to your brand.

8 successful social media campaigns in 2025

1. Duolingo’s “Duo’s Death”: Creating viral controversy

Duolingo orchestrated the theatrical "death" of its mascot Duo the Owl in February 2025. This artificial crisis turned into a viral sensation.

The language learning app's staged narrative began with mysterious announcements.

The original post even got reshared by Dua Lipa on X:

It then evolved into collective mourning and culminated in a community-driven "resurrection".

Here’s what Duolingo did

Created a clear storyline. It began with a cryptic "death" announcement and darkened app icon.

Manipulated social psychology. Tapping into users' attachment to the mascot transformed passive learners into campaign evangelists.

The results

Impressive social media engagement. On TikTok alone, the announcement post generated 500k likes and 120k shares.

Key takeaway

Orchestrated spectacle beats standard storytelling when it taps into real emotional currency. Duolingo turned its audience’s love for the mascot into a shared emotional journey. The key components? Shock, humor, and participatory storytelling. If your brand has a cult following, lean into it.

2. Oatly’s “DOMP” campaign: A shareable spoof (+ social proof)

Oatly created a satirical video warning about DOMP, or Dominant Oat Milk Preference (opening line: “Are you a person”?). To support the concept that this unknown preference for oat milk might be lurking in much of the population, they partnered with influencers, who conducted blind taste tests of Oatly vs cow’s milk.

Here’s what Oatly did

Oatly is known for its cheeky marketing campaigns, and this is no exception. The original video was a clear spoof of pharmaceutical ads.

To reach a wider audience, Oatly partnered with influencers.

Oatly created a micro site with a tone that matched the satirical tone of the campaign. It includes detailed instructions to become a “fully qualified unofficial Oatly blind taste test-tester.”

The results

In the blind taste tests, the influencers show friends and family members genuinely liking Oatly. This creates strong social proof. The campaign also gained media attention. This spread the message even further.

Key takeaway

Know your brand. Not all brands could get away with this style of campaign. But it worked well for a brand that has always been a bit zany in its marketing. When you partner with influencers, give them the concept as a starting point. But let them create the content in the way that works best for their audience.

3. Revolve at Coachella 2025: Dominating festival fashion

Fashion retailer Revolve generated more social media buzz than any other brand at Coachella 2025.

Their influencer marketing strategy created an immersive experience. They blended music, fashion, and social media.

Here’s what Revolve did

Hosted the exclusive Revolve Festival. It featured performances by major artists like Cardi B and Lil Wayne. Revolve collaborated with influencers to promote both the event and associated fashion lines.

Used Instagram and TikTok for real-time event coverage, influencer takeovers, and behind-the-scenes content. All while encouraging user-generated content through branded hashtags and interactive challenges.

The results

Revolve achieved one of the highest levels of social media visibility among participating brands at Coachella 2025.

Key takeaway

Exclusive experiences, combined with strategic influencer partnerships, fuel powerful social media campaigns. The key? Knowing who your audience is, where they hang out, and how they follow along.

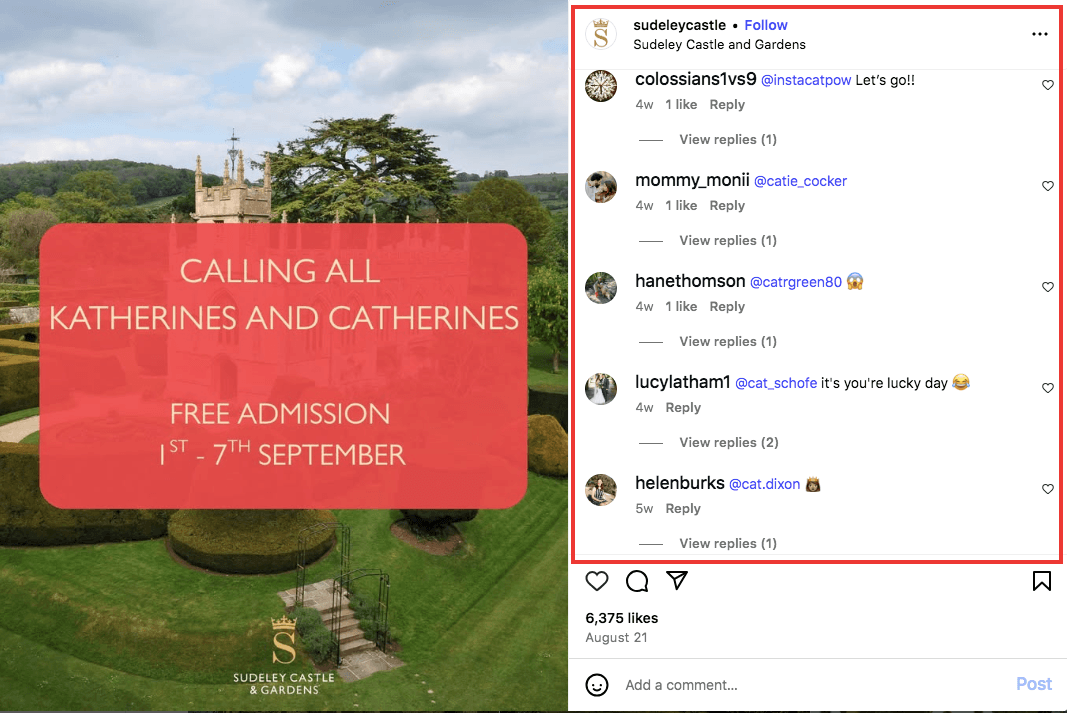

4. Sudeley Castle’s “Free entry for Katherines”: Attention online and onsite with no budget

As the final resting place of Katherine Parr (sixth wife of Henry VIII), Sudeley Castle created a social campaign to announce a unique promotion with free entry for anyone named Katherine during Katherine Parr week.

Here’s what Sudeley Castle did

Created static and video content for Facebook, Instagram, and TikTok to promote the free entry offer.

Maintained an active presence. They replied quickly to questions, including repeated questions about alternate spellings.

Suggested that people tag their friends named Katherine – this was a major source of new views.

The results

This completely organic campaign saw a 23% uplift in visitors. More than 240 Katherines visited the castle that week to take advantage of the promotion.

Key takeaway

Create an organic campaign with a shareable premise. Your audience will get the word out on your behalf.

5. Liquid Death's "Pure Sugar": Satirical marketing BS campaign

Edgy canned water brand Liquid Death created a satirical campaign attacking soda industry marketing tactics.

They invented a fake French soda literally called "Pure Sugar." They aimed to position their product as the honest alternative to sugary drinks.

Here’s what Liquid Death did

Filmed unsuspecting actors auditioning to promote “sugar water” in commercial settings. Then revealed the prank and offered them Liquid Death. The results showed their genuine relief and preference for water.

Released the footage as a video on YouTube and Instagram. It started as a glossy soda ad before revealing the prank.

All this directly attacked "Big Soda's marketing BS" while maintaining Liquid Death's irreverent brand voice.

The results

The main YouTube video generated over 3.6 million views and was widely shared across marketing forums.

The campaign also supported Liquid Death’s brand awareness and business growth: the company has achieved a valuation of $1.4 billion.

Key takeaway

Effective satire works better than direct attacks. Liquid Death avoided typical comparative social media advertising. They parodied competitor industry tropes. Consumers could draw their own conclusions while being entertained.

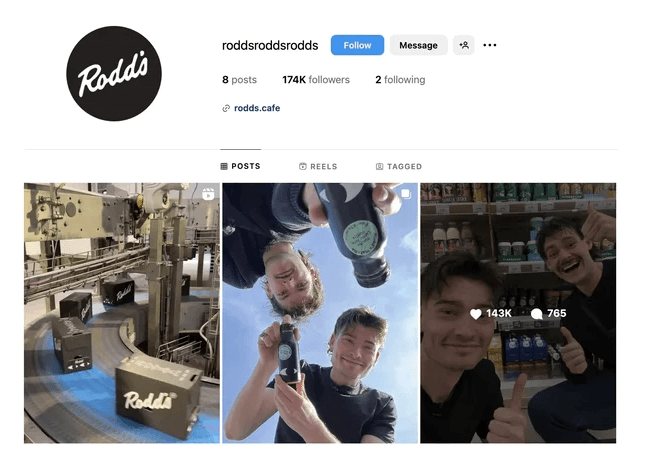

6. Rodd's Iced Coffee: YouTubers brew success

YouTube stars James Marriott and Will "Willne" Lenney turned their massive followings into a ready-made customer base for their new chilled coffee brand, Rodd's.

Source

Their approach shows how content creators can skip traditional brand-building steps.

Here’s what they did

Created a line of iced coffee in three flavors. Then quietly planted hints about it in their YouTube videos months before launch.

Used their YouTube channels and Instagram to share product development stories. They built hype through behind-the-scenes content that felt like part of their regular programming.

For instance, this video about viral restaurants ended with a stealth launch announcement for Rodd’s:

The results

Their Instagram account hit 174K followers within a few days.

The brand landed distribution in 300 Sainsbury's stores across the UK without a big marketing budget. They’ve since more than doubled that, adding 400 more stores.

Along the way, they’ve leaned even further into their connection with fans. For instance, they spent their “entire marketing budget” on a UGC contest.

Key takeaway

Creators with die-hard fans and personality-driven brands don't always need traditional marketing efforts. The trust Marriott and Lenney built with their audience created instant demand that retail couldn't ignore.

7. Visit Oslo's "Is It Even a City?": Reverse psychology tourism

Visit Oslo (the official tourism board for Norway's capital) ditched the standard tourism ad formula for something refreshing.

They featured a disinterested resident complaining about everything that actually makes Oslo great. From its walkability to the lack of pretension and tourist crowds.

Here’s what they did

Created a satirical video with deadpan lines like "I wouldn't come here" and "Is it even a city?" Meanwhile, they actually highlighted Oslo's best qualities. Like: no lines at museums, easy restaurant reservations, and a casual atmosphere.

Distributed the video across social media platforms, including YouTube and Instagram. Encouraged viewers to share with the hashtag #VisitOslo.

The results

The campaign’s social media content went viral, generating over 1.3 million views on the YouTube video alone and more than 73K likes on Instagram

International arrivals in Oslo jumped 26% in the quarter following the campaign launch.

Key takeaway

Standing out in digital marketing sometimes means doing the opposite of everyone else. Oslo's ironic approach worked because it entertained viewers first. This created genuine social media engagement that traditional tourism ads rarely achieve.

8. CeraVe's “Michael Cera Conspiracy”: A Super Bowl sensation

CeraVe flipped the script on Super Bowl advertising by building a month-long social media campaign before revealing their commercial.

The skincare brand created a fake conspiracy theory. The idea was to suggest actor Michael Cera was the secret founder of the brand. This generated massive engagement before the big game reveal.

Here’s what they did

The brand orchestrated a three-phase conspiracy. It started with an influencer "spotting" Michael Cera signing CeraVe bottles. Next followed leaked paparazzi photos. It culminated in the actor sending bootlegged PR boxes and walking out of an interview with influencer @BobbiAlthoff.

Carefully seeded content across TikTok, Instagram, X, and Reddit while CeraVe "fought back" through its own channels. This created a storyline that ordinary people and 400+ influencers joined organically.

The results

The campaign generated 15.4 billion impressions before the commercial even aired.

It won Campaign of the Year at the 2025 Ad Age Creativity Awards while achieving its business goals. Those goals? Boosting brand awareness, of course. Also reinforcing the key message that CeraVe is developed by dermatologists. (Not Michael Cera.)

Key takeaway

Turning social media users into active participants creates powerful campaigns. Building intrigue through staged controversy generated more engagement than a standalone Super Bowl ad.

What makes a good social media campaign?

Start with a clear goal

This may not be the most exciting part of creating a social campaign. But a clear overall goal and related KPIs are the foundation of any successful social media strategy, campaigns included.

Your goal will impact everything: which platforms you focus on, the theme of your content, even how much you’re willing to invest (in both time and budget).

Build your campaign around audience signals, not assumptions

Analyze where your target audience spends time. Which social networks do they use? Which influencers so they follow? What other brands do they like?

More importantly, identify what content they’re already engaging with. Are they responding to educational social media posts? Behind-the-scenes content? Humor?

Great campaigns speak to your audience in a way that feels natural and intuitive to their existing social community. Create content that they will want to engage with and share.

Adjust your content creation to each platform

Each platform has its own language. What works on TikTok might fail on LinkedIn. (Getting this wrong can tank your social media campaign or even turn it into a social media crisis.)

Build a simple content calendar with platform-native formats. Adjust your tone and type of content so it feels appropriate on each platform.

Don't feel that you have to be everywhere (especially if your audience is not). Two platforms done right beat five done poorly.

Focus on your concept and storytelling

Many of the social media campaign examples above had wild concepts and elaborate storytelling. A social campaign offers the chance to be creative. Kick your strategy sessions off with some good creative brainstorming. Don’t be afraid to experiment.

Move fast, adjust faster

Launch your campaign, then immediately start to optimize based on measurable real-time data.

The highest-performing campaigns are those that adapt in real time. Doubling down on what's working and cutting what isn't should happen within days, not weeks.

As you’ll see below, Talkwalker unifies your campaign data. You can see exactly which content pieces and platforms are driving results so you can reallocate resources on the fly.

How to track the success of your social media campaigns with Talkwalker

How do you measure the success of a social media campaign in Talkwalker? There are several options, depending what you want to track and how deep you want to go into your analysis.

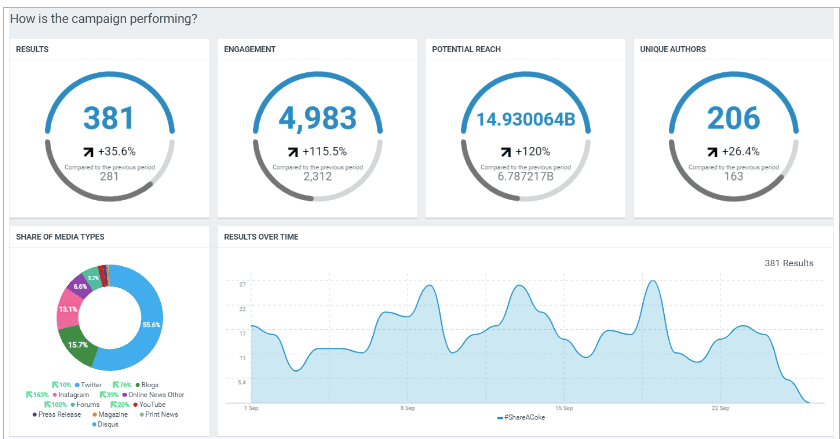

Campaign Monitoring IQ App

Talkwalker has a built-in Campaign Monitoring IQ App. It’s a dashboard pre-loaded with charts and metrics to track, analyze, and report on your campaign’s success.

Once you set up your campaign, the overview screen gives you a bird’s-eye view of everything happening on social platforms. How much are people talking about you? How many people are involved in the conversation? Where are those conversations happening? And so on.

Using the tabs in the left menu, you can dive deeper to surface actionable insights for both the current campaign and for future planning.

Theme identification

Theme analysis helps you see which messages and aspects of your campaign resonate with your audience. This can help you understand changes in sentiment. You're then equipped to make on-the-fly decisions about new content to boost messaging that’s already working.

You can also see whether the hashtags and keywords related to your campaign are trending.

Sentiment analysis

To fully understand the impact of your campaign, it’s a good idea to combine social listening with sentiment analysis, for a couple of reasons:

Social listening ensures you capture both direct and indirect mentions of your brand. You know what people are saying about you even when you’re not tagged.

Sentiment analysis helps you understand whether a spike in mentions surrounding a campaign is a good thing or a problem.

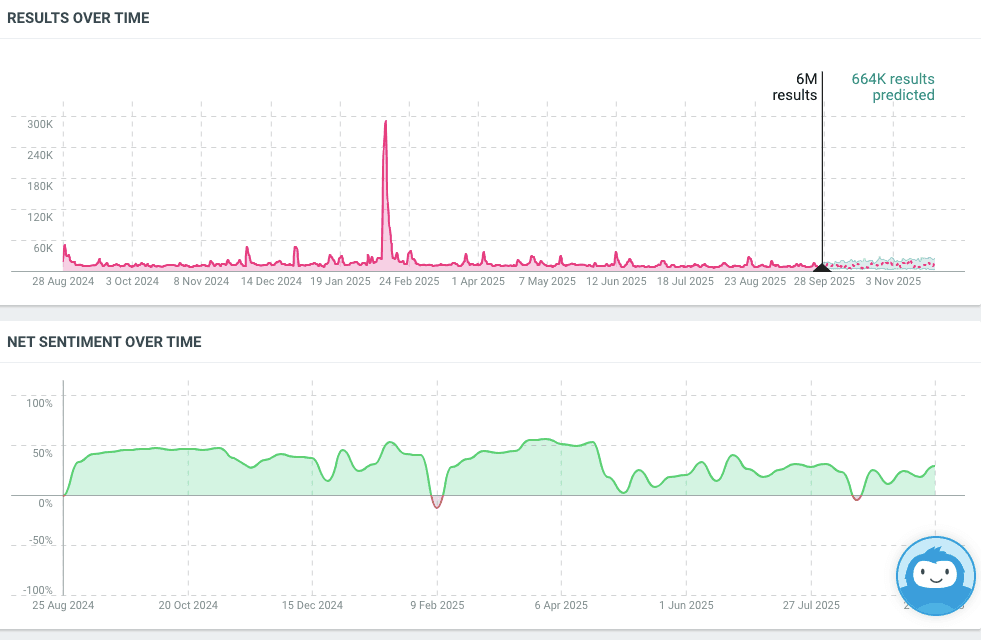

For example, you can see a huge spike in conversation about Duolingo around the time of the Duo is Dead campaign. But you can also see a brief corresponding negative trend in sentiment. If Duolingo had not been planning to bring Duo back, this would have been cause for concern.

Media monitoring

The reach of a good social media campaign can extend well beyond social channels. To see if you’re getting coverage in the news media, take a look at the Share of Media Types widget. It shows how much of the conversation about your campaign is happening on individual social platforms as compared to blogs, online news sites, magazines, print news, and more.

Influencer analytics

If your campaign involves working with influencers, you can track and analyze their performance using the Influencers tab. You can see who else is driving the most conversation about your campaign. This may help you identify potential new influencers to bring on board.

Also have a look at the Results tab to see which specific posts have generated the most engagement. These may be your own posts. But they could come from influencers sharing or talking about your campaign content.

Engagement metrics

Engagement metrics are some of the clearest measures of success for people beyond the social team. Likes, shares, comments, and potential reach show how your campaign is spreading across social platforms, and how people are interacting with it.

Talkwalker gives you a holistic picture of the response to your campaign, rather than having to check metrics on each platform.

Audience analysis

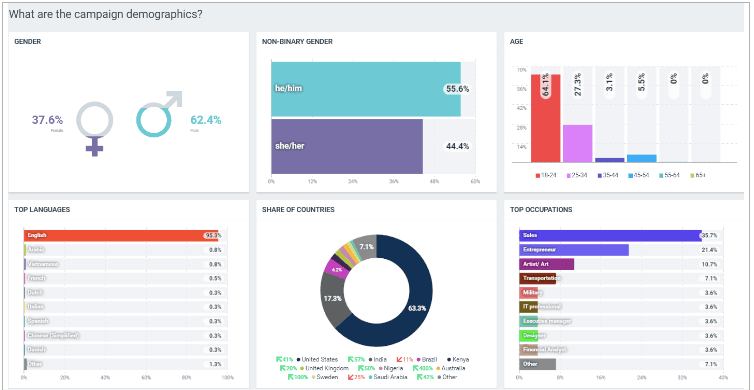

The Demographics and World Map tabs reveal a wealth of information about who's driving the conversation during your campaign. You’ll get a sense of whether you’re connecting with your target audience. You might also discover a new target market you hadn’t previously considered.

Build a custom dashboard

You can find metrics and data to help measure the success of your social media campaign in other areas of Talkwalker, too. You can add any of these tracking widgets, along with those in the Campaign Monitoring IQ App, to a custom dashboard. This gives you all the metrics and information that matter most to you, all in one place.

Follower growth tracking

Within the Social Channel Measurement IQ App, you’ll find the Follower Growth widget. This allows you to see exactly how your follower count has changed over the course of your campaign.

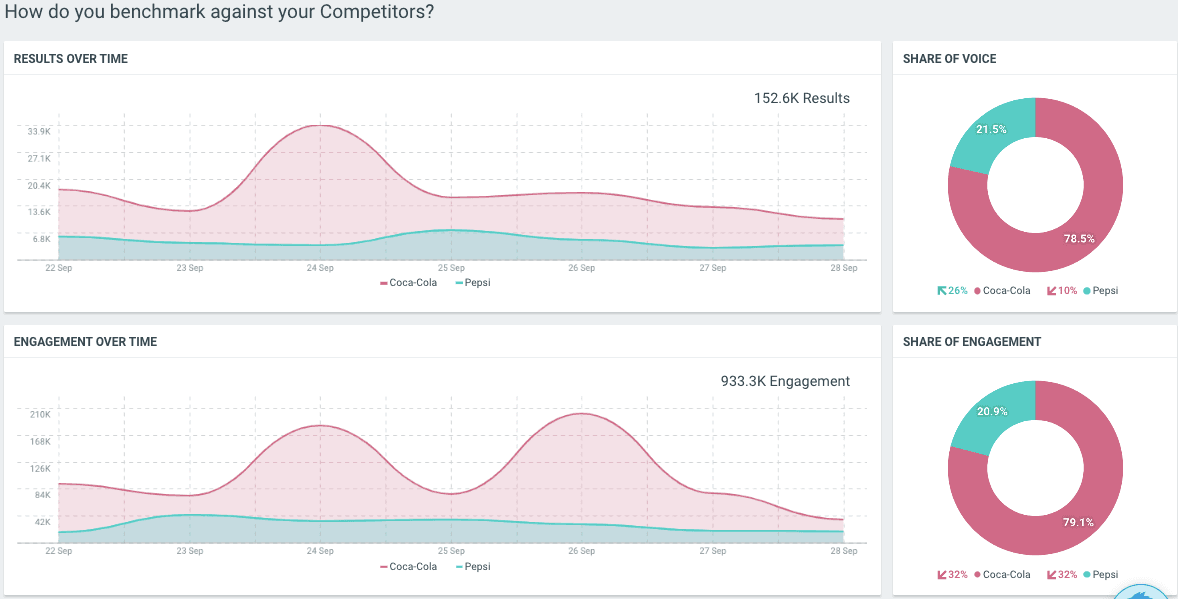

Benchmarking against competitors

It can be helpful to look at your campaign performance in the context of your competitors’ results. This allows you to understand whether your campaign is drawing attention to your whole industry, or specifically impacting your brand alone. It also helps you see whether you are taking market share from competitors.

Use the Competitive Intelligence IQ app to measure your results, engagement, sentiment, and share of voice against your competitors over the course of the campaign.

Business impact metrics

While all of the above factors reflect aspects of your campaign’s impact on your overall business goals, you can also integrate Talkwalker with your web analytics tools to track business impact and ROI metrics that help prove the real value of our work.

For example, you could directly compare your campaign reach to website traffic or sales data, or your social ad spend to social reach.

Social media campaign FAQs

What is a social media campaign?

A social media campaign is a planned set of engaging content on social media channels like Instagram, Facebook, or TikTok that work toward a specific goal.

These campaigns typically run for a set period and focus on objectives like increasing brand awareness, launching products, or driving engagement.

Unlike standalone posts, campaigns tell a cohesive story via multiple pieces of social content.

They often use hashtags, trending formats, and sometimes paid promotion to reach more users.

How to create an effective social media campaign?

Start with a clear audience analysis and campaign goals. Then develop a solid concept conducive to powerful storytelling. Create a content strategy tailored to the different social media platforms, and adjust on the fly based on real-time data.

How do you measure the success of a social media campaign?

Before you measure the success of a social campaign, you have to define what success looks like. Tracking the right metrics using a social media analytics tool is the key to proving the real impact of your social media campaign on business objectives.

For example:

For awareness campaigns: Track reach, impressions, share of voice, and sentiment.

For engagement campaigns: Track engagement rate, click-through rate, and shares.

For conversion campaigns: Track conversion rate, cost per acquisition, and ROI.

Compare your social media performance against your competitors and stand out among them as a trendsetter — not a follower. See Talkwalker in action.