- Category:Social listening and monitoring tools

Explore how AI agents help marketers turn massive datasets into instant insights, automate research and reporting, and unlock faster, smarter decision-making across the entire marketing ecosystem.

- Category:Crisis management

Learn how to prevent and manage a social media crisis with real examples and tactical tips for protecting your brand reputation.

Browse all our blogs

- Category:Social listening

The state of agentic AI in marketing (2026)

Discover how agentic AI in marketing is redefining the future: autonomous insights, faster decisions, trusted data, and the breakthrough workflows reshaping every marketing team in 2026.

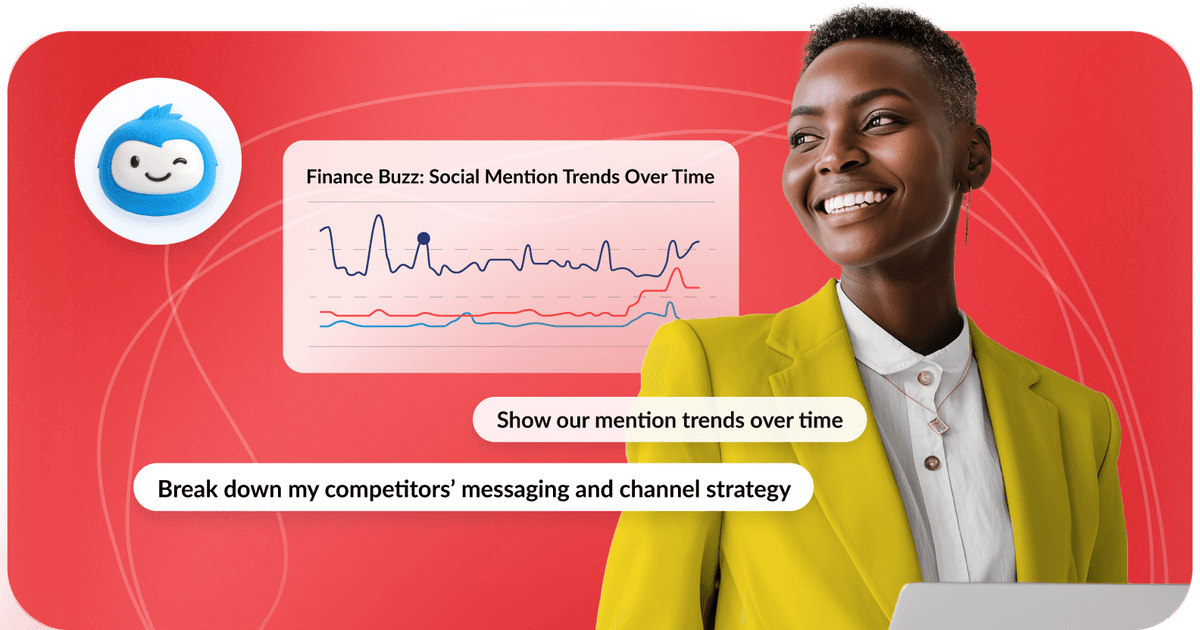

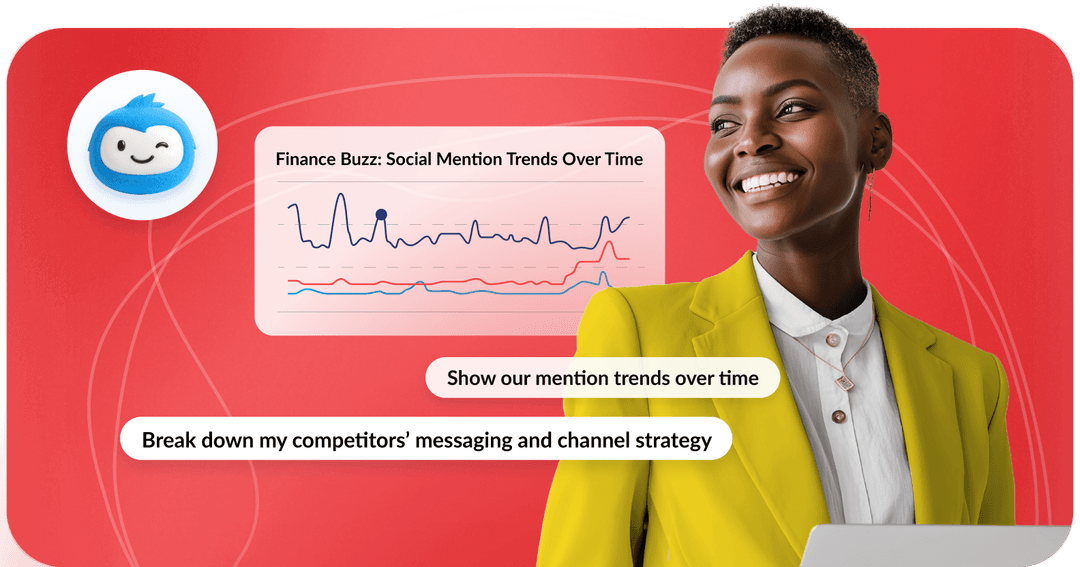

- Category:Social listening and monitoring tools

How to use AI agents to uncover marketing insights in 2026

Explore how AI agents help marketers turn massive datasets into instant insights, automate research and reporting, and unlock faster, smarter decision-making across the entire marketing ecosystem.

- Category:Crisis management

7 social media crisis examples (and tips for speedy mitigation)

Learn how to prevent and manage a social media crisis with real examples and tactical tips for protecting your brand reputation.

- Category:Trend insights

Why The Life of a Showgirl is a cultural moment

Taylor Swift’s The Life of a Showgirl is more than an album—it’s a cultural moment. See how her launch strategy lit up millions of conversations.

- Category:Social media analytics

8 successful social media campaigns + tips for tracking success

The best social media campaign examples from 2025 — and what they teach brands about virality, creativity, and results.

- Category:Competitive analysis

Competitive intelligence: How to turn data into an advantage

Learn how to use competitive intelligence to uncover market trends, analyze competitors, and turn public data into strategic insights that give your brand an edge.

- Category:Trend insights

What drove online conversations at the IAA 2025?

From EV breakthroughs to trade tensions — explore what dominated the online conversation around IAA 2025, and what it says about the auto industry’s future.

- Category:

Beyond the runway: Insights from Fashion Week 2025

Fashion Week shows how viral moments, sentiment shifts, and social listening insights can turn trends into business impact — lessons every brand can use.

- Category:

How to run an audience analysis that will inform better marketing

Move beyond assumptions with audience analysis. Use data to uncover who your audience is and how to connect with them through smarter marketing strategies.

- Category:

What the 2025 NFL Kickoff teaches brands about online buzz

The NFL Kickoff proved how quickly online conversations shift, and spiral—offering us a playbook for tracking sentiment and turning buzz into opportunity.

- Category:

Benefits of social media for social marketing, PR, and insights

Discover the most powerful benefits of social listening and learn how to improve your reputation, customer experience, product development, and more.

- Category:

What does the Labubu craze teach us about online trends? DATA

Here's what the Labubu craze reveals about the lifecycle of online trends — and how marketers can ride the wave from viral fame to lasting business impact.

- Category:

How to use Boolean operators for social listening EASY GUIDE

Learn how to use Boolean search operators to refine your searches, cut through the noise, and uncover actionable insights with precision.

- Category:

10 key benefits of competitive benchmarking: A strategic guide

Discover the benefits of competitive benchmarking. Learn how to track and optimize your brand’s performance against competitors with real-time insights.

- Category:

6 market research strategies for marketing, insights, and PR

6 market research strategies to better understand your audience, improve campaigns, stay ahead of competitors — and drive smarter business decisions.

Unpack online conversations and outplay your competitors with our leading social listening and benchmarking.