Competitive analysis

Competitive intelligence: How to turn data into an advantage

Learn how to use competitive intelligence to uncover market trends, analyze competitors, and turn public data into strategic insights that give your brand an edge.

October 16, 2025

Things move fast in the modern marketplace. Iconic brands stumble, upstarts emerge of nowhere, and consumers have more choice than ever before.

In this environment, competitive intelligence is a critical business strategy that can help savvy brands rise above the fray.

What is competitive intelligence?

Competitive intelligence is the process of monitoring, gathering, analyzing, and sharing intelligence about competitors to better understand your industry and the overall market environment. It can help you improve strategic decision-making by modelling success, avoiding failure, refining your unique selling proposition, and predicting what your competitors are about to do next.

Let’s be very clear about one thing, though. Competitor intelligence is not corporate espionage. The idea is to use publicly available data. Gathering information can sometimes be cumbersome. But it should not be stealthy or secretive. Don’t lie, steal, or try to dig up trade secrets. Trust us, there’s plenty of publicly available data to keep you occupied.

It is also not nearly as simple as “search Google, monitor LinkedIn, or scrape some websites.”

Those could be good first steps in a competitive intelligence program. But it’s really just data gathering. It doesn’t become intelligence until you:

analyze your findings,

look for patterns, trends, and gaps,

and strategically apply the results to your own business to get a competitive edge.

Competitive intelligence vs. market research

Competitive intelligence and market research both help you understand the competitive landscape. But they each have a different focus, as indicated by the name.

Competitive intelligence looks at the market in the context of the competitive landscape. The idea is to understand your competitors by extracting insights from publicly available data.

Market research (sometimes called market intelligence) focuses on the broader market and customers. What are people looking for? What are the demographics of the target market? What needs are not currently served? How big is the demand for what you plan to offer? Market research involves public data. But it can also involve primary data collection through surveys, focus groups, and so on.

There is some overlap. For instance, looking at your competitors’ audience can help you understand your own target customer. And customer surveys could provide information about their experiences with competitors.

Why is competitive intelligence important?

The importance of competitive intelligence is sometimes underestimated. It can do much more than tell you what your competitors are doing right now. It gives you a picture of the entire competitive landscape. That includes early warnings about potential changes that may disrupt the status quo, such as:

Emerging new competitors

New concepts or technology that will disrupt the competitive landscape

Political, regulatory, and legislative changes that could impact your business

This predictive power helps reduce uncertainty, supports strategic planning, and gives you an early-mover advantage. You can start to identify and address opportunities and risks before they become obvious to everyone in the market.

You can also use the lessons learned to get a competitive advantage by:

Identifying new markets and market trends

Understanding competitors’ saturation in regional markets

Identifying gaps in the market or underserved customer segments

Improving product development

Improving product differentiation by clarifying how your product better serves customers

Improving and better personalizing consumer interactions

Giving consumers more of what they want and increasing market share

Standing out from the crowd with a distinct corporate identity and tone of voice

The 7 Ps of competitive intelligence

Competitive intelligence research is based on the components of the marketing mix. These are seven key areas of business and marketing known as the 7 Ps:

Product

Price

Place

Promotion

People

Process

Physical evidence

The first four Ps were identified by the author and marketing professor E. Jerome McCarthy. He described them in his pivotal 1960 book, Basic Marketing: A Managerial Approach. But McCarthy was only concerned with product marketing. So professors B.H. Booms and M.J. Bitner1 added the final 3 Ps in 1981 to better address service businesses. Although they were created separately, all 7 Ps are useful for both product and service businesses to develop a truly competitive strategy.

So what do they all mean, and how do they impact competitive intelligence? Here’s a quick summary. The idea is to gather data for each P to understand the status quo and clarify your points of differentiation (or develop new ones!).

Product: What do your competitors sell? How do the features and benefits compare to your own offering, and to others in the market?

Price: Not only the specific dollar amount, but also pricing strategies. Do they offer regular sales? Discounts for bulk purchases or long subscriptions? Bundled or a-la-carte feature sets?

Place: Not the location of the head office, but the locations they use to connect with customers. Distribution channels, physical stores. In the modern context, you could also look at which digital platforms competitors use to reach customers.

Promotion: Marketing strategies, PR, advertising. Anything meant to drive sales or increase awareness of the brand.

People: How do their people interact with customers? This includes customer service and support, social team interactions, sales teams, and so on.

Process: How well do competitors deliver their products or services? Is the shipping fast and efficient? Is the service easy to set up? Is after-sales support for competitor products easy to access?

Physical evidence: Things a customer can see, touch, or experience in the real world. Product packaging, restaurant ambiance, store layout and design, and so on.

As you work through the steps in the next section, think about which of the 7 Ps best serve your specific goals right now. You don’t need to track all of them all the time. In fact, you probably shouldn’t, or you’ll find yourself overwhelmed with data.

How to use competitive intelligence

We've covered why competitive intelligence work is important, and what aspects you’ll want to track. Now let’s look at how to create an effective CI process of your own.

Setting up a competitive intelligence process

As you’ve already seen, there are a lot of moving parts when it comes to competitive intelligence. To gain real value from your research, you need a clear process that feeds directly from goals to insights.

Identifying your competitors

Before you can start gathering competitive intelligence, you need to define what you mean by “competitors.”

You likely have some obvious direct competitors, who sell a similar product or solution to a similar product market. Think Coke vs. Pepsi.

But these are not the only competitors you can learn from.

You may also have indirect competitors. These are companies that address the same customer need, but they do so in a different way. Let's stick with the cola example. You could expand the competitive field in a couple of ways, depending on your focus.

First, there's the context of caffeinated beverages. Here, you could say that energy drinks and ready-to-consume coffee products are your competition.

If you’re thinking of sweet bubbly drinks, your competition could include all forms of soda.

There will also be new players on the market that may create a new competitive product category altogether. Think about canned water, for instance. If you’ve got a good competitive intelligence program in place, you’ll be able to anticipate that those new competitor categories could even expand to become more direct competitors over time:

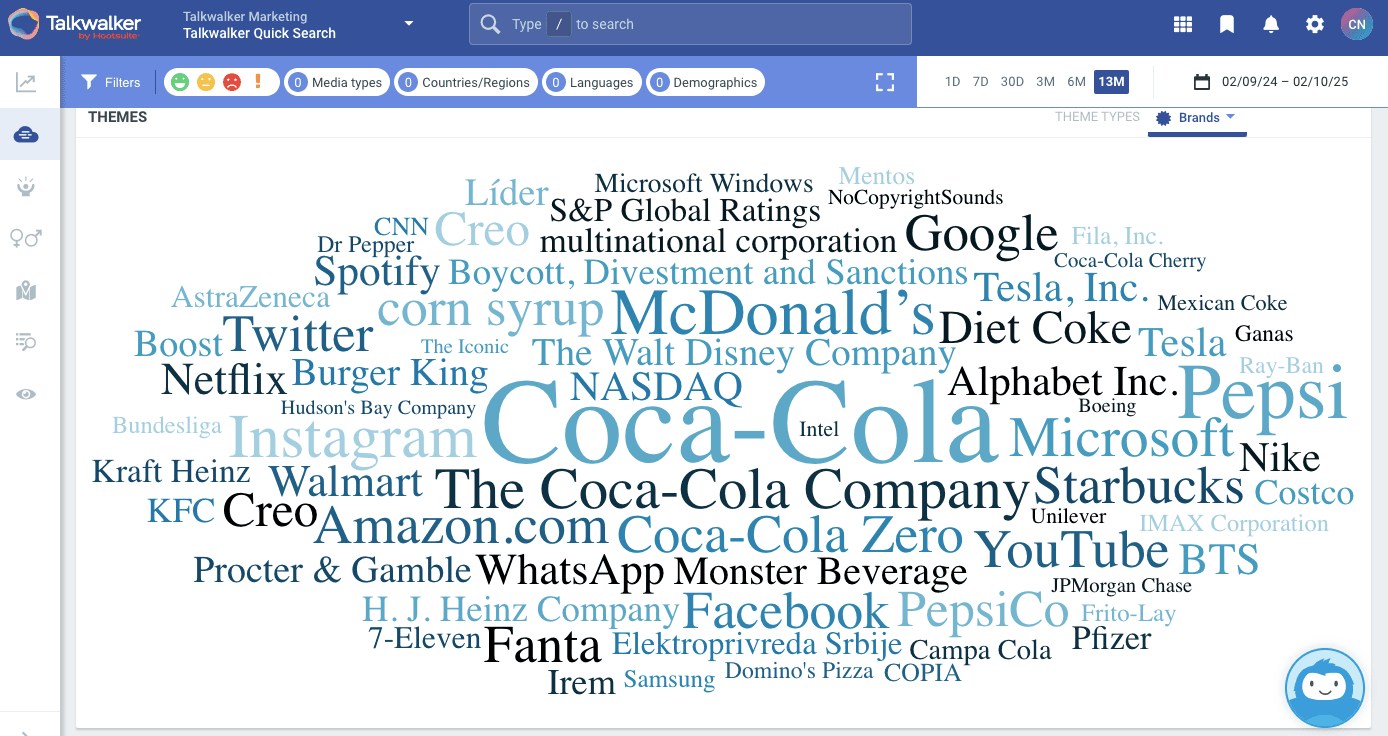

Not sure exactly who your competitors are? Try doing a search for your product category in Talkwalker and looking at the brands most associated with that topic. This search for “cola” includes quite a few brands that are obviously not competitors to Coke or Pepsi. But it does highlight some that you may not have thought of, like Campa Cola, a popular cola brand in India.

Knowing what you want to achieve with your competitive intelligence program will help you choose which aspects of the competition to focus on.

Defining goals and key questions

There is far too much information about your competitors out there to dive into competitive intelligence without a plan.

The very first thing you need to do is set the goals for your program. Those goals will tie to key questions. And competitive intelligence techniques can provide the answers. The goal is to find information that can have a real impact on your business strategy.

Here’s what this could look like in practice.

Goal | Questions |

Improve social media engagement rates | Which social channels are your competitors using? What content formats, styles, and types of messaging get the stronger engagement for competitors? How often do competitors post? |

Improve customer relationships | What kinds of loyalty programs or customer rewards do competitors offer? What are people saying about your competitors online? How does your social sentiment compare to competitors? |

Increase sales | What are customers’ pain paints for your product vs. your competitors? How does your pricing compare to competitors? Are your competitors targeting markets or regions you hadn’t considered? |

These are very general goals. But you may need to start with general goals in the initial stages of your competitive intelligence program. Once things are going smoothly, you'll have a better sense of the competitive environment. You can then create more concrete and specific goals.

Gathering information from diverse sources

We end this blog post with a long list of potential sources of competitive intelligence. Many of them require you to put in some manual effort, such as reading your competitors’ annual reports.

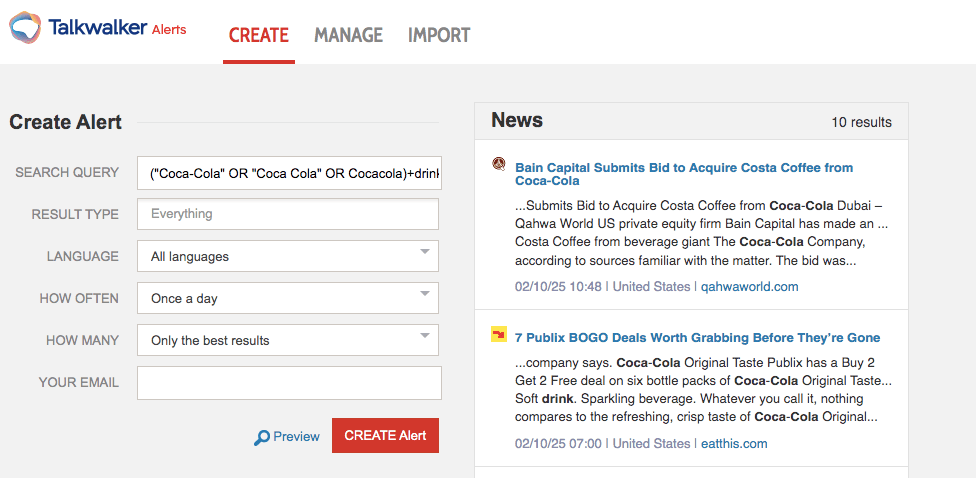

But, before you can read anything or analyze it for insights, you have to find it. To make sure you never miss anything, set up Talkwalker Alerts for your competitors’ brands and products. (Tip: You can do this for free.) Talkwalker Alerts gather all mentions of your topic from news platforms, blogs, forums, websites, and X.

For real-time and ongoing data gathering, a competitive intelligence tool like Talkwalker is a must. It draws data about your competitors from more than 150 sources, including:

online news sites,

forums,

blogs,

customer review sites,

print and broadcast media,

and more than more than 30 social networks.

It pulls all of that data together into simple charts. But you can also choose to filter out certain media types if you want to keep your competitive intelligence analysis narrow.

Talkwalker also has a built-in Competitive Intelligence IQ App. It's pre-loaded with some of the most common metrics that answer CI questions. But you can always create a custom dashboard if you’re looking for something different.

Making sense of the data and drawing insights

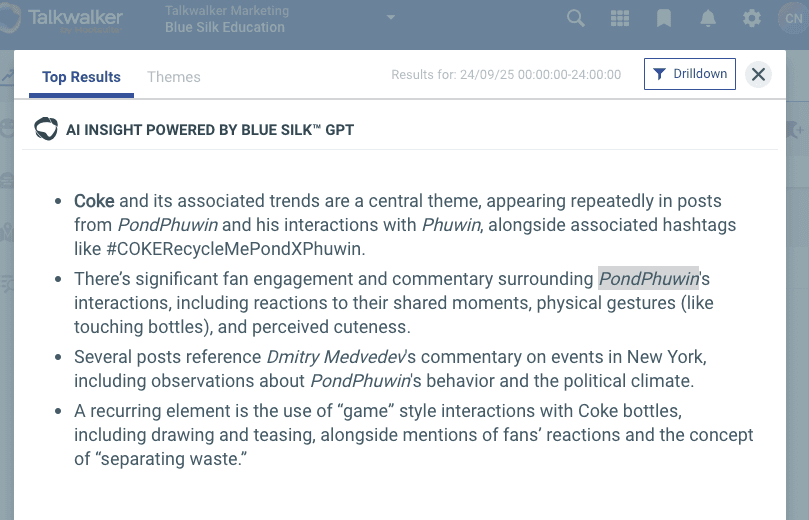

Here, again, you’re going to need help from some tools. Ideally one like Talkwalker with an AI component that can help you understand what you’re looking at.

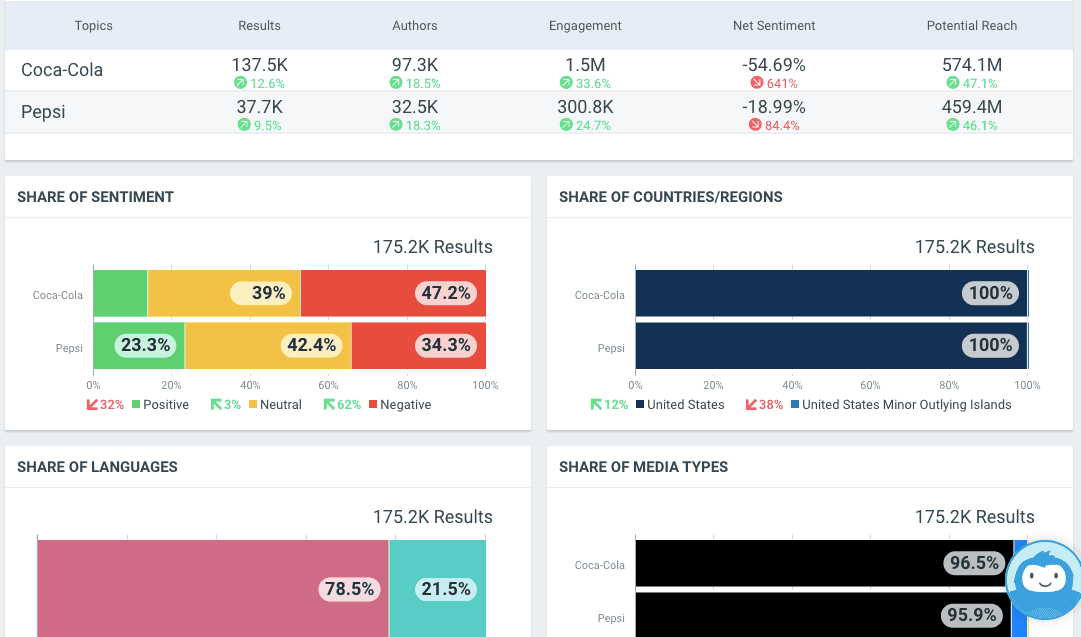

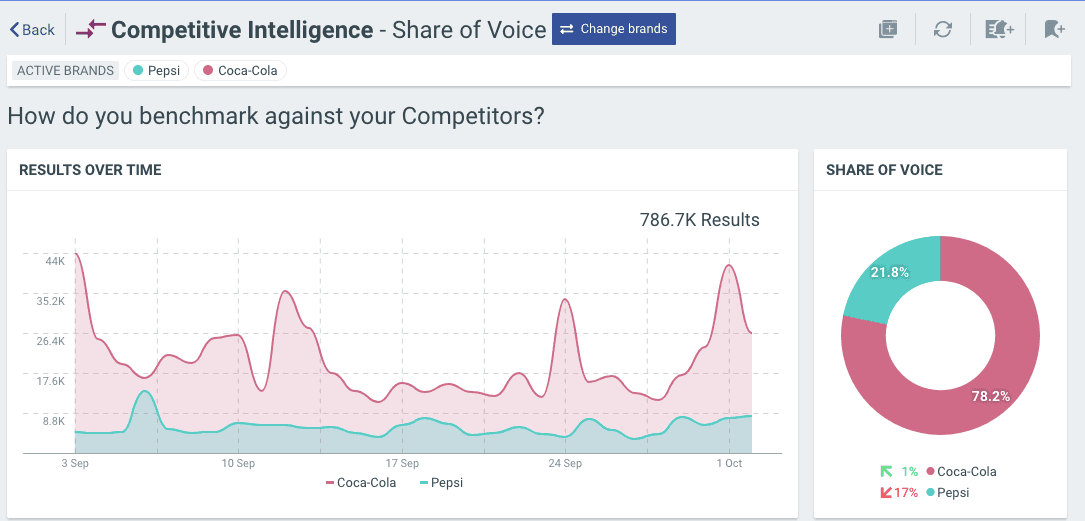

For example, the visualization in the chart above shows the results over time for the competitors Coke and Pepsi. But knowing where each brand had spikes in activity is only partly useful. Clicking on any spike or dip in the Talkwalker chart opens an AI-powered analysis of what was happening at that very moment.

You’ll also get a list of the top content results tied to that spike, so you can investigate what caused the change. Look for product launches, PR crises, successful social campaigns, or new influencer partnerships.

You can create custom reports using any of these data points to share with the relevant stakeholders across your organization.

Actioning your insights

The most basic type of action to take based on competitor intelligence is simple in theory. Replicate to the extent that makes sense the things that are working well for your competition and avoid the things that are not going well.

Of course, the real potential actions extend much deeper. Your findings can lead to better informed decisions in almost all areas of the business.

Optimize your marketing and content strategy

Analyze competitors' successful campaigns for strategies to model in your marketing efforts. Avoid their strategies that fall flat. Identify content gaps where your competitors are active but you’re not. Create a new series of social posts, blog content, or other marketing material to fill the gap.

Enhance your brand positioning and clarify your brand voice

Refine your messaging to differentiate your brand from the competition. Especially in areas where customers are not happy with their products. Create content that shows how your brand stands out from the other offerings in the marketplace. Revisit your brand voice guidelines to make sure they reinforce your positioning.

Improve customer engagement and experience

Begin to engage with audiences on channels where your competitors are significantly more active than you are. Create FAQs or comparison documents to show how your brand or product compares to your competitors. Make sure to address pain points you’ve identified.

Inform product development and innovation

Identify unmet customer needs, then be the first to market with a solution. Monitor competitor launches and development signals to anticipate shifts in the market.

Strengthen sales and business development

Adjust pricing, promotions, or distribution based on competitor activity. Create battlecards for your sales team. These quick reference templates provide your sales team with a summary of the CI you’ve gathered for each key competitor. They can then respond to prospect questions and objections more effectively.

What are some common sources of competitive intelligence?

There are a lot of potential data sources. Here are some to consider when building your competitive intelligence program.

Competitors’ websites, newsletters, press releases, white papers, and blogs. What are your competitors talking about to their own audience? Pay particular attention to any new announcements.

Social listening tools. What are your competitors doing on social media? How is their audience responding? What are people saying about competitive brands online? How do your competitors respond to criticism?

Social analytics tools. These can help you benchmark your own results against the competition, so you can understand areas for improvement.

Financial filings and quarterly reports. What are your competitors telling investors? What areas of the business are they investing in?

Job posting sites, careers pages, and LinkedIn recruitment. Keeping an eye on the roles your competitors are hiring for can give you a sense of where they’re focusing their attention and resources. This may offer clues to new products or competitor strategies under development.

Review sites. How well do people rate your competitors? How does that rating compare to your own? What specific positives and negatives do people call out?

Industry and market research reports. Sites like Statista, eMarketer, Gartner, and Forrester can provide useful information on competitive trends. Look for niche sites relevant to your particular business, too.

Industry events. Trade shows, conferences, and webinars may give you a chance to see your competitors in action, in person. Even if you can’t attend an event, just looking at the agenda can provide some useful info, like who’s speaking and what topics they’re covering.

Internal customer-facing teams. Your own customer-facing staff may hear complaints, comments, and questions that offer actionable insights into your customers’ experience with competitors.

1 Bitner, M. J. and Booms, H. (1981). Marketing Strategies and Organization: Structure for Service Firms. Donnelly, J. H. and George, W. R. (eds). Marketing of Services, Conference Proceedings. Chicago, IL. American Marketing Association.

Know your competition better. Harness AI to analyze earned mentions, track performance metrics, and identify strategic opportunities. See Talkwalker in action today.