Talkwalker had recently published a report looking at the evolution of consumer behavior in the Gulf Council Countries (GCC) market during Ramadan 2022. The report included survey data done in partnership with YouGov MENA, which revealed that GCC consumers of all ages and income groups primarily look at the price first when comparing brands.

Furthermore, the survey data also showed that 35% of GCC consumers planned to buy the same amount of CPG products as they did in Ramadan 2021. These metrics are indicative of consumers becoming price-conscious, an unusual feat for high-income countries such as the GCC.

Report: Evolving Consumer behavior in the GCC during Ramadan 2022

Turkey is one Muslim-majority market included in the survey but intentionally left out of the report for its unique characteristics. The country is estimated to have a population of 84 million consisting of a majority of Turks and not expats. Plus, Turkey is facing an unprecedented financial crisis. The lira lost half its value last year alone, and consumers are struggling with increasing inflation and the affordable housing crisis.

The official rate of inflation is 61.14%, however, the Inflation Research Group (ENAG) estimated that Turkey's monthly consumer inflation rate was 11.93 percent with its annual inflation rate at 142.63 percent in March 2022. Prices are changing daily and consumers are keeping away from buying imported products, especially as the Lira continues to weaken in front of the US dollar.

Consumer behavior in Turkey during Ramadan 2022: What the data shows

We asked a representative sample of 600 consumers in the Turkish market to understand how the current macroeconomic situation has changed their relationship with brands during Ramadan 2022. The survey was sent out to the consumers between April 7-11. As with the GCC sample, we asked them a series of questions that helped us understand their buying behavior, priorities, and drivers of brand loyalty.

Turkish consumers planned to consume the same amount of CPG products during Ramadan 2022 compared to last year

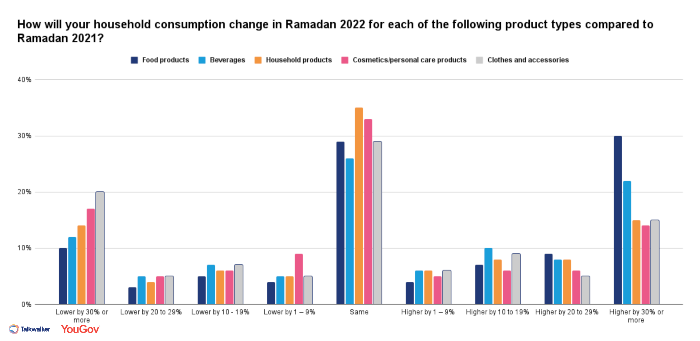

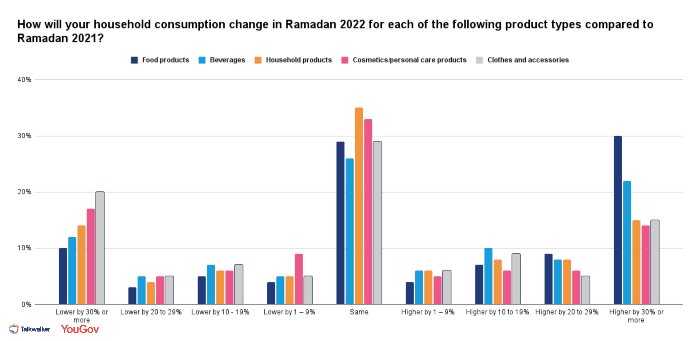

The majority of respondents have said that they planned on buying the same amount of consumer-packaged products during Ramadan 2022 compared to Ramadan 2021. According to the data, we are able to make the below observations:

- The clothing and accessories category is the biggest loser with 20% of the respondents saying that they planned on decreasing their purchasing by 30% or more. This is interesting mainly because consumers take advantage of the occasion of Eid to buy clothing items at discounted prices.

- The food category is the biggest winner with 30% of the respondents saying that they planned on increasing their purchasing by 30% or more.

- Turkish consumers of all income and age groups planned on buying the same amount of CPG products in Ramadan 2022 compared to last year.

Compare between the data of GCC countries and Turkey

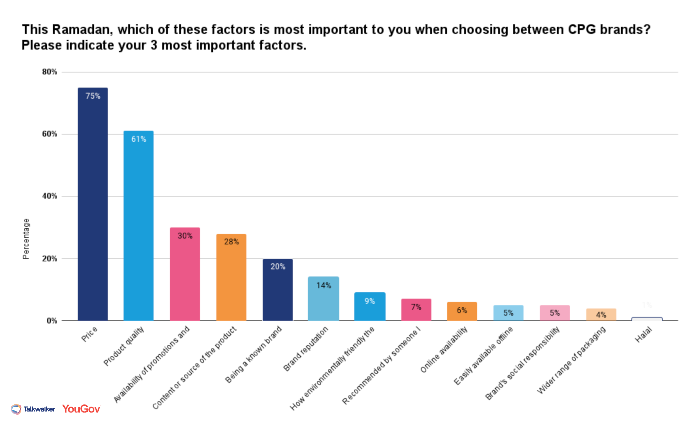

As with the GCC market, Turkish consumers prioritize the price, quality, and deals when comparing brands

Below are some of the insights that could be obtained from the survey data:

- Turkey and GCC consumers share similar priorities when it comes to comparing CPG brands, reflecting how the global economic slowdown is similarly impacting consumers across geographies

- Product quality is the second most important category when comparing CPG brands

- Turkey consumers do not choose a brand based on being recommended by someone they know, however, they consider quality as the main driver of that choice

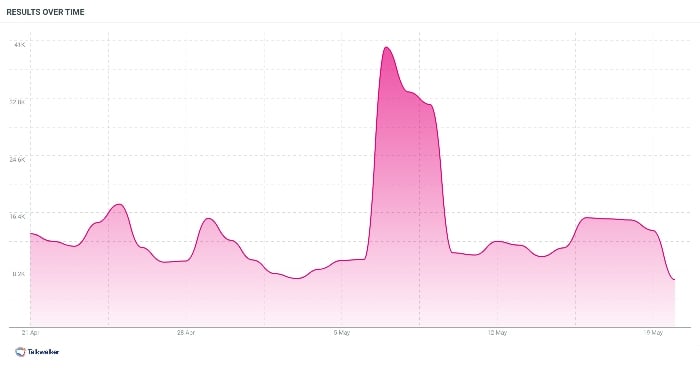

Online conversations related to "discounts" or "deals" in Turkey during the past 30 days show a significant peak in the days following Eid.

Request your free demo of Talkwalker now

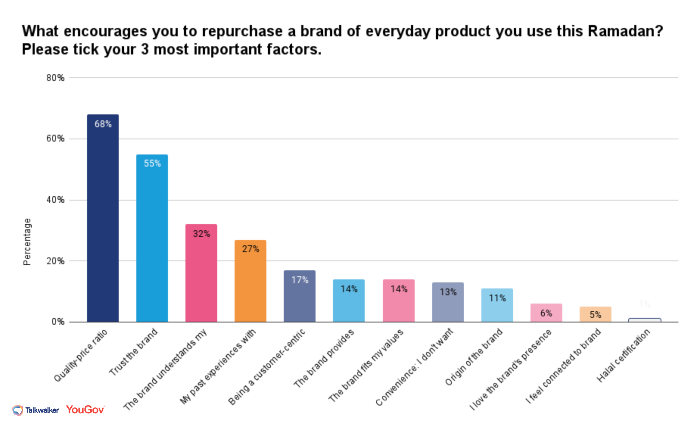

Turkish consumers would buy again from a brand based on: Quality-price ratio, trust in the brand, and whether the brand understands their needs

Quality-to-price ratio appears to be the main driver of brand loyalty among Turkish consumers during Ramadan 2022. However, unlike consumers from the GCC, Turkish consumers have responded by saying that ‘trust in the brand’ is the second most important factor for repeat purchases, followed by ‘the brand understands my needs and expectations’.

This is a clear indication that Turkish consumers are more likely to remain loyal to a brand that is continuously innovating and adjusting its offerings based on their needs.

Consumers want more value from their purchases and the most impactful way to increase that value is to create for success. Meaning, that brands must be able to predict and anticipate their end consumer’s needs before hitting the market. The way to achieve that? Consumer-closeness.

Consumer-closeness is a concept whereby brands no longer consider consumers as solely the source of profit, but instead a golden resource for innovation, product development, and brand positioning. Brands must leverage their relationships with consumers to become forward-looking and more proactive to avert crises.

Consumers are continuously giving signals of what they want and expect from brands. This survey data is only one indicator of what consumers want, though imagine if you had an unlimited supply of real-time consumer data that is centralized and reliable.

Stop imagining, the future is already here

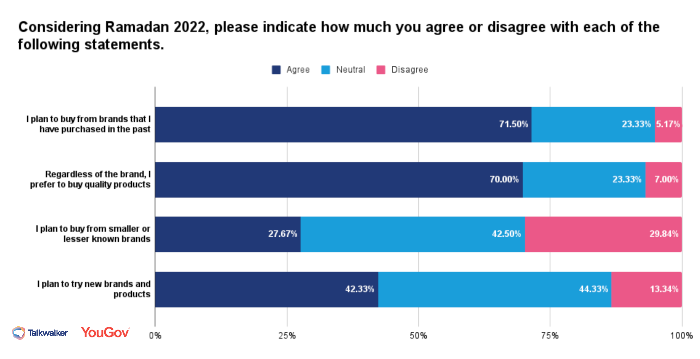

71% of Turkish consumers ‘agree’ that they plan to continue buying brands they have purchased in the past

In the last survey question, we wanted to see if Turkish consumers are changing their brand choices during the ongoing economic circumstances. It appears that Turkish consumers have a strong loyalty to the brands they purchase, however, 70% of the respondents said that the brand would become irrelevant if they were getting better quality. Quality is a difficult metric to measure and analyze because each consumer has their own understanding of it, though, understanding what value a product brings to consumers could give brands an indication of how they price it.

One interesting metric to note is that Turkish consumers are far less likely to buy from smaller or lesser-known brands compared to the GCC (43% said Agree). This might be an indicator that Turkish consumers generally have a negative experience with locally-made brands, often proposed by entrepreneurs and small businesses.

Understand what ‘value’ means to each consumer segment

What Turkish consumers are telling brands

One thing is clear, consumers in Turkey are dynamic and have evolving needs and expectations from brands. The price of CPG products is a key element in the customer journey with brands, though it is important to differentiate that the value metric provides a more granular understanding of whether consumers will continue to choose buying from a brand.

Consumers in Turkey are asking brands for:

- Better value for their money: Value has several dimensions that include quality, convenience, trust, peace of mind, etc.

- Consistency and reliability: Consumers don’t want to think about a product’s inner workings – they just want a solution to their problem, something that will serve its purpose effectively, all while being enjoyable and providing a stellar experience.

- Understanding of their needs: Turkish consumers are very proud people and they expect brands to match their needs and expectations. Being at the intersection between Europe and the Middle East, Turkey is a culturally diverse country with varying consumer segments who have very specific priorities.

Conclusion: Consumer closeness is the way, not the end goal

In order for brands to seize the opportunity and to continuously provide value to consumers in Turkey or anywhere, they must be nimble and quick on their feet with decisions and product developments. Consumers, especially Gen-Z, are always on the move – they’re traveling more, they’re using social media in various ways, they’re engaging with brands at many touchpoints that are difficult to track and extract insights from. Brands have a huge amount of data on their consumers, but in today’s real-time economy the journey from data to insight could prove crucial to the brand’s long-term success.

Now is the time for brands to put the strategies and tools that will enable them to have consumer-close data frameworks, technologies, and talent. Brands that manage to lay the foundations of consumer closeness today will reap the benefits of embedding the voice of the customer in the long run.