I compared two household US brands in the hygiene and tissue market. Major players in a segment estimated to be worth a one-ply shy of $40 billion. Are these brands driving engagement and making the most of social? Is Charmin cleaning up on social media or should Kleenex pass them some… well… Kleenex? Read on. There could be lessons to learn, examples of social media best practices, for other brands to note regardless of their industry.

The point of brand comparisons. Why do it at all?

A popular brand is an extremely valuable asset. A lot of time and resources are spent creating and protecting it. Social listening allows a business to check in on their investment. What are consumers saying about the brand? Are brand associations positive? I’ll show you how Quick Search is a great tool for finding these insights and revealing the big picture, fast.

I’ve used it to compare two popular US household brands, Kleenex and Charmin. A quick real-time comparison of multi-platform social media strategy performance. Are they employing familiar strategies? Are they resonating and engaging?

It’s always important to check out your competitors or other players in the industry. What are they doing and how do they measure up? There’s a chance you could anticipate potential missteps. Perhaps uncover otherwise missed opportunities.

Check out Meg’s guide on How to conduct a competitor analysis. A must-read that takes you in-depth into the topic.

The following simple questions will help us form a useful overview:

- Brand presence: Who’s saying what and where?

- Top influencers and mentions: Which brand wins on engagement?

- Social media buzz: How loud is the buzz and where is it coming from?

- Social media strategy: Roundup - which strategy is more effective?

Where to start? I packed Dan’s essential guide to Boolean search operators. Get ready to build spot-on queries like a Boolean SEAL team operator: fast, efficient and most importantly, painless.

1. Brand presence: Who’s saying what and where?

Kleenex is a brand that has become a generic term in the US for tissue paper. Much as people talk about Band-Aids to mean bandages or Hoovers for vacuum cleaners in the UK.

Charmin, on the other hand, does not come up often in topics of discussions. I mean, toilet humor is generally a conversation killer. But, do people talk about the brand when concerned about softness for their more... um... sensitive regions?

It pays to monitor brand awareness on social networks. Where there’s a conversation on social that mentions your brand, there’s an opportunity to increase engagement.

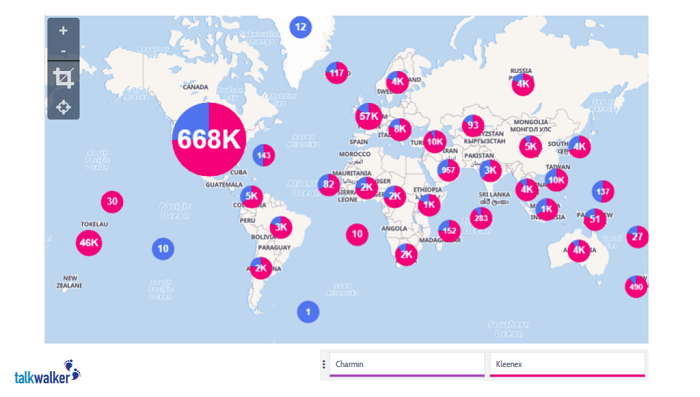

The World Map, allows me to focus in on global regions showing the highest brand presence. Mentions for both brands resonate more in the US, UK, and Canada than the rest of the world.

Charmin and Kleenex share of the world social mentions pie.

Kleenex is off to a good start with more brand mentions overall, taking the lead.

Score: Charmin = 0, Kleenex = 1

Having more mentions is great, but it’s just part-way up the hill. How the brand utilizes social mention potential, gives them that extra nudge to get ahead.

We’re just getting warmed up! Let’s see how they hold up, once we delve deeper.

2. Top influencers and mentions: Which brand wins on engagement?

Sustained brand engagement brings in significant ROI for long-term social media goals. Paid or organic, good quality influencer mentions play an important role in social media marketing.

Looking at the most active hashtags for each brand we can measure the impact of influencers and social mentions. Are hashtags being used in mentions as intended?

It’s raining hashtags!

Kleenex launched #MadeForDoers and #KleenexWetWipes aimed at active consumers. Top brand influencers were sent samples to ensure clear brand and product association in relevant mentions.

A post shared by Lita Lewis (@followthelita) on

Kleenex Wet Wipes for tweeters on the go.

Charmin’s #EnjoyTheGo wins the hype with celebrity placements and novel events. First, over the bustling Christmas shopping season in 2017, Charmin provided theme-free public toilets in Time Square. Afterward, New York City hosted their two-day promotion of the Van-Go, an on-demand portable potty vehicle.

A post shared by kristen bell (@kristenanniebell) on

A little Twitter Hollywood stardust can go a long way.

Score: Charmin = 1, Kleenex = 1

Why use a hashtag? Who owns a hashtag? Read Dan’s blog post about trending hashtags to find the answers to these questions and more.

3. Social media buzz: How loud is the buzz and where is it coming from?

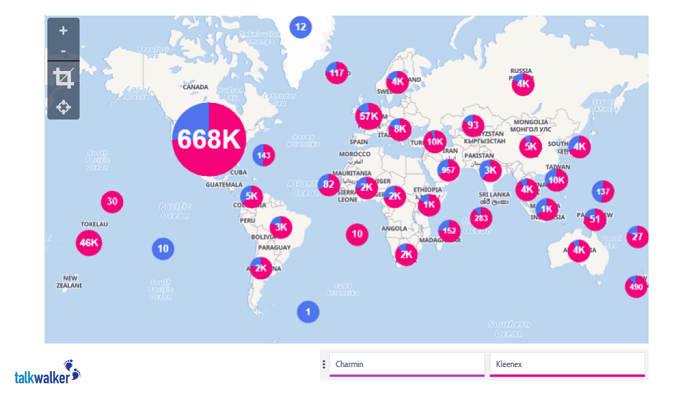

Viewing mentions over an extended time period makes it easy to identify sudden spikes in social engagement. Filtering out paid promotions lets me focus in on organic social media engagement and trends related to the brand.

Charmin buzz spike compared to Kleenex.

A major spike in Charmin mentions can be seen for September 2017. This was as the #MadPooper, a jogger seen relieving herself in public in Cincinnati USA, went viral. Seeing an opportunity, Charmin offered a year’s supply of toilet paper as a reward for surrendering to authorities.

This action resulted in an increase of around 7,000 Twitter engagements alone, in the span of 6 hours. Online news networks caught on to the buzz as well. As of this writing, the offer remains unclaimed.

If the #MadPooper turns herself in, we'll give her a year's supply of TP to help with her "runs" #EnjoyTheGohttps://t.co/GgEAyYp6aM

— Charmin (@Charmin) September 20, 2017

Charmin joins Twitter #MadPooper clean-up efforts.

Kleenex and #MadeForDoers activity was stable over time with slight spikes mainly due to increased influencer activity. Any major social media buzz could not be identified.

Judging from Twitter performance alone, Charmin’s #EnjoyTheGo boosted by #MadPooper hype outperformed Kleenex’s #MadeForDoers in winning social media buzz.

Social media strategies can profit immensely from a boost on social with unexpected viral opportunities and trends.

Score: Charmin = 2, Kleenex = 1

4. Social media strategy: Roundup - which strategy is more effective?

For insight into each brand’s unique social media strategy, I decided to conduct a competitive analysis at the product level.

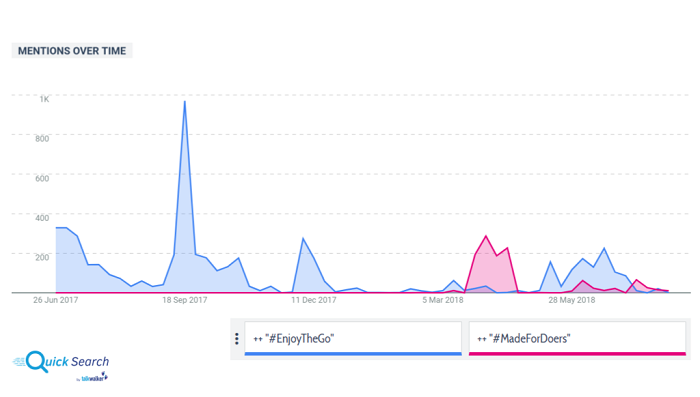

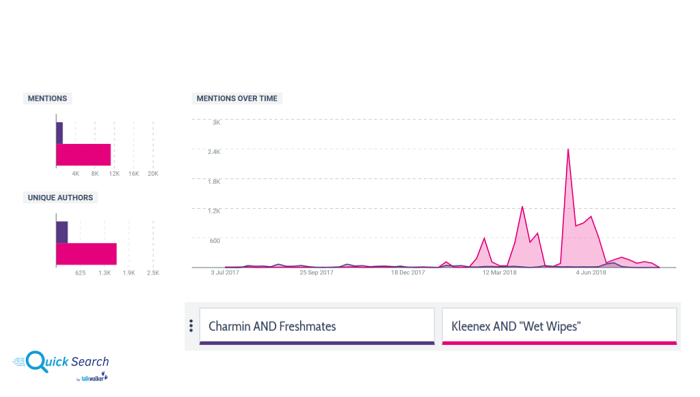

Final round: Charmin Freshmates vs Kleenex Wet Wipes, disposable moist tissues.

Freshmates take on Wet Wipes.

Which platforms are targeted to maximize social engagement and where are the relevant influencers most active?

A 70% majority of Charmin Freshmates social mentions can be attributed to bloggers. Online news follows in second place at 22.7% and a smaller percentage of influencers on Twitter at 6.1%. Activity on Instagram is barely noticeable.

Kleenex Wet Wipes share of voice is more spread out by comparison. The majority being Twitter with 40% and bloggers at 30%. Not far behind are online news outlets with 19.7% and Instagram at 8.3%.

Mentions for Wet Wipes outperform Freshmates.

Are hashtags being utilized to drive engagement at the product or brand levels?

A detailed look at Charmin’s social mentions shows that #EnjoyTheGo engagements are not tied to the product specifically. Influencer posts and tweets are connected largely to money-saving promotions, deals, coupons and third-party retail promotions. The potential for engaging social for product targeted promotion appears under-utilized.

Kleenex social mentions of #MadeForDoers connects the brand to consumers on an emotional level. Together with #KleenexWetWipes, the emotion is tied to a specific product. Working with influencers and product placements results in clear brand and product association.

Kleenex wins the final round. Cleverly combining the engagement of a hashtag at the brand level to boost a product level hashtag reach.

Final Score: Charmin = 2, Kleenex = 2

Final score tally shows a tie! Both brands may have different social media goals but they’re both winners!

Well, that won’t do, we need a clear winner here. That leaves me with but one last recourse.

Emoji bonus round showdown

Not to be taken lightly, emojis allow people to express emotions that simply can’t be put into words. It gives people the ability to accurately express their emotions using as little text as possible. Check out Dan’s Emoji analysis to find out more.

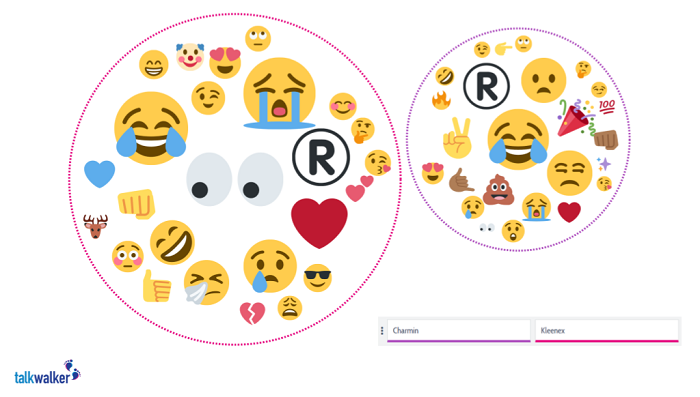

(Left) Emojis in Kleenex mentions, (Right) Emojis in Charmin mentions.

Emojis for Kleenex show a lot of positive usage (eyes calling attention to something important) and ❤️. Even negative seeming emojis are being used consistently with positive brand associations. For example, sadness and tissue emojis are in Kleenex mentions with the context of seeking or offering comfort for sadness.

Both brands equally have their share of humor, with tears of joy.

On a slight downside, posts for Charmin had more negative toned emojis by comparison. unamused, or slightly frowning were often used in Charmin mentions. Not targeted at the brand specifically. But tied to Charmin and used for sarcasm nonetheless.

The bonus round and overall winner title goes to Kleenex. Edging the lead in the end with the larger number of brand positive and happy emojis!

Final Bonus Round Score: Charmin = 2, Kleenex = 3

Using social listening tools, brands can monitor their social media presence, assist in defining priorities, and optimize social media strategy ROI.

Talkwalker Quick Search is excellent for getting a fast overview to measure and compare your social media strategy performance with your competitors. Try it now!