Themes surrounding the telemedicine industry.

Telehealth - who's it for?

In what’s a relatively new field of patient care, telehealth has seen a huge uptick in users over the past several months. The marketing strategies these companies use have mirrored the societal changes we’re all experiencing.

The first hurdle telemedicine needed to overcome to even exist was HIPAA laws protecting patients’ privacy. Proving the security of any platform or database where patient records are stored is a must in order to even get started. Then, telehealth companies had to convince patients that their records were safe in the cloud.

These two factors explain why telemedicine with patients is only really starting to take off in the last few years, even though people have been video chatting on Skype since 2003. Doctors have been using another form of telemedicine to conference and collaborate with each other for far longer than the patients themselves have been involved.

Virtual medicine is here to stay

The next phase of telemedicine is one we’re only just beginning to evolve from as a society: patient education. While it might feel quite logical that not everything can be diagnosed over a text message or a video call, telehealth providers have found themselves pushing messaging that emphasizes just that.

There are many, many forms of direct care that must be performed in person. One would think that a broken bone, or a heart problem would be obvious candidates for ailments that require in-person care. Yet I’m sure that these examples only scratch the surface of the types of problems that virtual doctors have encountered.

Telehealth companies’ marketing strategies originally targeted Gen Z and Millennials, thinking the strength of the platforms played into the preferences of that demographic. On their phones all day, yet they hate to get a phone call, Millennials and Gen Z are a highly mobile demographic. So lots of virtual health providers used marketing strategies aimed at students in college towns - uprooted, with few connections and a busy schedule, it’s a strategy that proves its longevity.

When those students graduate and move to the big city, and their schedules get even busier, keeping a telehealth appointment was seen as easier to do than finding a new PCP in a strange place. Easier is the operative word, and it was soon realized another population also values convenience.

Despite the common stereotype of senior citizens struggling with technology, the barriers for that group to access technology (whether it’s social media, telehealth, e-commerce, or even education) continue to fall. These two considerations led telemedicine companies to use their marketing strategies to grow their share of revenue from Medicare and senior patients

Finding the right people to use a new service is a great way to grow a user base, with the advantage of solving a real need for these populations. In March of 2020, turns out everyone is now a potential candidate for using telehealth services. Virtual visits became the norm practically overnight, and empty doctors’ waiting rooms bore testament to that fact.

Telemedicine branches out

One positive thing to come out of this pandemic is the almost magically rapid developments in telemedicine.

Turns out you *don't* have to wait several days and then go in for an in-person appointment just so the doctor can refill the inhaler Rx you've had since you were six!

— Sara Nović (@NovicSara) April 30, 2020

Virtual medicine won’t be going away anytime soon, either. Many telehealth companies have burst onto the scene, some as recently as this year. What could previously be described as a nascent industry has jumped profoundly into a thriving one in the ongoing pandemic. There are now many niches and sub-categories of telehealth solutions. There’s virtual medicine solutions for clinical dietitians, for medical billing, for natal care, or even an AI guru to help patients navigate the ever increasing complexities of the healthcare system.

Dr house calls via @healapp remain one of the most impressive customer experiences around. pic.twitter.com/qpxB5lRVDn

— Hasan Luongo (@hasanluongo) August 25, 2020

In the virtual pediatric medicine space, there’s lots of competition. Whether it’s Heal that harkens back to an older time of medicine when doctors made house-calls, or Snap.Md that aims to connect parents and kids to physicians seamlessly and quickly, it seems telemedicine providers have latched on to two truths: parents want the very best healthcare for their kids, and they want it to be simple to get.

Demands on fast-forward: who's winning on social?

Using Talkwalker’s social listening software I looked at what people are saying about the industry.

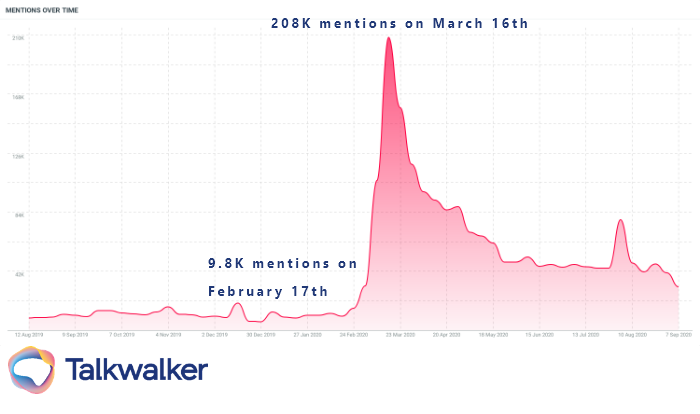

Mentions of the telemedicine industry increased 21x between February and March of 2020.

Mentions of telehealth exploded on March 16th. This was driven, in part, by investors in a panic wondering what to buy in a new pandemic economy. The other part of this conversation was of course patients themselves learning about the new ways they’d be keeping their doctor appointments.

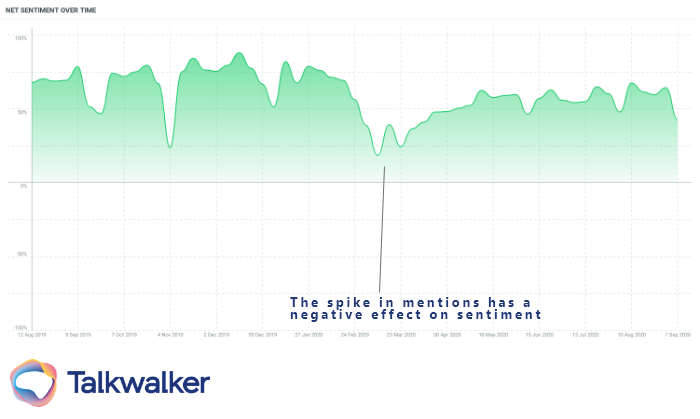

As a new surge in demand for their services took place, the sentiment around the industry actually declined.

Sentiment around the telemedicine industry has not fully recovered since the pandemic began.

This is quite common: when something becomes massively popular and discussed, you can’t please ‘em all, as the old adage goes. Complaints go up, sentiment goes down.

It should be noted of course that the net sentiment is still overwhelmingly positive ~65% positive (on a 200 point scale from -100 to 100). That speaks to how great a job these companies and their doctors especially, have done on the frontlines of the pandemic… and also how well they did before COVID-19.

Before the pandemic, the industry sentiment hovered at around 85% positive, which is not common at all.

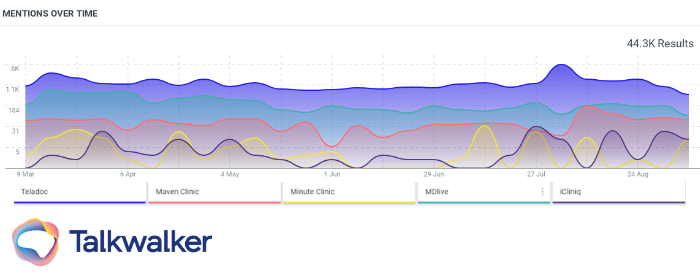

When looking at five telehealth companies to find out more about their marketing strategies especially on social media, I found that Teladoc is far and away leading the pack for social media mentions.

This logarithmic graph shows that the only publicly-traded company, Teladoc, is also leading the way in social media mentions since the pandemic began.

Even though some of these companies may not have an extensive following on social media, just showing up and sharing what you do is enough to help grow brand loyalty.

Check out Maven Clinic, which offers help with reproductive health from fertility to postnatal care.

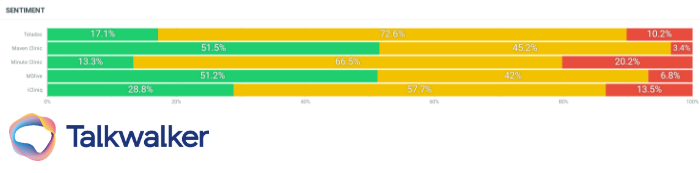

Despite these modest numbers, they have a much higher sentiment than Teladoc or other virtual medicine providers in the space, in fact the highest I found, at 51.5% positive.

Net sentiment for five telehealth companies on social media.

How do they do it? One way is through an aesthetic and easy to understand brand. Another is through PR, helping reach a far wider audience than they could alone. PR is one of the traits Talkwalker has identified as an avenue to building loyal and passionate fans through Brand Love.

Very cool to see @mavenclinic in @NewYorker! All about how our COVID-19 Child Care Decision Tool, created with @ProfEmilyOster, is guiding parents to thoughtful decisions about what to do re childcare and education in the fall: https://t.co/q5OAjSRlqO

— Kate Ryder (@KentuckyChang) September 1, 2020

The everything phase

Virtual healthcare has seen a wild 2020. Most people and industries have of course, but talk about essential lifelines. Today, virtual healthcare need not segment out the audience they target, instead the telemedicine companies that are patient facing, and broadly at that, are showing signs of industry maturity.

Contentwise, it’s back to school season, so of course telehealth is making a big push into getting the healthcare paperwork (and inoculations) in order for school. But there’s still some warmth in the air, so make sure you know the difference between sunburn and sunstroke. There’s still a global pandemic raging, no one’s seen the result of that more directly than the telehealth industry.

In short, the industry has grown so massively so quickly that just about everyone has something they can get resolved through telehealth now.

New, niche companies are sprouting up to chip away at various corners of industry leaders like Teladoc’s business. Or to chip away at the barriers to more telehealth solutions, through technology. Telehealth app development services are an adjacent, and growing industry. Anything to fight the global pandemic. There's telehealth services to educate, and there's services to deploy AI or genetic advancements as they happen.

An advanced industry has competitive segments of its own, because there’s so much business overall that companies can gain a competitive advantage by focusing on and excelling at just one or two aspects of that business. Medicine is, of course, one of the biggest industries in the US. In many ways the only surprise is that it’s taken us this long to get to this point.

This is the everything phase. Telemedicine can be a catalyst to solving nearly everything for nearly everyone. If it can’t yet, it will soon. As the industry grows further, building out brand loyalty will become increasingly important, and using social media is the best way to do it quickly.

If we advance to some world where doctors and their services look ever more like a ride-hailing service (multiple platforms, users pick which price and experience serves their needs best) the doctor’s phoneside manner and personal character will play a big part in their personal success. It will make them in-demand to long-time and loyal patients.

But for the companies and platforms that bring those patients to the doctor, the loyalty will have to come from what is built and experienced by the patient in the lead-up to that first experience when the phone screen flicks from black and a doctor’s smiling face appears, ready to provide care.