Here are just a couple of reasons we hear all too often..."The compliance issues are just too complicated for us to do anything interesting", "We’re too scared to make a mistake and cause a crisis" and the kicker, "It's too hard to link social to business KPIs".

All are valid concerns. But what about the risks of NOT being present on social? It’s the flip side of the social media coin that’s too often ignored.

And, it's a subject we've explored in our joint White Paper with Hootsuite - How Financial Services can use Social Media to Drive Business Advantage - but here's a look at some of the finance brands who are getting social media rightl.

Financial Social Media – Listening Lessons from American Express, OneLife & Think Money

The stats below highlight some of the lost opportunities and risks of not having a strong social presence.

- 71% of consumers who have had a good social media service experience with a brand are likely to recommend it to others. (Source: Ambassador)

- 60% of customers interact on social media with the brands they buy from (Source: Dreamgrow)

- 80% of customers expect a response to social media postings within 24 hours - and only 1 in 8 financial sector firms respond to social messages within 3 days! (Source: Altitude, Blueskyto)

In truth, social media has advanced from being a helpful (often free) marketing channel for brands to a place where customers expect to be able to engage, be informed and even entertained by brands.

The time for hiding on social and hoping for the best has passed. But the good news for banks, insurance companies, and other financial institutions is that a smart social media and listening strategy can help financial services brands stand out from competitors and reap big rewards.

American Express – Linking Social Data to Financial Transactions

A lot of companies have valuable internal data that helps them to build better pictures of their customers, but financial services and banks in particular, have the mother lode.

Transactional data gives us all kinds of information about our habits, needs and desires. Combined with social data it gives brands an incredibly detailed view of their customers.

American Express take this to a new level. First, they encouraged customers to connect their social profiles to their American Express card and used the social data and transactional data they now had access to, to deliver personalized offers directly at the point of purchase.

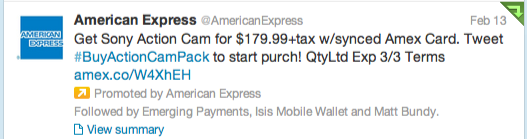

Then, through a partnership with Twitter, Amex allowed users who sync their cards with their Twitter account to pay for exclusive products simply by using a hashtag.

By combining social data, transactional data and smart use of social networks, American Express created a truly innovative social commerce program that directly links social activity to sales.

Connecting social data to internal data such as customer transactions is not only a smart way build a comprehensive profile to improve personalization, it's also one of the best ways for brands to start linking social media activity to business KPIs which you can read more about here: The 7 Levels of Measurement for Digital Marketers.

OneLife – Driving digital transformation by spreading social intelligence internally

The focus of social data analysis is often about what can be done to learn more about customers, improve campaigns and ultimately, drive sales. But although all these points are considerations for OneLife, a fintech firm based in Luxembourg, they also had a broader, internal goal.

It’s all part of a digital transformation that has social data at it's core. Although it is only certain members of the marketing team that use social listening technology, information relevant to each department is spread throughout the company so sales teams, for example, understand the trends and influential figures that matter to their prospects.

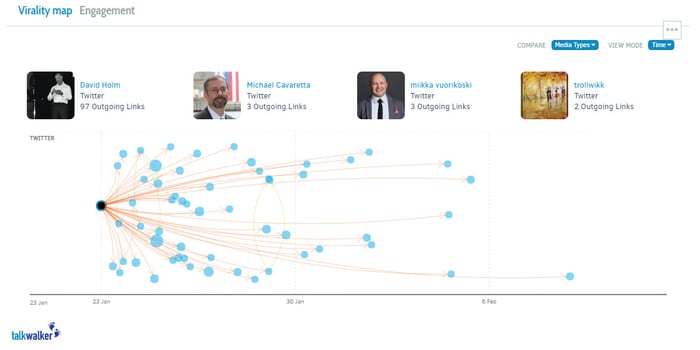

(Example of data OneLife use to understand how messages from key Fintech influencers spread across social)

The result? Aside from half a million daily impressions for the OneLife Twitter account, the fintech specialist has also seen a steep increase in the LinkedIn social selling index of OneLife employees. (Read: more revenue!). Here's a more in-depth look at how OneLife use social data.

Think Money - Bringing flexibility and scalability to social customer service

“Customer service is the new marketing”. It’s a common refrain in the age of social, as customer expectations increase with around 40% of people now expecting brands to respond on Twitter within 40 minutes.

It’s a daunting task for businesses and requires careful planning and contingencies, something Think Money had to take into account during a recent IT overhaul.

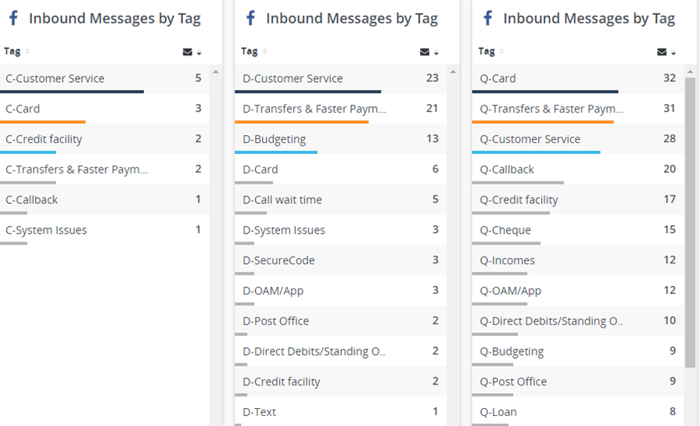

But through the creation of a smart social listening and management process, Think Money have been able to deal with and understand customer problems at scale and speed. Here's an example, of how Think Money set up their social customer service to manage inbound messages coming from Facebook.

This smart listening and engagement system helps Think Money to handle customer complaints quickly and efficiently by not only have a clearly defined social workflow, but also by being able to prioritize issues and allocate resources depending on the scale of the problem.

Financial services have generally lagged behind other industries when it comes to social media and social listening adoption for understandable reasons. But a tipping point has been reached. The lost opportunities from not having a strong social strategy are now too substantial to ignore. I’ll leave the last word to the authority on social media and finance, Amy McIlwain from Hootsuite: