Todd Grossman: Troy, tell us a little bit about U.S. Bank.

Troy Jansich: U.S. Bank is the fifth largest bank. The four banks larger than us are quite a bit larger, and the banks smaller than us are quite a bit smaller. So we have a gap in between. Sometimes we’re grouped with the big banks, especially as people are talking about banking related to COVID and the current financial issues that are being discussed widely. Yet sometimes we're considered a regional bank. We track the activities of both of those groups so we can be an active member of both.

Todd: Troy, customer trust and satisfaction are critical to success, especially during times of crisis. As consumer expectations rise, the ability to meet them can make or break your brand. How have insights from social media listening guided U.S. Bank’s operations during the pandemic?

Troy: When I started in social media listening and analytics, it was really all about just listening with the intent to respond and provide customer service. That's something we've been doing throughout. Where we find the most value with social media channels and websites, is extracting data from the voice of the customer.

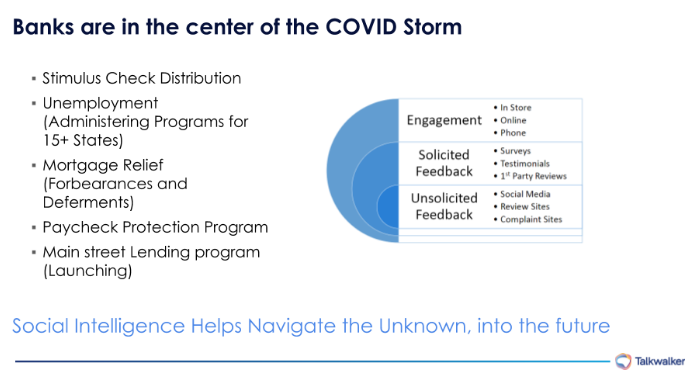

We've got a strong customer experience team. We've been monitoring engagement, seeing how people are interacting with our brand, and we do the same solicitation as other brands in terms of surveys and reviews and extracting testimonials.

U.S. Bank's responsiblities during the pandemic.

Todd: So can you talk to us about the jump from social listening to social intelligence?

Troy: The untapped area for a lot of companies where we've got a bit of a jumpstart, is in unsolicited feedback. We don't know the answers to questions we're not asking to people who are not engaging directly with the brand.

That's where social media has been a really valuable part of the customer experience, creating insights that we leverage on an ongoing basis.

When it comes to COVID, banks are in the center of everything, but we don't drive any of it. These aren't things that we've initiated, right? We've done social listening around all of it. Whether that's people getting their stimulus checks, unemployment checks, mortgage relief, all of these federal programs. These are issues that people have a lot of worry over. So banks, U.S. Bank and others are thrown in administering a lot of programs that were unplanned for.

It's a great case study for social intelligence because it really kept us thinking ahead and moving quickly to make sure that we were providing our teams the most knowledge possible so they could deliver a good customer experience.

The finance industry is innovating due to uncertainty

Todd: Break down how U.S. Bank works to make the unknown less unknown.

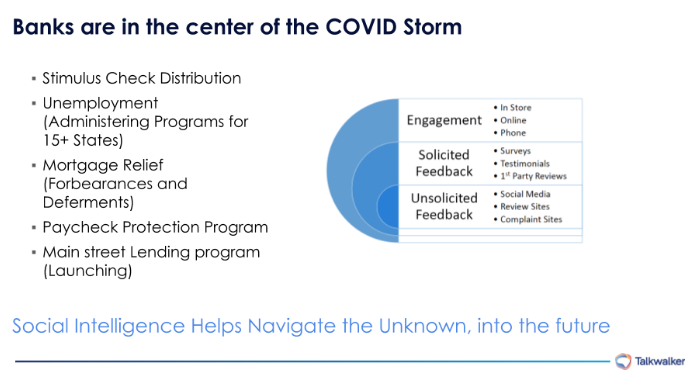

Troy: Well there’s a couple of interesting scenarios, because a lot of brands are really comfortable using tools for social media listening about themselves. What we've found is that there are lots of dimensions to any issue. When it comes to COVID, for example, we've got a lot of different reports.

We have a dashboard that's just people talking about US Bank. We have another one for insights, another one for talking to other banks, and then just banking in general. The whole idea of banking from home amongst other examples really helps improve the customer experience.

For example, with U.S. Bank mentions, we were able to learn from customers, their expectations as it related to transitioning from the local experience where they could go into a branch to one that was primarily online and also using drive thrus.

For top banks we looked at issues that were important. As an industry, we were creating a new standard. Things like disinfecting, pneumatic tubes, and all of the precautions, alongside banking in general. Finding out from the good and bad experiences that people had elsewhere, we were measuring that and benchmarking.

The on demand dashboards were one of those pieces that allowed the teams implementing each of those programs to jump in and ask “What are people saying today about us? About banking? How can we use that to improve the customer experience?”

Dashboards on many topics show how to stay informed about the day's headlines.

While the on demand dashboards contain a lot of information, they're usually the second point of contact people have. I think of my job in social intelligence as pulling out the voice of the customer, finding those examples that make the teams want to find the answers.

Todd: How does that play out on a day to day basis?

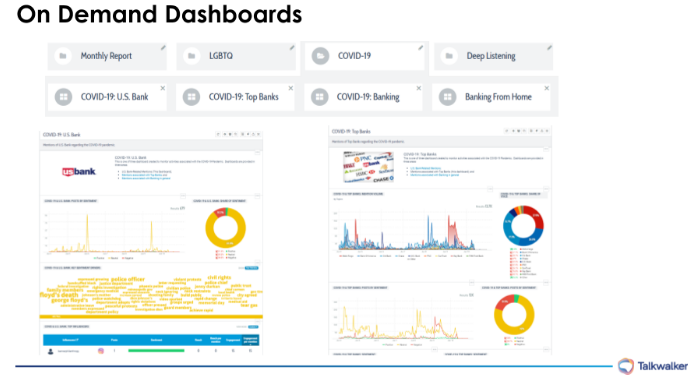

U.S. Bank's dashboard surrounding the brand and the pandemic.

Troy: These are daily updates we use related to COVID-19. Daily updates are things that you know are good from a voice of customer perspective, for any number of topics. The George Floyd protests here in Minneapolis and other cities, we used these updates to keep our teams informed.

The idea here is to give people an executive summary of what's happening. They can click through and explore those issues. But typically, a daily update is two flavors. The first flavor is what are the interactions that are happening specifically with U.S. Bank that we need to be aware of. The second, is how things are in the industry, because we're the fifth largest bank. So we aren't always the center of attention. But if there's an instance where a company like U.S. Bank gets thousands of mentions in 48 hours, it can be a very concerning thing, because that's not normal for us. So part of what we want to do is give context to our executives.

We were getting a lot of negative mentions related to the Payroll Protection Program (PPP). It was often because we were just grouped together as one of the top five banks. So we were able to provide context. Then we can learn how our sentiment and brand mentions differ from our peers.

One example: we were pretty even on the volume of conversation, it was as we would expect in the marketplace. It became clear we were getting a higher volume of mentions and negative experiences from folks calling about unemployment benefits. The call centers weren't ready for the 10-times volume increase. That unsolicited feedback shows up in the reports.

This way for finance industry insight

Todd: Insight is nothing without action, afterall.

Troy: That’s right. What we did was leverage the incoming insights and give a heads-up to the team on the issues people were having, and how to resolve that.

It puts it on their plate, shows them how to create excellent outcomes. I think that’s important, because if we’d only used those other two points of voice of customer, we'd have only heard from people who we asked, who reached out to us, or who had already reached us successfully.

The fact is that the call centers were overrun, and people had to wait for several hours and weren't getting speedy service. They weren't part of our radar, until we brought in the insights that come from the outside, that unsolicited conversation.

Todd: Troy, in addition to monitoring brand mentions and the overall industry, do you have more examples like resolving issues with unemployment?. How else did you uncover customer experience blind spots and discover emerging trends?

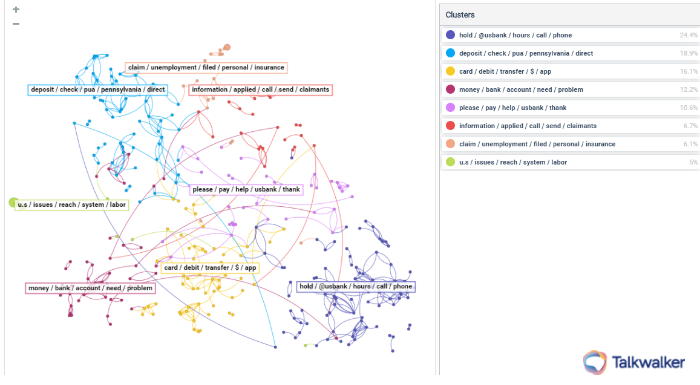

A Conversation Cluster surrounding banking and the brand.

Troy: A lot of times insights bubble up from individual mentions, but Talkwalker and there are other tools, have the ability to use machine learning and group together topics that humans wouldn’t notice. Topics that would otherwise not be visible, so you're able to drill from the top down. A quick example when you look at all the conversations related to unemployment -- the problems that people were having are visible by different colors. We’re able to drill down, to find opportunities to help in those areas, as opposed to the bottom up, which we've also done, which relies on you to look at all of the individual mentions and then kind of group them.

Todd: What we see here is the bottom up alerts that you are talking about.

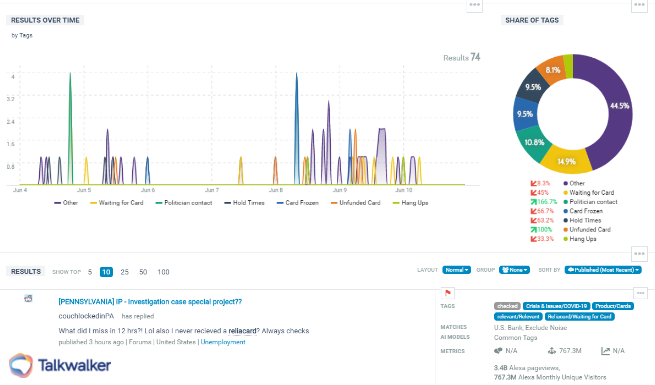

Bottom-up alerts inform about which issues the brand can manage, and those they can't.

Troy: Here's a graph that shows the spread of where the issues are. We can see if they were having issues related to things in our control: they were on hold, their cards were frozen, or were they issues that are part of those state owned programs?

Where voice of customer insights from social intelligence is awesome, is when you don't have full control. We're implementing state programs and the problems they're having could be related to what's happening at the state level, even though they're directing that at us. That allows us to identify those problems and provide both content and helpful tips for folks. Then on our end of course, we know when to step in and provide a higher level of support when that's required.

Todd: Right. So tell us a little more about how you get the right content for the moment.

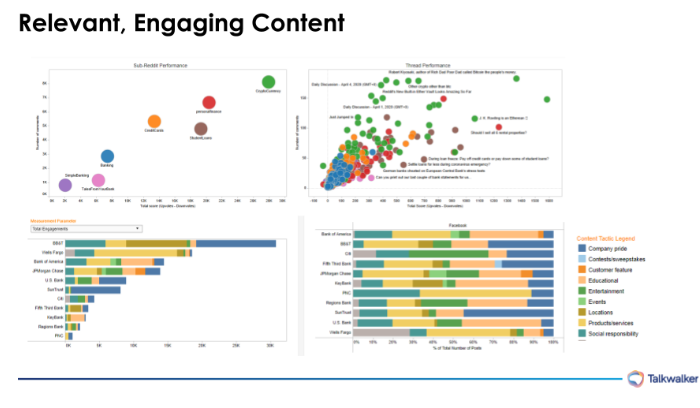

Relevant, engaging content is the key to customer experience. Finding the right content mix is essential.

Troy: One of the social insights is: what people care about. The top two graphs to the left, show different subreddits related to banking, and how much activity is happening. So we know which type of content people are talking about. It breaks down to the very detailed. Using a tool like Talkwalker, you can see the emerging conversations about personal finance. When we publish content, it's not the same generic stuff everyone else is doing. The graphs at the bottom show our content mix versus competitors. We can look at who's sharing what type of content, and then, look at engagement. At a glance, we know our financial service marketing to customers is resonating and how it compares to competitors. Social data is great for benchmarking how well you're providing relevant content.

Get some of the powerful insights U.S. Bank uses for decision-making

Todd: I know you've been looking at pre and post COVID sentiment and themes, and it'd be great to understand a little bit of these changing times and show any themes that you uncovered as well.

Troy: The other thing that social data is great for, for customer experience, is anticipating when the rules change vis-a-vis COVID-19.

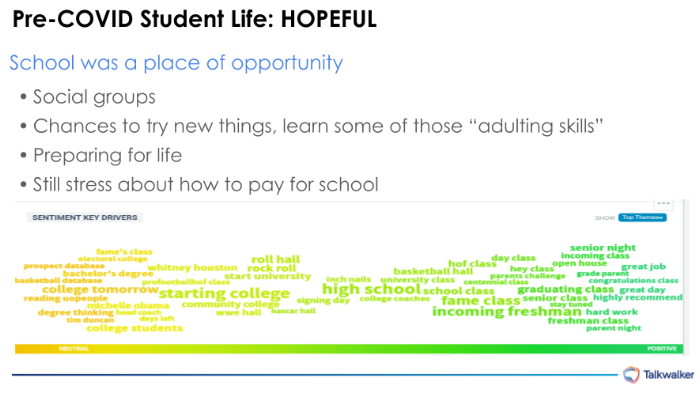

Key sentiment drivers surrounding student life, pre-pandemic shows a hopeful place of opportunity.

Student Life is an example where, if folks are going to school, there is a certain expectation, and experience has changed a lot. You can see that happening through data. Here is a graph that just shows sentiment. The further to the right something is, the more positive it is. Basically what it says is, student life before COVID was hopeful. It was a great thing, and it was all about learning those adulting skills. You'll see that since COVID has happened, that same graph has changed and now, student life is fearful.

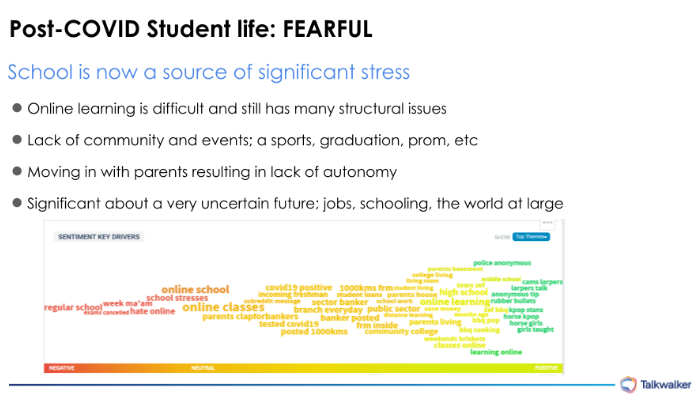

The key sentiment drivers around student life in the pandemic show a place of stress.

It's a point of stress as opposed to hope. The environment has changed a lot. There's a lot of uncertainty. So, proceeding with the same paradigm of pre-COVID, in the way that you talk to students about financial decisions, or our products is going to be different too. This is just an example.

We do a lot of trend analysis. We feed that to the market research team at U.S. Bank, and then they create focus groups and surveys to see what US Bank needs to do to make its experience and its product more timely and relevant.

Todd: Thank you so much for all this insightful information. I have one last question for you. What steps should organizations like yours take in terms of evaluating platforms, tools to work with, what were the things that were important to you?

Troy: A couple of things are really front and center for me. One is a robust Boolean language. For any listening tool, you need to pull everything in, then filter. The tools that have powerful languages allow you to get down from half a million mentions, to the 20,000 mentions that matter most. For me, the more pre-processing a tool does, the better.

Talkwalker has a really robust query language. And also machine learning. Those two pieces make it easier to go right to the insights. I'd say one of the other key things is the ability for a tool to integrate with your own platform.

The social data is in high demand, it’s something the customer experience team wants to provide in dashboards, so the social feedback is right next to surveys and other sources of customer feedback. Leveraging the API we can pull in that data, put it in a dashboard, so if you're a bank manager, you see how customers have responded, you see social media mentions, the performance, all in one spot.

We're breaking down the walls between social listening, and actionable information, and putting it right in front of the people who can apply it to make the experience better.

Troy Janisch is Vice President/Director of the Social Intelligence team at US Bank. Learn more social intelligence insights from Troy by following him on Twitter.