Download the latest Finance Industry report from Talkwalker

In the high-touch financial services sector, customer experience is key to brand success. Understanding clients’ needs is pivotal to retaining their business and building fruitful long-term relationships. Yet 40% of finserv brands have reported that keeping up with customer experience trends is a challenge that they continue to face.

The increasing importance of mobile accessibility across all industries is changing the consumer landscape, and could be contributing to the urgency that many companies feel around evolving CX solutions. Technology now has a huge role in how finserv brands do business, from integrating more user-friendly digital products into their business models to competing with upstart online banks that are beginning to steal customers from traditional institutions.

How it started How it's going pic.twitter.com/tJpQOfQ2mK

— Ally (@Ally) October 14, 2020

Companies like Ally are providing digital-first money management solutions, forcing brick-and-mortar banks to adjust their online offerings accordingly.

In fintech, CX (customer experience) and UX (user experience) go hand in hand. Getting users to trust and find value in your tech solution, whether it’s a simple B2C money-management app or robust financial tracking platform for enterprise corporations, is essential to client service. And to get the full picture on what users need from a service provider, you need the right tools in your stack.

Software that helps you track digital feature engagement, analyze customer data, perform social media monitoring, and manage client relationships should all be in your arsenal. I’ve outlined some of my favorite tech tools below, all of which have been instrumental in building effective CX frameworks in orgs I’ve been part of. If you’re looking to give your customer experience strategy an overhaul, these best-in-class solutions will definitely help you crack your customer code:

Looker

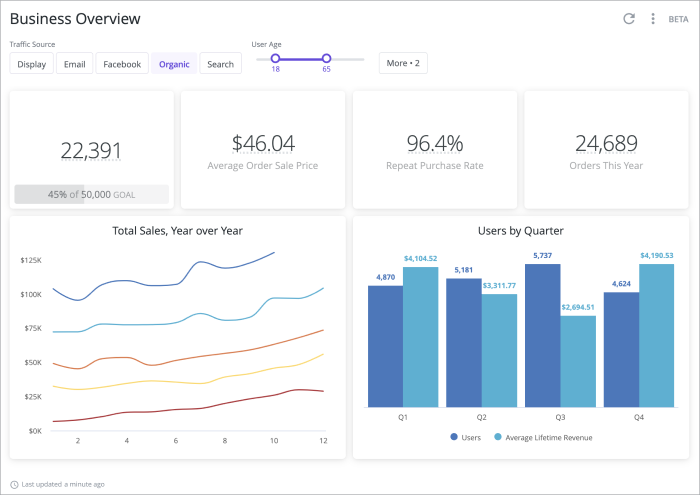

Looker is a powerful analytics platform with data-rich dashboards that can give you the full picture of your customer base at a glance. The platform integrates with most databases on the market (Oracle, Snowflake, Big Query, etc.) and, through custom reports, makes it easy for even the least SQL-savvy among us to analyze CX metrics and share results.

User-friendly “looks” (AKA reporting dashboards) and alerts in Looker make it easy to understand your product and services’ average use cases, and address customer concerns quickly. The tool provides lots of solutions for fintech providers specifically - set up alerts to track client activity and flag fraudulent behavior, or map Excel-like pivot tables of financial data that can be shared across your organization to improve business forecasting. Integrations with CRM systems, messaging apps, and cloud softwares can make Looker your single source of truth, and an easy way to get data visualizations to back up recommendations around strategic pivots and product development.

Customizable “Looks” provide insights on user engagement and customer acquisition at a glance. (Via Looker)

Pricing for Looker varies depending on a few factors - like how many users you’ll need, data integrations, and onboarding scale. Since the platform encourages collaboration through slicing and dicing custom dashboards, it’s a great solution for fintech companies looking to make data accessible across their teams.

Zapier

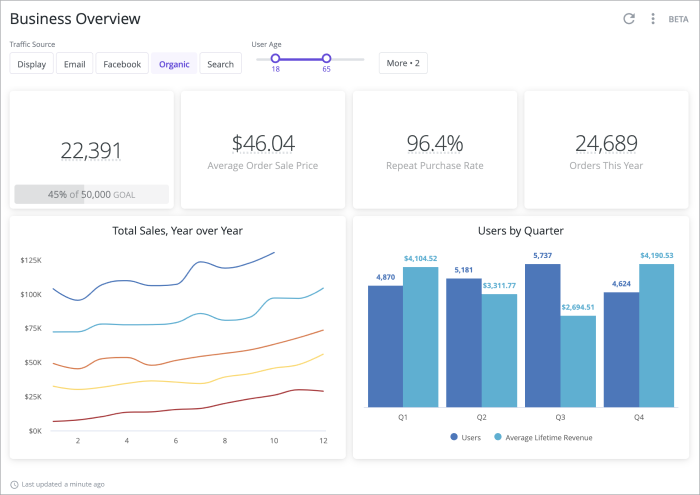

Acting as a middle-man for data sharing on apps and SaaS platforms, Zapier provides easy software integrations that help businesses automate processes and build faster ways for customers to use their products. Integrations with over 1,000 apps means that you can connect just about any digital tools you’re using to one another and get real-time info to improve customer engagement practices.

Create workflows within Zapier by setting up “zaps” that trigger actions within your other apps and systems. For example, let’s say your team receives invoices from customers via email that often get lost in overloaded inboxes. You can set up a zap to be triggered in Gmail so that when a message with an invoice attached comes in, the attachment is automatically added to a Dropbox file for team review and a new line item is created in Quickbooks to account for the spend.

Zapier connects popular apps across channels to streamline communications and get in touch with customers faster. (Via Zapier)

Many fintech companies are using Zapier to improve their internal and external CX process. Ponto, a tech solution that helps companies add bank data to their business management software to automate financial flows, partnered with Zapier to connect their customers with over 150 banks across Europe and make financial transactions more efficient. The integration allows Ponto to track their customers’ transactions and link their financials to commonly used apps to review trends and issues, and it gives their customers access to thousands of apps and SaaS services that Zapier also connects with.

Start out with Zapier for free to get an idea of how many apps you’d like to create integrations with before leveling up to a paid plan. Even with a Zapier Premium account, plans starting at $20 make this an accessible tool for companies of all sizes.

Get 2020 the Finance industry report and prepare for what's next

Pendo

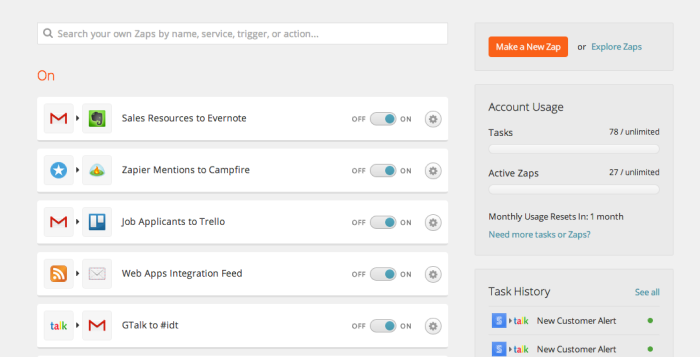

Feature adoption stats are essential for effective design in fintech, and Pendo is an incredible resource for this. The tool is favored by product developers who use it for deep dives into user analytics that inform digital tools and app design, but it also has great value for CX teams.

Pendo gives you the ability to track feature engagement, customer inquiries, team onboarding, and tons of other metrics to get an inside look at how people are using your software. The product cloud includes tools for customer insights, sentiment tracking, targeted messaging, real-time feedback, and product roadmapping that can help solve issues throughout your user journey. For fintech providers, Pendo dashboards provide feature usage stats at a glance and show where there may be user roadblocks to address, or repeat issues that can be solved with product tweaks.

Detailed Pendo metrics on users - from their in-app time to what operating system they’re using - make it easy to find trends and understand customer intent. (Via Pendo)

This year, Pendo has proven to be essential to many SaaS companies who needed to support users during times of crisis. By gaining insights around customers’ biggest concerns, CX teams could deploy informational campaigns quickly to their userbases and develop products based on the feedback they received. Pendo also helps users understand their own customers’ churn risk through data around sign-ins, tool usage, and overall product satisfaction to address it head on. This results in less communication breakdowns and a better customer experience, but also helps Pendo users assess business risks during tumultuous times.

Pendo has a tiered pricing model as well as a la carte tool options, so you can start small and scale up with this platform depending on your need.

Talkwalker

Shameless plug or not, no CX tool list is complete without a social listening software. Want to know what your customers think about your product? They’re probably talking about it - with reverence or revulsion - within their social media community. CX teams around the globe use Talkwalker tools for crisis management, customer service, and trend analysis that helps them develop solutions and services to meet their users’ needs.

Talkwalker’s AI-powered sentiment analysis provides meaningful insights around customer data to understand their overall satisfaction with your product:

Talkwalker sentiment analysis for Wells Fargo, filtered for themes around customer experience, shows the key driving terms that people use when describing the bank's service on social media.

Set up dashboards based on keyword queries for easy conversation tracking around new product launches, feature enhancements, and more, to assess how users are reacting and identify pain points early on. Creating Talkwalker Alerts for brand mentions simplifies crisis management by notifying you the moment that conversations around your company are going south online, so that you can identify the issue and quickly address it with customers.

With the fintech market expanding more each year, our guide to competitive intelligence is key to differentiating your products and services to earn and retain customers. Track your competitors’ brand mentions and social handles in Talkwalker to understand how to better differentiate your product offering from theirs, and see gaps in the industry that your company can fill.

To drive robust marketing in financial services, it's important that you understand your target consumers. What they want. Where they are. How their behavior is evolving. The Talkwalker consumer intelligence platform will help you get closer to your consumers so you can meet all their demands.

Check out Talkwalker’s Free Social Search tool to get a taste of what the platform has to offer, or request a demo to get a personalized brand health report and see how social intelligence can impact your CX strategy.

Intercom

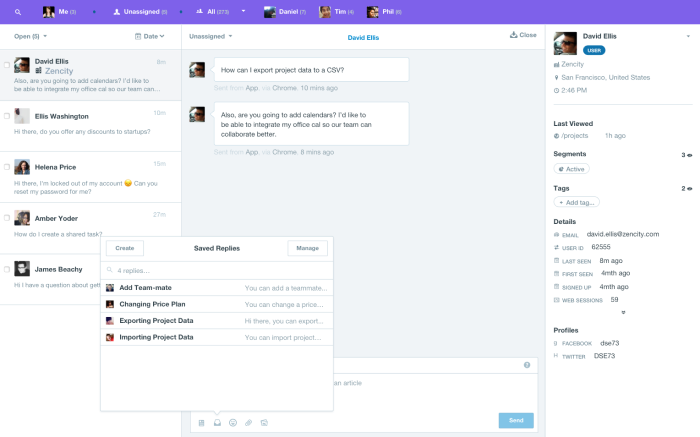

Perhaps the first tech solution focused on “conversational experiences”, Intercom gives companies the ability to create targeted messaging across the customer journey. Through chat bots, push notifications, and one-to-one interactions, the platform helps CX teams provide personalized support and foster better relationships with their users.

Intercom’s Conversational Intelligence Platform scales messenger experiences easily across companies’ communication channels. Whether you’re looking to install a live customer service chat function on your website, announce big brand news to users, or launch an internal workflow, the tool makes it simple to get your message out there.

Set up communication streams in Intercom to address customer questions and tackle projects as they arise. (Via Intercom)

The platform provides activity reports for campaigns with engagement and attention metrics to help you understand how your messaging is resonating with people. You can automate workflows within Intercom so that common customer inquiries can tie to canned replies or FAQs, streamlining communications with users and freeing up your CX team’s bandwidth. Integrations with platforms ranging from Salesforce to Slack to Stripe mean that Intercom users can connect with their customers instantly and map their conversations back to business goals.

While Intercom’s main offering is around customer connectivity, the tool can also be used to manage internal comms across teams for things like support tickets or content review, so it’s a great cross-functional solution. With a higher price tag than the other tools on this list, these collaboration capabilities can help your argument to invest in it.

Takeaways

There are a ton of CX-friendly tech tools on the market, and maybe the platforms featured here aren’t the right fit for your business needs. No matter what solution you choose, keep the following in mind when you’re exploring software options:

- Get hard data and context - numbers mean nothing without anecdotal details that help you understand how to apply them strategically.

- Relationship management is essential to CX, so make sure that you have a tool in your tech stack that streamlines your customer comms.

- Go with a cross-functional solution whenever you can, because it will provide the most value to your whole organization.